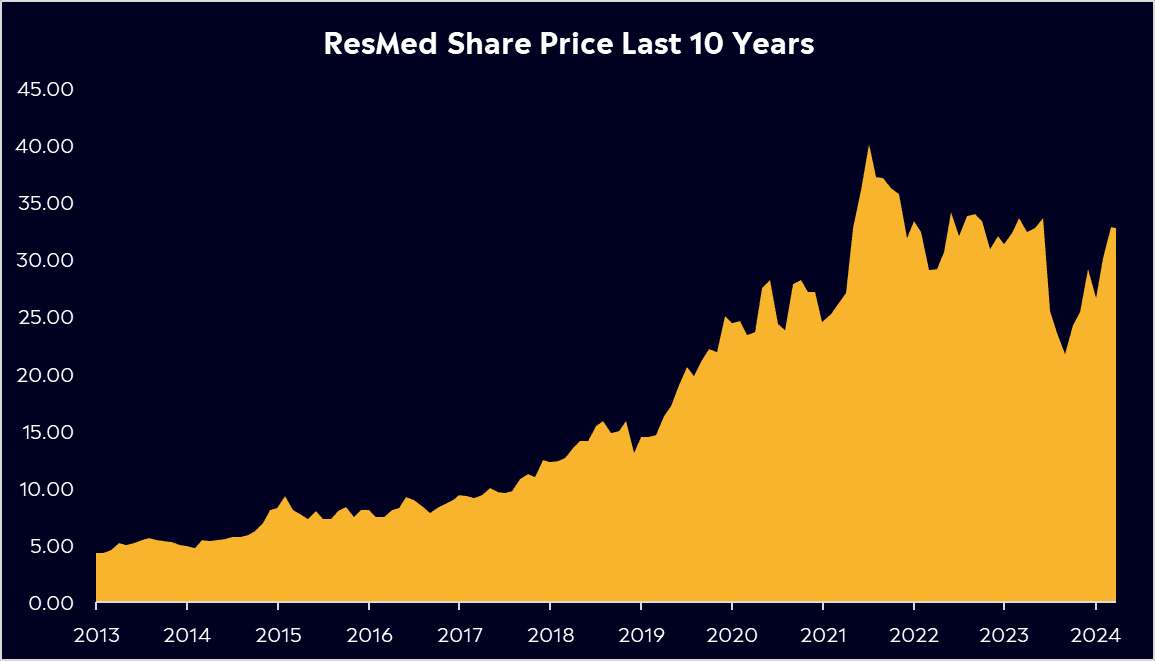

ResMed (RMD) is a global blue-chip healthcare company that has rallied 27% in 2024, with solid earnings growth. The company dominates the sleep apnea market with significant growth potential as the condition remains widely untreated globally. ResMed has a strong history of rewarding shareholders, but does it have more upside, or are there risks ahead? Let’s find out.

- Sleep wellness is one of the top growing trends in the USD$1.8 trillion wellness market, with consumers’ desire for a good night’s sleep becoming more prominent.

- The emergence of GLP-1 drugs, such as Ozempic, sank shares in 2023, but the impact of these drugs on sales may have been overestimated, and fears are diminishing.

- Importantly, analysts like it. ResMed has 14 buy ratings, 0 holds, and 0 sells, with an average price target of AUD$35.23.

View ResMed

The basics

ResMed, a global leader in medical device development and cloud-based software, was founded in Australia in 1989 by Dr. Peter Farrell. Today, it operates worldwide and is dual-listed on the NYSE and the ASX, both trading under the ticker RMD. ResMed aims to design innovative solutions focused on sleep-disordered breathing, also known as sleep apnea, to help people sleep and breathe better.

As of today, the company employs more than 10,000 people and sells its products in more than 140 countries. ResMed operates in two key sectors: Sleep and Respiratory Care and Software as a Service (SaaS). Sleep and Respiratory Care drive revenues, making up for 90% of sales, but its SaaS business, helps diversify revenue and leverages ResMed’s status as a global health leader.

Competitor Diagnosis

ResMed is by far the leader in the sleep apnea space, with minimal competition. Philips Respironics is its biggest competitor but has lost ground in recent years due to recalls and the discontinuation of certain products. Some small names are coming to market, but none seem threatening to ResMed for now. However, ResMed must be continuously vigilant over ongoing safety concerns to ensure recalls don’t affect sales in a highly regulated sector.

The biggest challenge instead has been the emergence of GLP-1 drugs like Ozempic. Originally designed to treat diabetes, these drugs have also shown potential for appetite suppression and weight loss. This development has impacted ResMed due to the connection between obesity and sleep apnea, reducing the demand for its devices and posing a threat. ResMed shares sank by 18% in 2023 over fears the drugs would affect sales. However, investors may have overestimated the impact of the drugs on sales, and fears are moderating. A study of over 660,000 patients diagnosed with sleep apnea while taking GLP-1 drugs showed that they are 10% more likely to start sleep apnea treatments.

