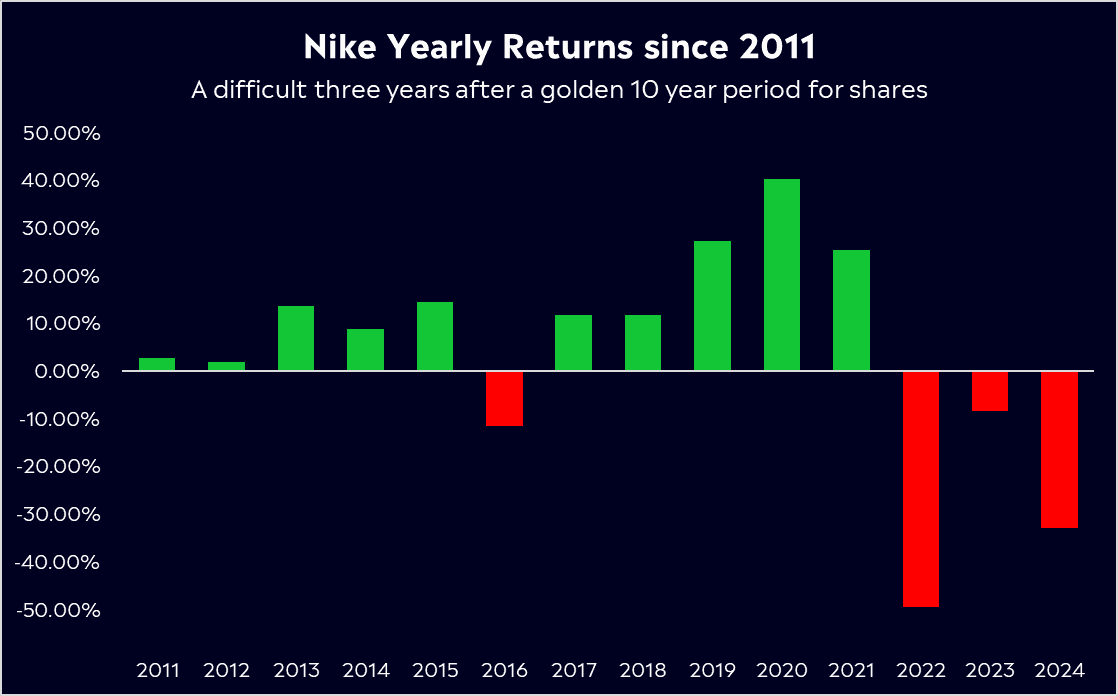

Nike is down, but is it out? That’s the big question I’ll try to answer. I’m a football fan, soccer for some of you, and that means I know that if you’re down, you’re not completely out. Nike shares have fallen 60% from their high in 2021 after facing a myriad of challenges over recent years, from slowing sales, growing competition and a sales strategy shift that just really didn’t work. However, the world-renowned brand is fighting back with a new CEO at the helm who is looking to turn its fortunes around. So can Nike actually do it, or is the swoosh starting to fade? Lets find out.

- Nike’s turnaround is underway, but challenges remain. Sales in North America and EMEA were better than expected, yet China remains weak, and digital traffic is set to decline next quarter.

- CEO Elliott Hill is refocusing on sports, rebuilding wholesale partnerships, and streamlining products, but the path back to growth will be a marathon, not a sprint.

- Nike has 23 buy ratings, 19 holds, and 2 sells, with an average price target of USD$86.68 signalling a potential upside of 20% from its last closing price.

Explore Nike

The Basics

I’ve been a Nike fan for years, but even I can admit it has taken its eye off the ball and lost its way. Shares have fallen 60% from their peak in 2021, and investor sentiment is weak, leaving question marks over what’s ahead. Its recent earnings showed some positives, but that there is still a lot of work to do.

Nike has seen a post-pandemic inventory glut, shifting consumer preferences, rising competition, and a disastrous sales strategy shift. During the pandemic, Nike went all in on online sales, aggressively pivoting to direct-to-consumer sales. This came at the expense of wholesale relationships with retail giants like Foot Locker. These retailers responded by giving more shelf space to competitors like Adidas, Hoka, and On Running. The digital shift initially pleased shareholders, but it didn’t last, and sales have slumped. China, an important region for Nike, has also struggled, with anemic consumer spending hurting sales.

Enter Elliott Hill, Nike’s new CEO as of October 2024, replacing John Donahoe, whose tech-focused approach proved ill-suited for Nike’s challenges. Hill, a Nike veteran with 32 years at the company before his 2020 retirement, faces the daunting task of returning this elite brand to growth. His strategy? Doubling down on what made Nike great in the first place: sports and performance products, particularly running and basketball shoes. The company has also announced plans to streamline its product lineup by 25% to focus on innovation in key categories, with several new performance technology platforms expected to launch in late 2025.

