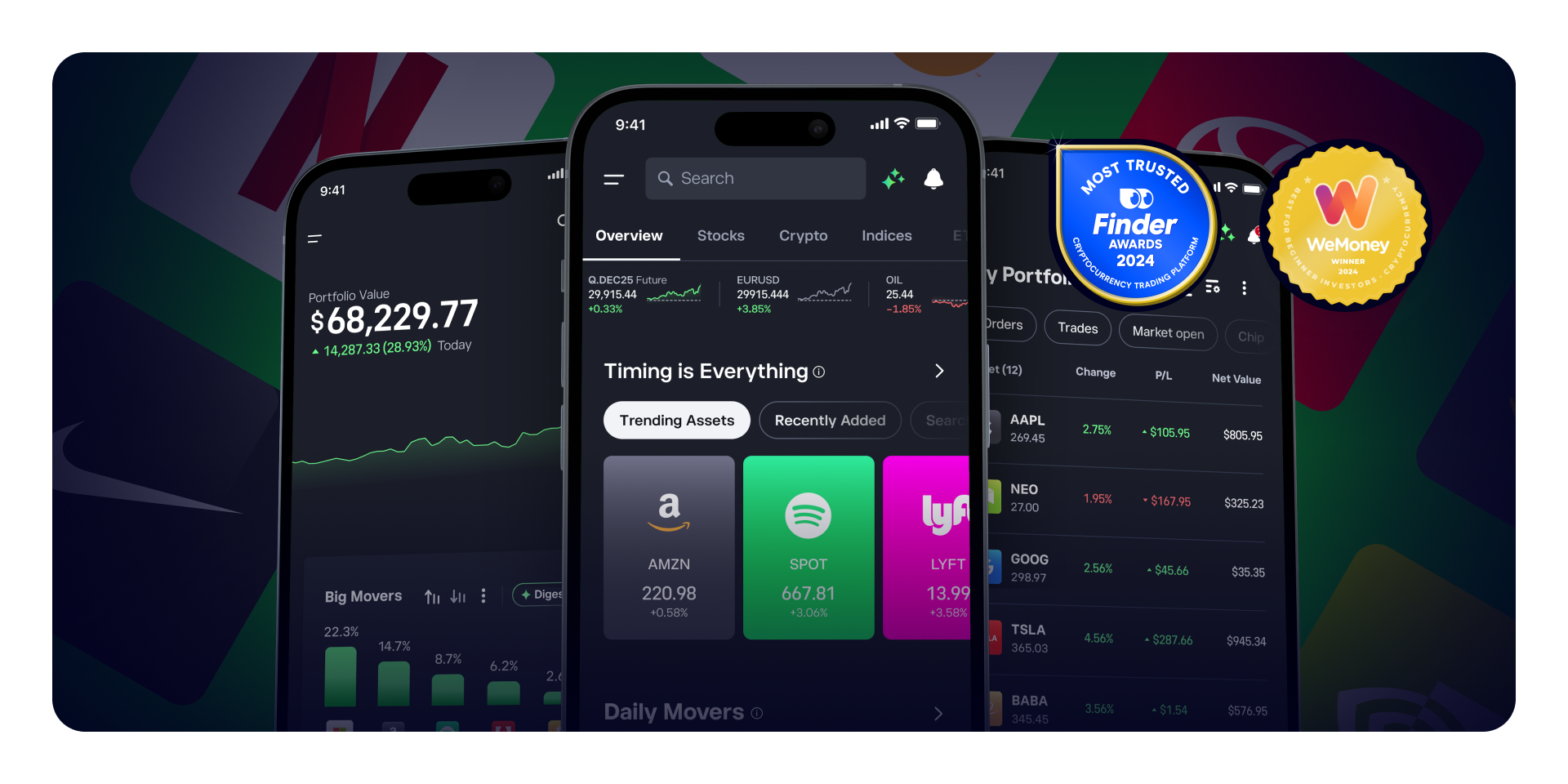

AUSTRALIA’S ALL-IN-ONE SMSF INVESTING PLATFORM

Grow and manage retirement with an SMSF structure

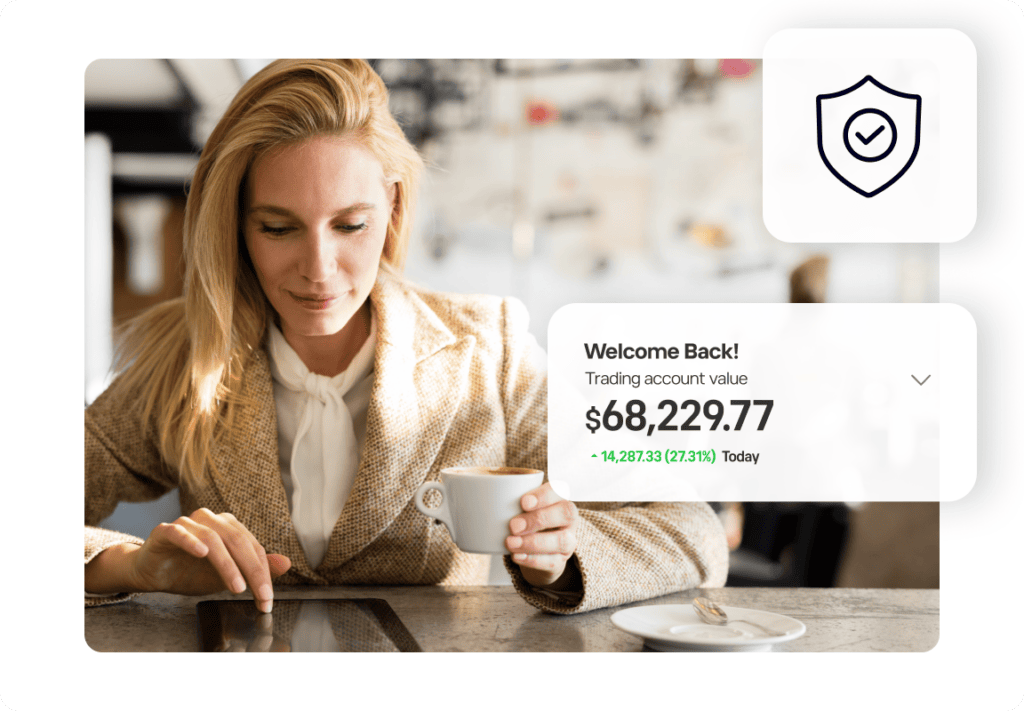

An SMSF account on eToro gives you greater control over your super, helping you manage your savings efficiently and invest across global markets.

A minimum of $10,000 USD is required to open an eToro

SMSF account.

Why invest with an SMSF with eToro

Invest with confidence across global & local markets using award-winning tools,

thousands of assets, and support from a local specialist.

and ETFs

crypto & more

investing platform

Set up a new SMSF for

only $990 AUD

Take the hassle out of SMSF administration with smart, streamlined support powered by Intello. Access up to 20% off ongoing administration and account fees, based on your eToro Club tier.

Speak with a specialist

Have questions about eligibility or how it works? Speak to our Australian-based team, with zero obligation.

Already have an SMSF?

Choose SMSF as your account type.

Upload your details via our secure eToro portal.

Access thousands of assets across global & local markets.

Don’t have an SMSF account?

Australians invest with their SMSF on eToro because we offer:

Trusted by Australians

eToro is a global investing platform trusted by over 40 million users across 75 countries. We make investing simple, transparent, and accessible across a wide range of traditional and emerging markets.

Your funds are held in top-tier institutions

The eToro Group works with globally renowned banking partners, including:

These banks are partnered with the eToro group and do not serve all entities within the group.

FAQ

- What are self-managed super funds?

-

A self-managed super fund, or SMSF, is a way of saving for your retirement. Also known as DIY super, it is a private super fund that you manage yourself, in which you are responsible for making all relevant investment decisions.

