Sustainable investing – also known as ESG (environmental, social and governance) investing – has become an increasingly popular preference for investors in recent years. With consumers now paying closer attention to how companies apply their corporate policy to act responsibly, investors may decide to diversify their portfolio with ESG stocks.

Here, we look at some of the most intriguing ASX companies leading the way in sustainable investing and provide insights into the opportunities and challenges associated with investing in ESG stocks. To kick things off, here are 3 ASX ESG stocks to look into.

#1: Endeavour Group Limited (EDV.ASX)

Endeavour Group has a dedicated Sustainability Strategy that outlines how the company is committed to responsibility and community, championing individuality and reducing its impact on the planet through various initiatives. Living by its mantra ‘Creating a more sociable future, together’, Endeavour Group has made several commitments it intends to meet by 2030.

Past performance is not an indication of future results.

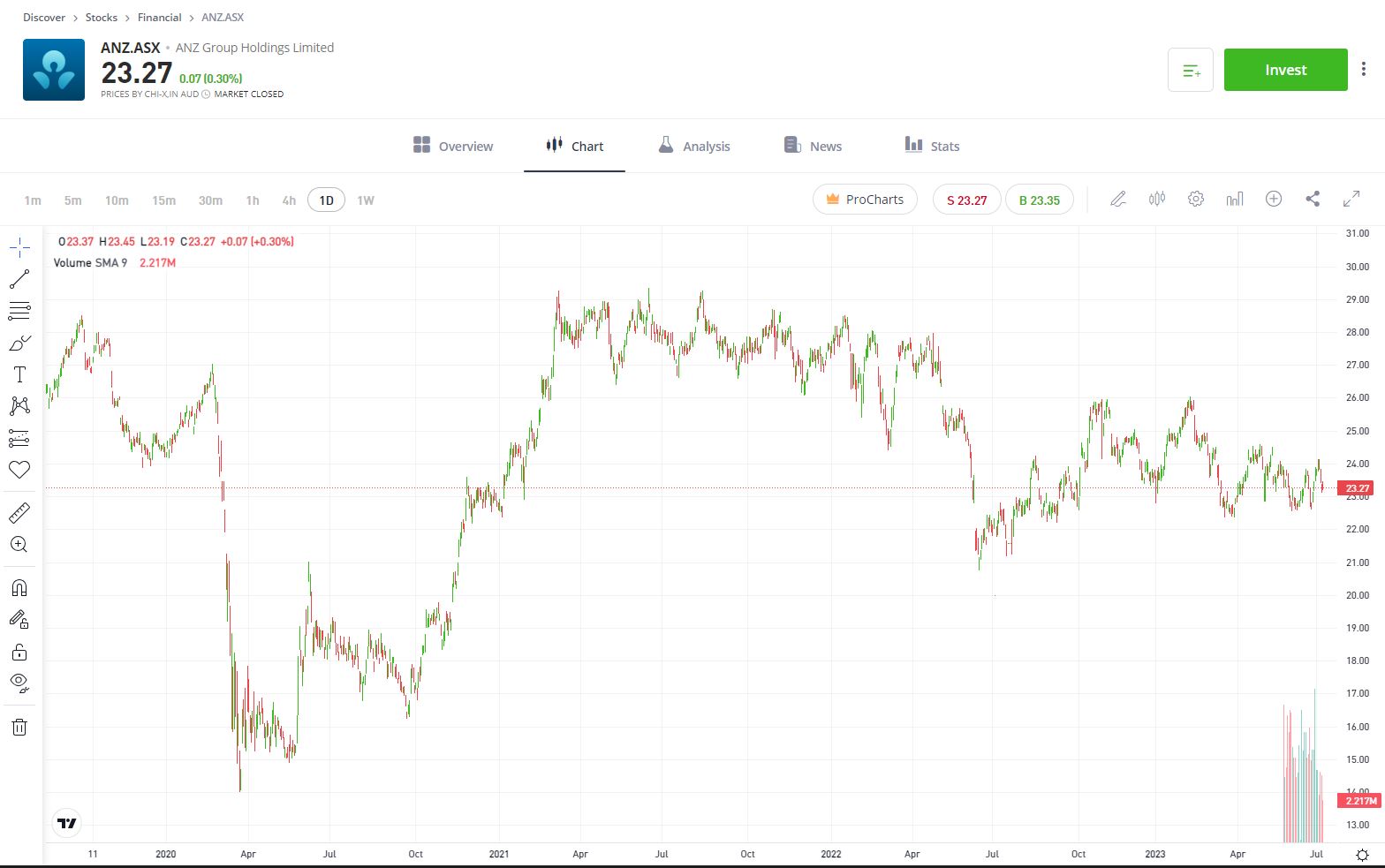

#2: ANZ (ANZ.ASX)

As one of Australia’s ‘Big Four’ banks, ANZ is leading the way regarding ESG. The bank’s efforts have been formally recognised by the annual Australian Corporate Treasury Association (ACTA) awards, taking out ‘best bank for environmental, social and governance and sustainable finance’ in 2022. ANZ also recently announced it was boosting its net-zero targets with a new sustainable solutions target of $100 billion by 2030.

Past performance is not an indication of future results.

#3: Transurban Group (TCL.ASX)

With its long-standing commitment to sustainability, Transurban Group is a popular stock for many investors looking to add an ESG company to their portfolio. The company is mainly focused on transitioning to renewables, such as wind power, improving the energy efficiency of its motorways, deploying tunnel-ventilation systems to ensure safer air quality, and replacing existing fleets with low- and zero-emission vehicle options.

Past performance is not an indication of future results.

What should you consider before investing in ASX ESG stocks?

Before investing in any new stock – particularly ESG stocks on the ASX – it is essential to consider your investment goals and risk tolerance. This is because sustainable investing may sometimes involve higher risks than more traditional investments, requiring companies to meet ESG targets that may impact their profitability.

It is also important to do your due diligence and research every company you are considering adding to your portfolio – this means not only evaluating their ESG performance and transparency but also their recent market performance.

Is ESG reporting mandatory in Australia?

While ESG reporting may not be mandatory for all companies in Australia just yet, many companies are following the lead of their UK, EU and US counterparts by voluntarily disclosing their ESG performance.