What does the smart money think? Well, billionaire investor Bill Ackman has been accumulating shares within the last year, with his firm, Pershing Square Capital Management holding over 18 million shares worth $1.4 billion at the end of Q4 2024. A substantial vote of confidence from one of Wall Street’s sharpest minds.

For more on Nike’s story, I highly recommend reading Shoe Dog by founder Phil Knight. It’s a great read not only on Nike’s start and growth but also the challenges of creating the world’s largest sportswear brand.

Fun Fact: Nike was originally founded as Blue Ribbon Sports back in 1964 by track Coach Bill Bowerman and his student, Phil Knight. In 1971, Knight paid a student at Portland University $35 to create a new logo, in which she created the swoosh, now recognised as one of the most iconic brand logos globally.

Competitor Diagnosis

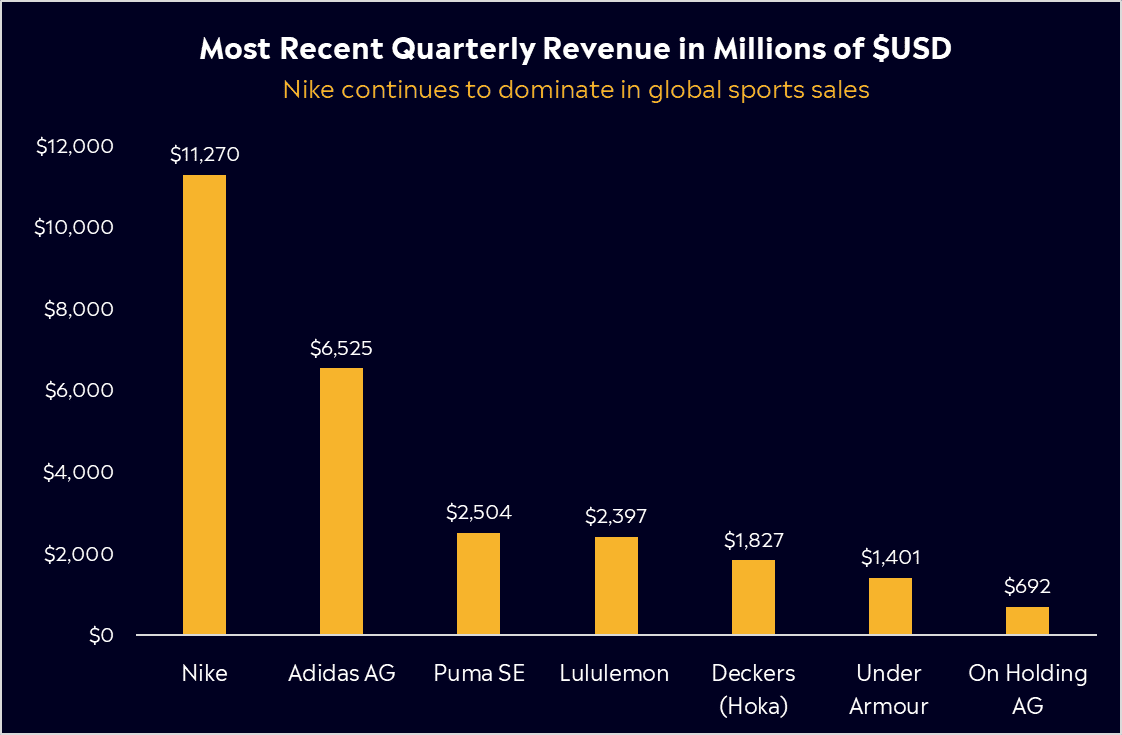

Nike has been the leader in sportswear for decades, but now, more than ever, competition is gaining ground. According to Morningstar, in 2024, Nike’s share of the global sports footwear market was 16%, more than double that of its closest competitor, Adidas. Nike ships products to more than 190 countries (with more than half its sales outside North America), has around 6,000 branded stores operated by franchisees, primarily in Greater China, and directly operates more than 1,000 stores.

Over the years, Nike has been known for its high-profile sponsorships—think Cristiano Ronaldo, LeBron James, Tiger Woods, and Roger Federer. The latter two legends have left, while the first two are nearing retirement. They aren’t just brand ambassadors; they drive revenue and profits. One of Nike’s biggest challenges now is replacing these legends and finding new icons, a task that won’t be easy. New partnerships with trending brands like Skims are a sign that the business is narrowing its focus on what consumers want.

