Develop your understanding of securities and stock lending and learn the processes which allow investors to loan out and borrow assets from each other.

Stock lending is the act of letting other traders borrow your shares and other securities, and receiving an income in return. It has long been the reserve of large institutional investors, but an increasing number of platforms are providing clients with the opportunity to loan out the securities they hold.

What is stock lending?

Stock lending occurs when one investor who holds a stock or other type of security lends it to another investor or third-party institution for a period of time. The time period will be agreed upon by both parties and may be fixed —– for example, for one month, although it could be open-ended. The trader who then holds a “stock borrow” position can sell part or all of that asset at the market price. Stock lending provides a way for the borrowing party to short sell a market and bet against the price of an asset. In return for loaning out the asset, the lender receives a fee.

Tip: Stock lending facilitates short selling and offers a more aggressive approach to betting against a market that might have overshot.

How does stock lending work?

Stock lending works by connecting two parties in a stock lending arrangement — the lender and the borrower —through an intermediary specialist or lending agent. The lenders have traditionally been large institutional investors, such as pension funds, that hold billions of dollars worth of assets. They employ specialist teams to manage the process, which includes setting up legally binding contracts and managing stock loan positions. The time and money spent on the process are offset by the ability of firms to achieve a return on assets that would otherwise just be sitting there.

Retail investors can take advantage of stock lending in two ways:

- Become a borrower: Borrowing is the more established way in which investors have been taking advantage of stock lending. Once a stock borrow is in place, a trader can click “sell” on their trading dashboard and open a short position. Brokers typically carry out the behind-the-scenes work on behalf of their clients, so to many traders, selling short simply involves navigating to a market and booking a “sell” trade. There will be an overnight fee associated with the borrowing and this will be charged on a daily basis.

- Lending stocks: Traditionally, there have been significant obstacles that prevented retail investors from lending their stocks out to others. The process involves complex legal agreements and the ongoing management of positions, but some brokers are beginning to act as intermediaries and offer this service to their clients.

What are the potential benefits of securities lending to investors?

The main incentive for anyone considering securities lending is the fee paid by borrowers to lenders. If you are holding stocks, usually the only income you can expect to receive on that position will be in the form of dividends. Participating in stock lending offers a way to potentially make your portfolio work harder for you.

The good news for lenders is that, even if they loan stocks out, they remain the ultimate beneficiary and can still expect to have dividend payments applied to their accounts. When the short position is closed out, and the borrowed stock is returned to the lender, the daily fees will no longer accrue.

Those who borrow stocks and other securities can benefit from being able to take a more nuanced approach to investing. It enables them to apply strategies that go beyond the traditional “buy and hold” approach. Securities lending also allows traders to sell short in inflated markets. Consequently, short positions can potentially be used to hedge risk in a portfolio that is otherwise weighted towards long positions.

Tip: Pairs trading strategies involve simultaneously going long and short in two different stocks in the same sector.

Are there risks when lending your stock?

Stock loan agreements are designed to protect the interests of the lending party. The stock loan can be recalled at any time, and in that instance, the borrower will have to buy back the stock in the market to close out the short position in order to return the stock. There is a risk that the borrowing party may default due to bankruptcy or a similar event, with this risk being offset by borrowers being required to put up collateral or cash when borrowing stocks from a lender.

There are additional risks that should be factored in when looking at the stock loan market. Short-selling is risky because losses on short positions are potentially infinite — prices can, in theory, rise to any level. In contrast, losses on long positions are capped by price not being able to go below zero.

While shares are on loan, clients lose ownership and associated rights, such as voting rights. Dividends may be paid to the borrower instead, with clients receiving equivalent payments in lieu, which may have different tax implications.

If a client sells shares that are currently on loan, there may be delays in the settlement process, which could temporarily prevent access to the sale proceeds.

eToro’s lending agent provides collateral, often in the form of US treasury bonds. The value of this collateral is maintained at between 100% to 105% of the lent inventory’s updated value, protecting against the risk of borrower default. However, there are still some risks associated with the practice.

It is important for investors to understand the complexities and risks of stock lending before opting in.

Tip: Lenders recalling borrows can create a “short squeeze” where short sellers buy back stock and inadvertently drive price upwards.

How does securities lending impact fluidity and efficiency?

One of the benefits of stock lending is that it can help to deflate market bubbles. Allowing some investors to sell short can counteract exuberant buying pressure and reduce overall price volatility. This can be beneficial to market participants who are looking to secure stable long-term gains. Quieter, more stable markets are also favoured by regulators, exchanges and government agencies tasked with monitoring and managing the financial markets.

How to lend stocks on eToro?

