Bitcoin quietly stole the limelight in 2023, with a huge resurgence gaining 150%, and it may steal the spotlight again in 2024, but maybe not so quietly. The anticipation around the potential approval of a US spot bitcoin ETF is reaching new heights, and here’s what you need to know.

After a solid start to 2023, crypto assets plateaued until June, when the world’s largest asset manager, BlackRock (BLK), filed for a spot bitcoin ETF on the 13th of June 2023. This was significant given that the SEC had rejected every application for a bitcoin spot ETF over the last 10 years, but mainly because BlackRock has an almost perfect ETF application record. The asset manager boasts a scorecard of 575 accepted applications to 1 rejected application. This news saw the price of bitcoin spike from just under USD$25,000 to over USD$30,000.

Who is BlackRock?

BlackRock is one of the largest and most influential investment management firms globally. Founded in 1988, it has become a key player in the financial industry, specialising in asset management, risk management, advisory services, and investment technology. Today, they are seen as the world’s largest asset manager, with over USD $10 trillion in assets under management. One of BlackRock’s notable offerings is its iShares brand of ETFs, which are widely traded and cover various market segments. These ETFs have become popular investment vehicles for many retail and institutional investors due to their diversification benefits and cost-effectiveness.

Is it just BlackRock applying for a Bitcoin spot ETF?

Simply put, no. There are other big names competing for ETF approval, with a standout being Cathie Wood’s Ark Investment, as well as huge asset managers such as Grayscale, VanEck, Bitwise, Invesco, Fidelity and Wisdometree, to name just a few.

Bitcoin Futures ETF

As mentioned, the SEC has never accepted a single crypto spot ETF, but that doesn’t come without a lack of effort. Grayscale emerged as the front-runner for a Bitcoin spot ETF; it initiated its application in 2016 but ultimately withdrew it after engaging in extensive deliberations with the SEC throughout 2017.

As of today, there are actually crypto ETFs operating, however, these are futures ETFs. Spot ETFs allow investors to invest in a crypto ETF at the current price, just like buying spot bitcoin. On the other hand, futures ETFs require investors to predict specific prices at certain points in the future of a crypto asset effectively predicting the future value of the asset.

Bitcoin Spot ETF Deadline

The leap for decentralised finance into the ‘traditional’ finance world is nearing closer, as the clock ticks down on the SEC’s January 10th deadline, when US regulators must finally decide whether to greenlight a physically-backed Bitcoin ETF. The decisions will be made on Cathie Wood’s ARK Investment and 21Shares, who were the first to file in 2023, but this day may also signal the ruling on other applications. For BlackRock, their decision date is the 15th of January, but this isn’t the final deadline, and the SEC could push this to the 15th of March. However, Bloomberg analysts predict a 90% chance that a bitcoin spot ETF will be approved in January.

How likely is an acceptance?

This is the million-dollar question. However, late in December 2023, BlackRock updated its ETF filing showing that it had received seed funding for its potential ETF. In the context of an ETF, seed funding refers to the initial capital allocated towards the initial creation of shares to be traded once the vehicle goes live in public markets. The filing revealed that the seed investor agreed to purchase $100,000 in shares on October 27th 2023, and took delivery of 4,000 shares at a price of $25 per share. While the outright number of $100,000 in seed capital is not a remotely significant number, this adds further evidence of the expectation for approval by the upcoming January decision deadline.

Why is a Spot ETF significant?

The launch of a bitcoin spot ETF will help the digital assets space become a more significant part of traditional finance as money managers will be able to buy digital assets with greater ease for these clients thanks to the ETF. A simple way to view this is that the ETF is a bridge from traditional finance to bitcoin.

Ultimately, a bitcoin spot ETF would be an entry for institutional funds, think pension funds, hedge funds, and asset managers, that have so far sat on the sidelines, and the level of funds can’t be underestimated. There is over $10 trillion in AUM across ETFs globally and trillions more dollars from advisers; just a small allocation of this capital could significantly impact the price of Bitcoin if we see an ETF introduced. It would be similar to the first international gold ETF in 2003 and US gold ETF in 2004. According to Bloomberg Intelligence estimates, the spot bitcoin ETF market can grow into a $100 billion juggernaut over time.

The acceptance is also significant from a regulatory perspective and will help build legitimacy and trust in crypto. It’s a nod of approval from regulators that have previously been tough on the asset.

What else does 2024 hold for Bitcoin?

There are several catalysts for Bitcoin in 2024, outside of the potential ETF acceptance.

Firstly, we have an improving macro environment. Late in 2023, the Federal Reserve made a dovish pivot, foreseeing three rate cuts in 2024. The market believes we will see more than three rate cuts and is already pricing in a rate cut for March 2024. This is good news for Bitcoin, as rate cuts often boost risk appetite amongst investors.

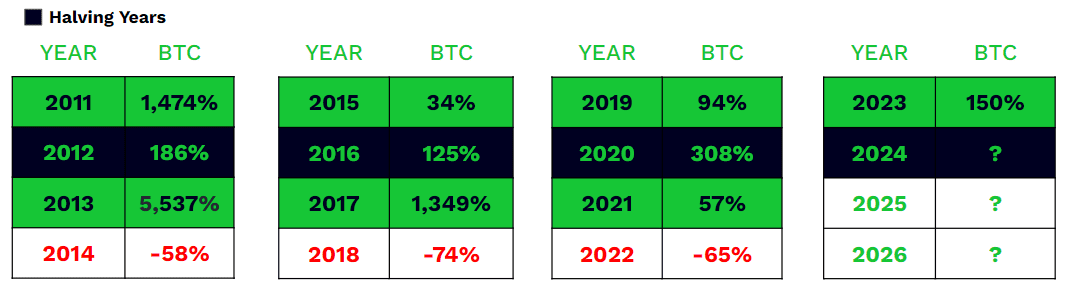

Then, we have the Bitcoin halving in April, which ever since its existence has marked a pivotal moment for Bitcoin. It reduces the supply for Bitcoin, and with demand growing in the meantime, that scarcity will be a key catalyst in 2024. Every halving event has been followed by a bitcoin bull market, which is why investors are so optimistic about what’s ahead.

We also see new global banking and US corporate accounting regulations being implemented in 2024 making it easier to own crypto and there is the potential to see a first central bank holding bitcoin in its reserves. Crypto remains very popular with retail investors. Our global retail investor survey showed it was the most popular of all assets in the fourth quarter of 2023, ahead of cash and stocks, and the average holder has a chunky 21% allocation. 2024 looks to be an exciting year for bitcoin and crypto assets more broadly. Bitcoin ETFs are good for crypto and could be a major step in the wide-scale adoption of Bitcoin.

*All data accurate as of 15/12/2023. Data Sources: Bloomberg and eToro

Buy Bitcoin on eToro

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Crypto assets are unregulated and highly speculative. There is no consumer protection. You risk losing all of your capital. Refer to our Terms and Conditions. See full disclaimer

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.