Importantly for ASX investors, you should know that according to Listing Rule 4.10.3, “all listed entities [must] publish annually a corporate governance statement that discloses the extent to which the entity has followed the recommendations set by the ASX Corporate Governance Council during the reporting period”.

Additionally, recommendation 7.4 of the ASX Corporate Governance Council’s Principles and Recommendations states that “a listed entity should disclose whether it has any material exposure to economic, environmental and social sustainability risks and, if it does, how it manages or intends to manage those risks”.

Together, these are helping to provide greater transparency for investors and make it easier to identify companies committed to sustainable practices.

What opportunities do ASX ESG companies offer investors?

By investing in ASX ESG companies, you have the opportunity to support companies that are committed to sustainable practices and have the potential to generate long-term returns. Companies that prioritise ESG targets often have a competitive advantage in their respective market, as they can better manage risks, reduce costs and build stronger relationships with customers, employees and other stakeholders looking to do business with ESG-focused companies.

Having partnered with ESG Book, a company specialising in ESG data analytics, eToro allows investors to review ESG scores for more than 2,700 assets. Companies are compared to others in their sector using a traffic light system. Green scores represent high achievers, amber scores reflect average performance and red scores signal poor ratings. Scores are adjusted daily to display.

What challenges do ASX ESG stocks present investors?

That’s not to say that investing in ESG stocks on the ASX is not without its unique challenges. Investing in these companies requires a broad understanding of the market and how to evaluate a company based on non-financial metrics, which can be challenging to measure.

ESG performance can also vary significantly among companies in the same industry, making it challenging to identify who the leaders are and who is lagging behind. ESG goals may also not always align with short-term financial performance, which can impact share prices and, subsequently, your portfolio.

Investing in ESG stocks provides investors with an opportunity to support companies committed to sustainability with ambitions to deliver long-term returns to their shareholders. As always, you should conduct thorough research and evaluate any company you intend to invest in based on its ESG performance. This may help you identify the right opportunities at the right time for your investing goals and help you make more informed decisions.

AU disclaimer: eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.