Artificial Intelligence is here to stay, and companies are reaping the rewards. Of course, Nvidia is the standout, delivering eye-watering profits in the last 12 months. But, investors have the opportunity to capitalise on the AI boom here in Australia by investing in local companies providing critical infrastructure, tools, and services enabling AI development and deployment.

One such company is NextDC, which is investing billions to meet the skyrocketing demand for data centres. Will their shares continue to rise, or is a slowdown on the horizon? Let’s find out.

- NextDC shares have soared 190% in five years, driven by AI and cloud growth, with new data centres opening in 2025 to meet rising demand.

- The business has raised nearly AUD$2 billion to support growth, but the industry’s capital-intensive nature poses ongoing financial challenges.

- Shares have rallied so far in 2024, but analysts are still bullish. Bloomberg’s Analyst Recommendations show 15 buys, 1 hold, and 1 sell.

View NEXTDC

The Basics

NextDC Limited (NXT) is a prominent Australian data centre services provider, operating facilities in major cities such as Sydney, Melbourne, Brisbane, Canberra, and Perth. They offer colocation services, allowing businesses to rent space, power, and cooling for their IT equipment in secure and reliable data centres. Their ecosystem hosts the country’s largest specialised ICT community, consisting of over 750 cloud, network, and IT service providers.

They are increasingly involved in supporting AI workloads and providing the high-performance infrastructure needed for AI applications as the technology revolution continues to boom. Over the past five years, shares have surged by over 190%, driven by increasing demand for cloud services and AI. They also believe these trends aren’t slowing down, with two new Data Centres in Auckland, New Zealand and Kuala Lumpur, Malaysia, set to open in 2025 to cater to growing demand.

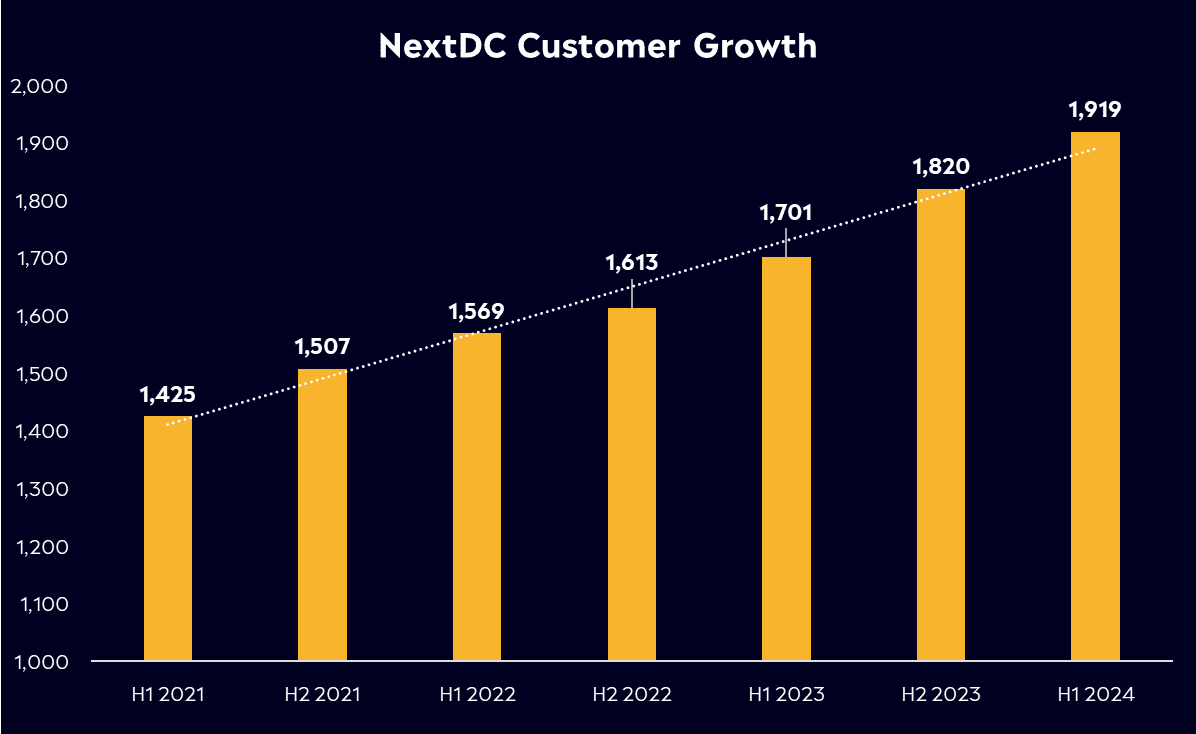

Their revenue comes from recurring subscriptions for colocation and interconnection services, one-time setup fees, and value-added services. In this line of business, stability is vital, as downtime can severely impact businesses. The company saw 13% customer growth in 2023, underscoring its capability to support power-intensive AI products.

Competitor Diagnosis

The data centre sector is booming, and in Australia, capacity is set to more than double by 2030; therefore, it’s almost inconceivable that companies won’t continue to benefit from that demand. Of course, those businesses will need to deliver on their growth strategies and roadmaps, while there is always the risk of a significant change in the macro environment.

NextDC has a few competitors, but the standout names are Equinix (EQIX), AirTrunk, Canberra Data Centres, and Goodman Group (GMG). Only Equinix and Goodman are publicly traded stocks; the other two businesses are privately owned. While traditionally focused on logistics and industrial real estate, Goodman Group has increasingly expanded into the data centre space in recent years. Equinix, though, is the global market leader, with 260 centres in over 30 countries. Both these businesses are profitable, giving them the financial position to scale their data centre businesses to meet growing demand.

Additionally, major tech giants such as Google (GOOG), Microsoft (MSFT), and Amazon (AMZN) pose competitive threats while also serving as partners. The Australian government recently announced a partnership with Amazon Web Services (AWS) to construct three data centres to handle top-secret information.

Financial Health Check

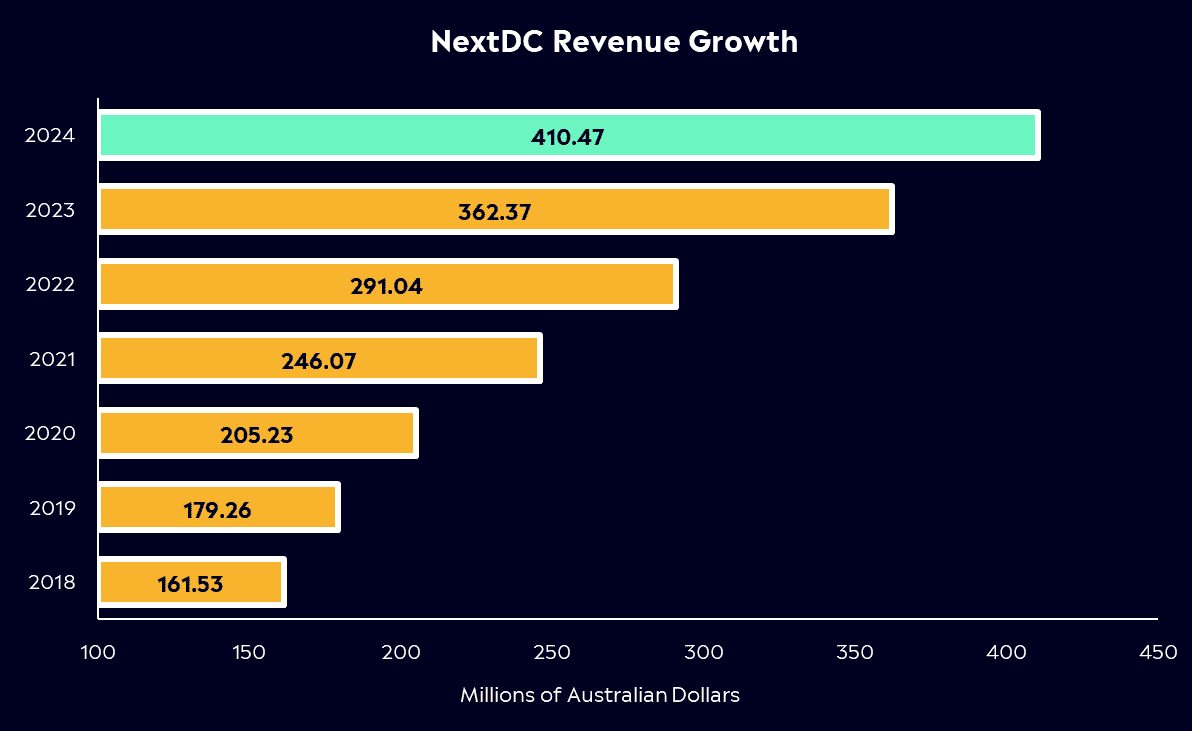

With demand for data centres increasing due to AI and cloud computing, there is likely to be an ongoing supply-demand imbalance. That is why the business is investing heavily to continue scaling, with capital expenditure set to grow by 27% in 2024. NextDC operates in a capital-intensive industry, but the company has raised almost AUD$2 billion in capital over the past 12 months to help achieve ongoing growth.

Since the business is still in its growth stage, profitability isn’t yet on the horizon. The market does not expect NextDC to turn a profit until 2028. That, of course, may come sooner, and it will depend on how the business navigates the next few years from raising more capital, acquiring land to build data centres and then acquiring customers to take on the new capacity. Revenue for the full year is expected at AUD$410 million, with EBITDA of AUD$196.8 million.

As new developments rise, new customers will need to grow at a solid pace, which is the key to profitability. As the business has expanded, they have continued to add and retain new business, which is a good sign. With a customer base broad by industry and a growing international footprint, NextDC has solid foundations for scale.

Buy, Hold or Sell?

Naturally, investing in technology stocks during a growth phase carries risks. Continued capital raising will likely be necessary for NextDC to sustain its growth trajectory. A slowdown in the AI and Cloud sectors could impact demand down the line, while its valuation is looking stretched. Shares recently reached a new all-time high, and it now trades at 50x EV/EBITDA for FY2025.

However, current indicators show no signs of deceleration, with the AI market projected to surge to USD$1.3 trillion over the next decade. Analysts are still bullish on the stock despite its valuation. According to Bloomberg’s Analyst Recommendations, NextDC has 15 buy ratings, 1 hold, and 1 sell, with an average price target of AUD$19.45, signalling 7% upside.

NextDC has fantastic growth prospects, but management needs to keep delivering. Although the business is not yet profitable, the stock looks to be an attractive long-term investment, as it is positioned well to capitalise on the growing demand for data centres.

View NextDC

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.