Nike’s biggest rival is Adidas, which is coming off a strong year thanks to solid demand for its retro Samba and Gazelle sneakers. However, Adidas has faced its own challenges with slowing revenue growth. Meanwhile, New Balance is making strides with its ‘dad shoes’, which are now considered cool, while even Asics is making a comeback. Competition is fierce.

Other brands, such as Puma and Under Armour, are vying for market share, while Anta Sports is gaining ground in China. Meanwhile, smaller brands like On Running and Hoka are growing fast, particularly in the running shoe category, a sector where Nike built its reputation. Running is seeing a surge in popularity through run clubs and community-led fitness trends. These challenger brands are gaining traction through innovation and strong connections to younger audiences—something Nike has missed in recent years.

Lululemon is another brand that can’t be ignored. While traditionally focused on yoga and women’s wear, it has expanded and is now a serious competitor in premium athletic apparel. A loyal customer base and premium positioning have helped drive revenue growth of over 20% annually in recent years, far outpacing Nike. Nike’s biggest strengths lie in its brand power and marketing dominance. Very few companies have a global footprint and brand awareness, like Nike. Although it may have lost focus in recent years, investors can be sure that the business will invest heavily in technology and sponsorships to regain market share, something that smaller competitors simply can’t match.

However, Nike has seen challengers come and go over the years and has always managed to fend them off, but is this time different? The real test for Nike is whether it can reignite growth, reclaim innovation, and keep these rivals at bay. If not, the market share gap will continue to shrink, and shares will remain under pressure.

Financial Health Check

Nike’s latest earnings report showed better-than-expected results, with revenue falling 9% to USD $11.3 billion, outperforming Wall Street’s expected 11% decline. However, the company continues to grapple with weak consumer spending, elevated inventory levels, and margin pressure from discounting. While North America and EMEA sales outperformed expectations, China remains a major weak spot, with sales down 17% year-over-year, reflecting sluggish consumer demand in one of its most important growth markets.

The biggest near-term concern is profitability. Nike is aggressively clearing inventory through heavy discounting, particularly in staple sneaker franchises like Air Force 1s and Dunks, but this comes at the cost of margins. Margins fell 330 basis points to 41.5% while net income fell 32% to $800 million. Nike’s CFO warned that gross margins will decline sharply next quarter, pressured by both markdowns and new U.S. tariffs on goods from China and Mexico. Nike needed to deliver a strong message to investors this quarter to help bring the stock out of its slump, but we didn’t quite get that. The company expects a double-digit decline in digital traffic, as it shifts its inventory mix toward performance sports and moves away from its previous digital-heavy sales strategy.

Shares are trading at 34.5x forward earnings, which is higher than its 10-year average of 31x, showing there may be more pain ahead for Nike if it continues to disappoint investors. Nike’s unmatched brand equity and global footprint provide a strong foundation, but execution in the next two quarters will be critical to determining whether this iconic brand can regain its stride.

Buy, Hold or Sell?

Let’s be clear: This isn’t going to be an overnight turnaround for Nike. CEO, Elliott Hill has himself said, it’s a marathon, not a sprint. That tells us investors are going to need some patience. But if Hill’s plans to restore wholesale partnerships and push for new products while focusing on footwear bear fruit, it is likely to drive profitability and grow market share once again over the next few years. According to Bloomberg’s Analyst Recommendations, Nike has 23 buy ratings, 19 holds, and 2 sells, with an average price target of USD$86.68 signalling a potential upside of 20% from its last closing price

Positives:

- Nike remains the leading name in sportswear, commanding a 40% market share with a globally recognised brand and high-quality products.

- Sales in the most recent quarter were better than expected and show early signs that Elliott Hill is having an impact on the business.

- Bill Ackman’s Pershing Square hedge fund recently acquired three million shares, signalling strong institutional confidence in Nike’s future.

Risks:

- A new CEO brings optimism, but strategic shifts take time. Nike’s shares could remain under pressure before improving as changes are implemented.

- The running boom is fueling growth for emerging brands like Hoka, On Running, and New Balance, which are chipping away at market share.

- Margins are under pressure as heavy discounting to clear inventory levels persists and US Tariffs come into play.

- If the US economy slows, discretionary spending could decline, impacting Nike’s largest market, North America.

So, back to the first question: Is Nike out? Not at all. It’s down, but it’s certainly not out. Can they actually do it? Well, CEO Elliott Hill has an arduous task ahead. He needs to return Nike to its roots by improving wholesale partnerships after a disastrous direct-to-consumer strategy, reconnect with younger consumers, who increasingly view the swoosh as their parents’ brand and navigate inventory challenges.

Nike’s near-term sales declines may continue as it aggressively seeks to clear out aged inventory, and margins will remain under pressure. But don’t write off this iconic sportswear brand just yet.

Explore Nike

*Data Accurate as of 21/03/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication