- One in five (22 per cent) see global recession as main investment risk, while 18 per cent cite inflation as top concern

- Retail investor confidence strengthens, 79 per cent feel upbeat about markets versus 73 per cent in June

- One in three (32 per cent) plan to increase investment contributions in Q4, whilst 7 per cent will scale back

Thursday, 28 September 2023 – The prospect of a recession has jumped above inflation as the chief concern for Australian retail investors, according to data from the latest Retail Investor Beat (RIB) from trading and investment platform eToro.

In the study of 1,000 Australian retail investors, more than a fifth (22 per cent) said they regard the state of the global economy and a potential recession as the biggest risk to their investments, while 18 per cent see inflation as the top risk. This is a significant reversal from three months ago, when inflation was the number one worry (20 per cent), with local and global recession fears lower down the list (19 per cent and 16 per cent respectively).

The RIB data also shows that, while a potential global recession is now the biggest perceived threat to investment portfolios, it is not weighing down on investor sentiment in the way that out-of-control inflation did three months ago. When Aussie retail investors were asked how confident they felt across different aspects of life during the last three months, every single confidence metric rose. Those confident about their investment portfolio jumped from 73 per cent in June to 79 per cent today, while those upbeat about income and living standards rose from 60 per cent to 68 per cent over the same period.

Confidence in the Australian property market also rose significantly, with 65 per cent of Aussie retail investors feeling confident today, versus 52 per cent in June.

Table 1: How Aussie retail investor concerns have shifted from inflation to recession in 2023

| Potential risk to investments over the next 12 months | June | September |

| Inflation | 20 per cent cited as biggest risk | 18 per cent cited as biggest risk |

| State of the Australian economy (potential recession) | 19 per cent cited as biggest risk | 21 per cent cited as biggest risk |

| High-interest rates | 16 per cent cited as biggest risk | 11 per cent cited as biggest risk |

| State of the global economy (potential recession) | 16 per cent cited as biggest risk | 22 per cent cited as biggest risk |

Commenting on the data, eToro Market Analyst Josh Gilbert, said: “Retail investors are no longer fixated on inflation concerns as the RBA’s tightening cycle continues to drive inflation lower. But, investors’ worries have now shifted to the potential economic downturn that could result from higher interest rates. However, this concern isn’t affecting market sentiment to the same extent as earlier inflation concerns. The good news, though, is any potential recession is expected to be relatively mild, and as economies continue to perform better than initially expected, the prospect of a recession is becoming less likely.

“In fact, retail investors are feeling a lot rosier about their investments than they were three months ago, they are generally quite bullish about the remainder of 2023, and the consensus amongst this group is still for a sustained bull market in the first half of next year. Retail investors are forward-looking, and that’s why we are seeing confidence rise. If we look at the fundamentals of lower inflation, interest rate cuts, and a Chinese economy that has seemingly bottomed, 2024 looks set to be a good year. ”

The jump in confidence related to investments is resulting in a more bullish approach when it comes to the size of investment contributions. According to the data, a third (32 per cent) plan to increase the size of their regular contributions in the next three months, with this group outnumbering those who plan to scale back investment contributions (7 per cent) by more than four to one.

“Recent consumer sentiment surveys tell us that consumers are feeling pessimistic, but a third of investors planning to increase their investment contributions paints a different picture. This points towards their confident outlook on financial markets and is also aided by the strength of Australia’s employment landscape, with Aussies clearly feeling financially stable to increase their investments. This data continues to tell us that Aussie investors are understanding the importance of investing early, and consistently. ”

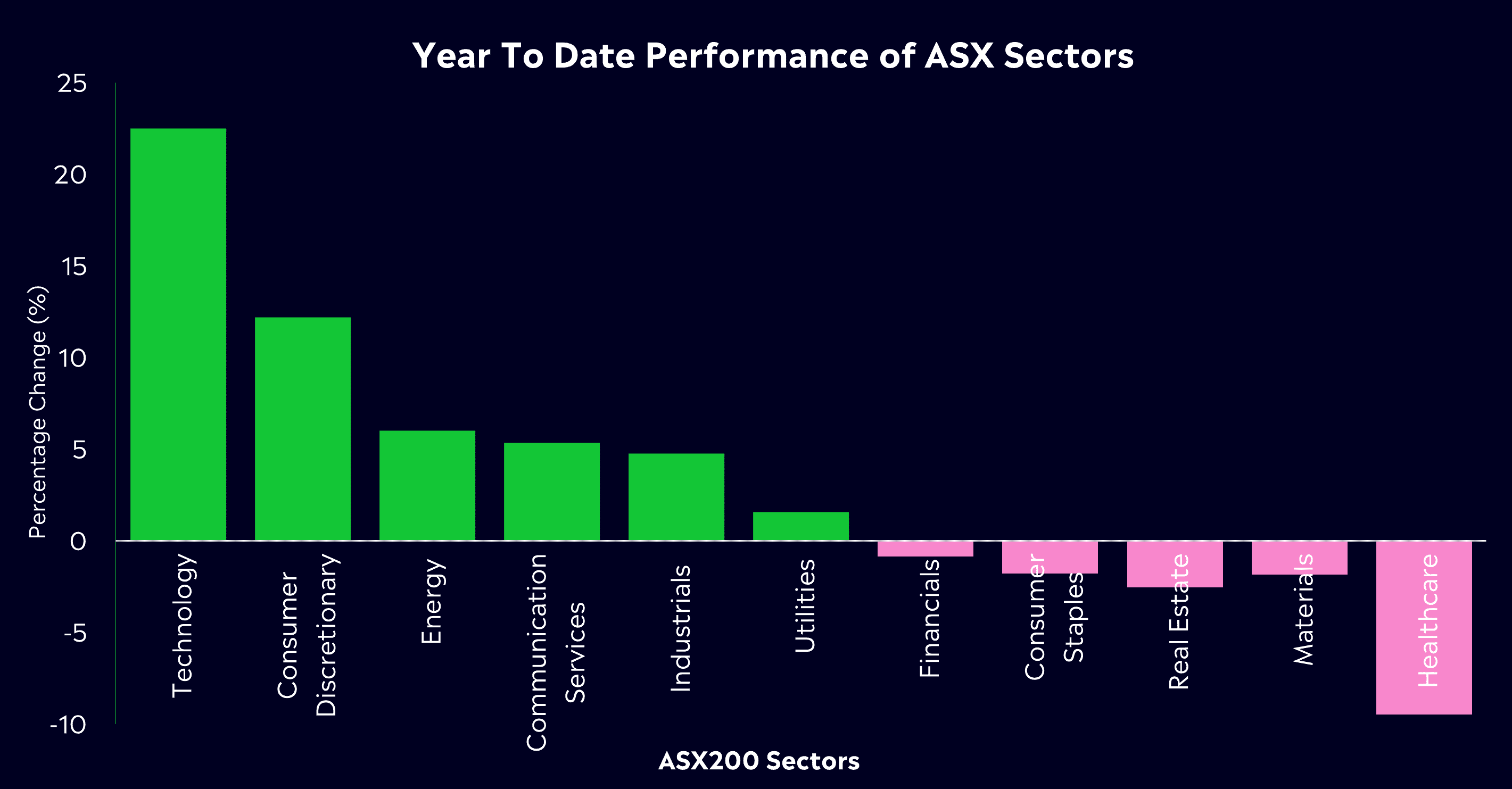

The industry most likely to benefit from this upturn in sentiment is financial services, an industry that historically performs well with high-interest rates, has Aussie investors more likely to up investment in this sector over any other sector during Q4. Technology was the second favourite amongst respondents for the remainder of 2023, followed by the materials and real estate sectors. The sectors least attractive to Aussie retail investors in Q4 are industrials and discretionary consumer goods.

Gilbert adds: “In 2023, technology has made a strong resurgence, capturing the attention of retail investors once more. This resurgence is hardly unexpected, given the impressive performance this year, particularly with AI stocks taking on a significant role. However, on the flip side, consumer discretionary goods come bottom of the list for investors, despite also being a top-performing sector, driven by investors’ fears of recession. But they are not afraid of being contrarian, with a significant focus on real estate and materials sectors, recent underperformers that would do well with any early cutting of interest rates.”

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

eToro is authorised and regulated by the Financial Conduct Authority in the UK, in Cyprus by the Cyprus Securities and Exchange Commission, by the Australian Securities and Investments Commission in Australia and licensed by the Financial Services Authority in the Seychelles.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.