Financial Health Check

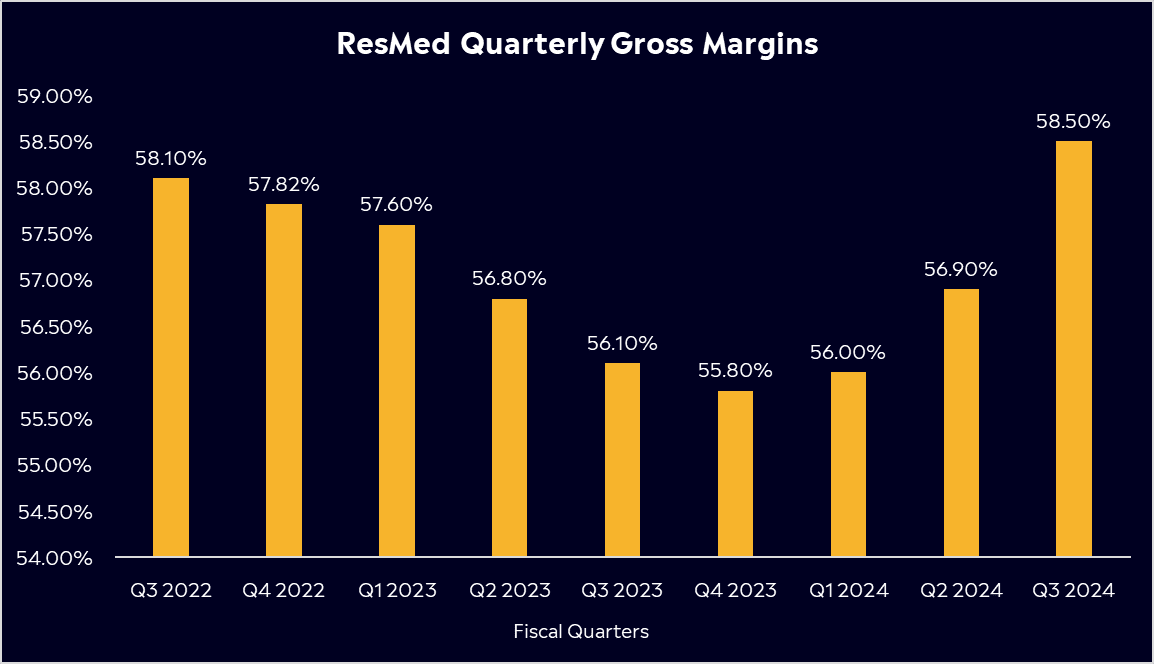

ResMed reported solid earnings growth in its most recent quarterly earnings in April, with 27% growth and solid margin expansion. Sales were driven by increasing patient demand, while gross margins grew from 56.10% to 58.50% thanks to reduced freight and manufacturing cost improvements.

Gross margins and earnings look set to grow further over the years ahead, thanks to operational efficiencies and continued sales growth. Expansion in both these areas will be key for shares to continue moving higher.

The business has also made a significant step forward with cash. Free cash flow is set to grow by over 100% for the full year ending July 2024, which will aid in paying down debt, continuing its buyback program and supporting future growth. According to a study by McKinsey, sleep wellness is one of the growing trends in the wellness market, with consumers’ desire for a good night’s sleep growing. This is a welcomed boost to not just ResMed’s devices segment but also ResMed’s SaaS business, which will be the business’s fastest-growing segment this year and extend ResMed’s reach beyond respiratory care.

Buy, Hold or Sell?

The company believes that over 1 billion people globally have sleep apnea, and that number is only growing. However, only a very small percentage of the world’s population is being treated for the condition, with many being left undiagnosed, opening a huge addressable market. This offers a large runway of global growth for ResMed, especially with its global presence and dominance in the sector.

ResMed has a solid history of rewarding shareholders with annualised returns of over 19% in the last ten years while paying a dividend of 0.9% that could grow further over the next 12 months as earnings and cash grow. Given the addressable market ResMed has, alongside its market dominance, the stock has a resounding buy rating from analysts. According to Bloomberg’s Analyst Recommendations,

ResMed has 14 buy ratings, 0 holds, and 0 sells, with an average price target of AUD$35.23.

Nonetheless, challenges remain with tough regulatory governance and high expectations for margin expansion, while its valuation has jumped to 25.5x forward earnings this year. However, with fears diminishing from GLP-1 drugs and awareness of sleep apnea growing, ResMed looks to have a lot of momentum, helping investors to rest easier.

View ResMed

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD.

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.