- What is the difference between an SMSF and a superannuation fund?

-

The difference between an SMSF and other types of funds is that the members of an SMSF are also the trustees. As trustee of your SMSF, you manage your own super fund, rather than having a bank or fund manager make all of the investment decisions for you.

- Who can own an SMSF?

-

You can usually have up to six members in a fund and almost all Australian residents can apply to set up their own SMSF. To be an SMSF member, you generally must:

– Be at least 18 years old

– Be financially solvent

– Consent to being a member or trustee of the fund

– Accept the fund’s responsibilities by signing a Trustee Declaration

– Have no criminal convictions relating to dishonest behaviour

– Have never breached the Superannuation Industry (Supervision) Act 1993 or been disqualified by SMSF regulators

– Not breach the sole purpose test - What types of assets can SMSFs invest in?

-

SMSF investment types can include, but are not limited to:

– Australian and international shares

– Residential and commercial property, or REITs

– Exchange-traded funds (ETFs)

– Commodities (e.g., gold and silver)

– Antiques and collectables

– Cryptoassets

– Businesses

– Cash - What are the benefits of an SMSF?

-

Some of the benefits of a self-managed super fund are:

– Flexibility. You have the flexibility to make decisions according to fluctuations in the market — and timing is critical when it comes to investing. Investing in stocks in Australia gives you greater control over your investments, so you can track their performance and adjust your investments accordingly.

– Diversification. You have the freedom to choose from a range of investments, industries and asset classes. From stocks in Australian securities to investing in cryptocurrencies, it can be a good idea to diversify your retirement portfolio to help reduce the risks associated with individual stocks. Be sure to do your research before deciding which asset types are right for you.

– Liquidity. A self-managed super fund lets you exit a stock at a time that suits you. Plus, most shares can be sold quickly.

– Assistance. You may have control over your super and be responsible for its financial and legal obligations, but that doesn’t mean you can’t seek professional advice. Consider speaking to an independent financial advisor to make the most of your SMSF.

– Tax credit. Because it is a retirement fund, your SMSF will only pay a flat 15% tax rate. Income from shares generally comes with a 30% tax credit, so you can claim back the difference.

– Tax savings. Super funds generally do not pay tax on all capital gains. That means once you have held an investment for over one year, only two-thirds of the gain is taxable. Over time, this could help you significantly increase your investment gains and help build your overall wealth.

- What are my risks and responsibilities as a trustee of an SMSF?

-

As an SMSF trustee, you are responsible for making all investment decisions for your fund. SMSFs also have legal administrative obligations that require you to maintain records, provide financial statements, complete a tax return and organise an independent audit.

Some risks may include:

– You are personally liable for all of the fund’s decisions — even if you get help from a professional, or if another member made the decision.

– Your investments may not bring the returns you expect.

– You are responsible for managing the fund even if your circumstances change — for example, if you lose your job.

– There may be a negative impact on your SMSF if there is a relationship breakdown between members, or if a member dies or becomes ill.

– If you lose money through theft or fraud, you won’t have access to any special compensation schemes or to the Australian Financial Complaints Authority (AFCA).

– You could lose insurance if you’re moving from an industry or retail super fund to an SMSF. - How much does it cost to set up SMSF?

-

Setting up an SMSF generally costs between $300–$800 AUD. In addition, there are annual auditing fees which can cost $1,000 AUD or more, depending on whose services you employ.

- Do I pay tax on SMSF?

-

Holders of SMSFs pay tax at a rate of 15% rather than your marginal tax rate of tax.

- How many SMSF can I have?

-

It is legally possible to have multiple SMSFs. However, bear in mind that additional fees for each fund would be incurred.

- Do I pay capital gains tax (CGT) on my SMSF?

-

Any net capital gain made through your SMSF will be included in your SMSF’s assessable income. SMSFs have a flat tax rate of 15%. Complying SMSFs are entitled to a CGT discount of 1/3 if the relevant asset has been owned for at least a year.