Investors buy the dip after a 10% drop to $34K

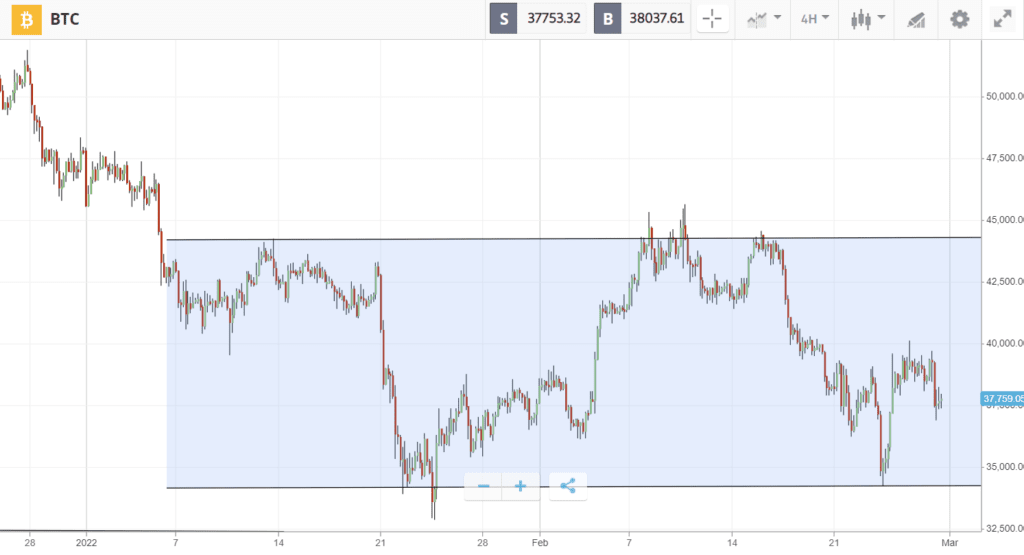

On the eruption of war in Ukraine, Bitcoin sank 10% before making a full recovery back to almost $38K.

The low of $34K came on Thursday as Russian troops invaded, and investors fled to traditional safe havens such as gold. Yet Bitcoin couldn’t be held down for long, and soon pushed back up as Biden imposed sanctions and said the US will not directly engage in the conflict. Bitcoin’s resilience was also supported by other big news, with $46 trillion bank BNY Mellon announcing an institutional crypto custody platform, and the US state of Colorado planning to accept crypto for tax payments.

In the face of seismic shifts to the geopolitical landscape, most altcoins are showing muted gains. Uniswap and Cosmos have inched around 4% higher to become top performers, while Ethereum Classic stayed flat as the history of the DAO hack was unearthed.

This Week’s Highlights

– Ukraine crypto donations hit $16M

– European Central Bank calls for faster crypto regulation

Ukraine crypto donations hit $16M

After legalizing Bitcoin last week, the official Ukraine Twitter account has requested donations in crypto amid the ongoing Russian invasion.

In total, more than $16 million has now been donated to both the Ukraine government and nongovernmental organizations supporting the military.

The speed and scale of the cross-border donations has highlighted the wartime utility of crypto, which is fast becoming critical payment infrastructure after services such as Patreon have banned pages funding Ukraine.

European Central Bank calls for faster crypto regulation

As the global financial system is weaponized against Russia, crypto is in the spotlight as a potential tool to sidestep sanctions.

Although US Treasury officials say they aren’t overly worried about crypto undermining the effort to cut off the Kremlin’s access to capital, European Central Bank (ECB) President Christine Lagarde is calling for new regulation to control the illicit flow of funds.

This could introduce more uncertainty to the crypto market, as the ECB matches Biden’s executive order on crypto with a faster roll out of the European Markets in Crypto Assets regulation (MiCA).

Week ahead

As the Ukraine crisis continues to play out, crypto and traditional markets are sitting on a knife’s edge, and more volatility could be expected in the week ahead.

On Wednesday and Thursday, Federal Reserve chief Jerome Powell will testify before Congress. Investors will be watching closely for signs that geopolitical events could impact the rate hikes that are thought to have damaged crypto market momentum.

On Friday, the crypto market could also potentially react to the release of US economic data in the February jobs report.