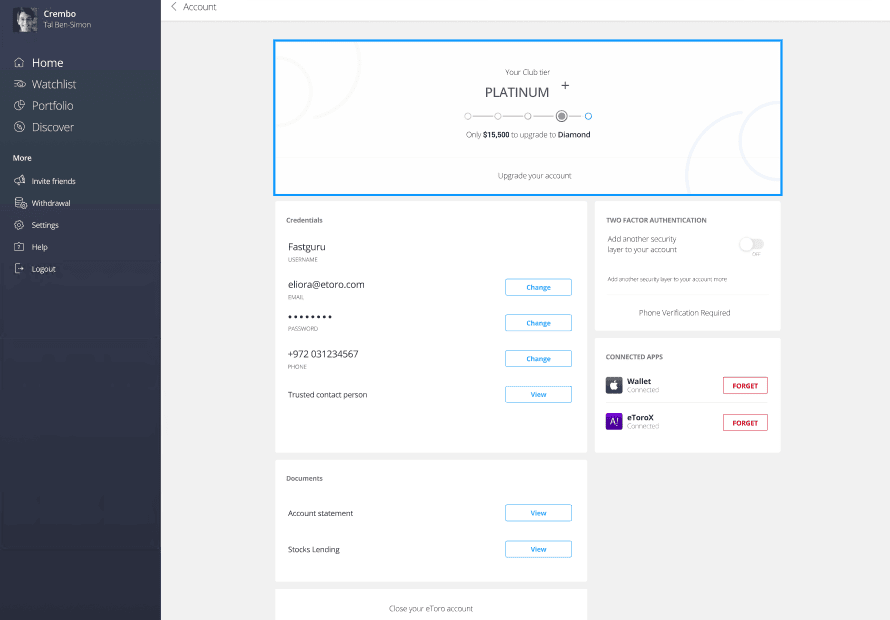

Setting up your eToro account to manage your stock lending preferences is a straightforward process.

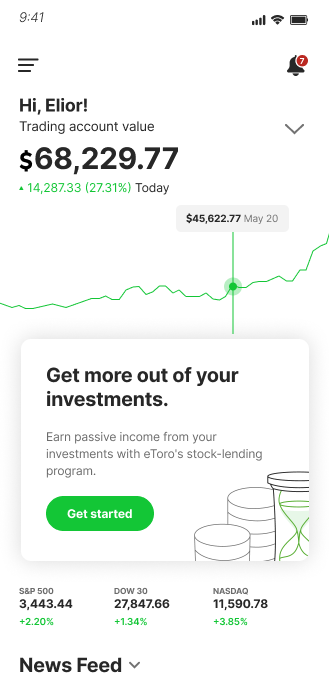

If you are eligible for stock lending, you will have the option to opt in on the Homepage, below the portfolio overview.

for illustration purposes only

When you loan out securities, you will continue to be the ultimate owner of that security, and you can recall the loan and remove your portfolio from the lending program at any time by completing this opt-out form.

Opting out will result in any borrowed stocks being returned, allowing you to sell your position. Until that happens, any stock loan will generate an income that will be credited to your account on a monthly basis.

- Not all securities are eligible for stock lending. Examples of assets that do not qualify include fractional shares, CFDs, cryptoassets and copy positions.

- Opting into the stock lending programme results in all eligible assets in your portfolio being considered for stock lending. You can’t select which shares are and aren’t made available.

- There are no guarantees that your stock will be loaned out. This will be determined by levels of demand from borrowers.

- The actual income from stock lending will likely vary from month to month depending on: which stock position in users’ portfolios gets loaned out, the number of stock units lent, the lending fee paid for each stock lent, and market demand to borrow the stock.

- Payments in lieu of dividends received through stock lending may be taxed differently and potentially less favourably than regular dividends. Lenders should consult an independent tax professional to understand the implications for their specific situation.

You will be able to see all of the stocks currently on loan by visiting Settings > Accounts > Stock Lending Activity Report. Monthly summary reports are released after the 10th day of the following month, and detail the name and quantity of stock on loan, the lending fee rate, and the net earnings paid to the lender.

Tip: When markets are distressed, regulators may introduce rules that prohibit short selling to try to prevent further price falls.

How much can I earn from stock lending on eToro?

Many factors influence the amount of payment you may receive from stock lending, making it difficult to estimate how much someone can earn from the process.

When opting in, you allow eToro to consider your entire portfolio for lending. Shares are lent according to market demand. It’s possible that none of your shares are loaned during a particular month, which would produce no payment, but it’s also possible that your entire portfolio is lent, and you receive a larger payment that month.

There are no additional fees for participating in the stock lending programme, other than the third-party facilitation and maintenance costs.

How is the stock lending revenue calculated?

If your shares are in demand and lent out, the general formula for calculating the gross daily amount earned (prior to any deduction of third-party facilitation and maintenance costs, revenue shared with eToro etc.) on a lent position is as follows:

Daily gross revenue amount = asset closing price × number of units × (lending fee rate % / 360)

Example:

If you wanted to calculate the lending revenue for Tesla Inc., assuming the following data doesn’t change for the duration of a 112-day loan:

Asset closing price = $350

Number of Units = 2,000,

Lending Rate (%) = 1%,

Price = $350,

*Third-party facilitation and maintenance fee (%) = 15% ,and

Days on Loan = 112.

Daily gross revenue amount = $350 x 2,000 x 1% / 360= $19.44

Third-party Facilitation and maintenance fees = $19.44 x 15% = $2.91

Net lending revenue = $19.44 – $2.91 = $16.52

Retained by eToro = $16.52 x 50% = $8.26

Customer’s daily net revenue = $16.52 x 50% = $8.26

Customer’s net revenue for a 112-day loan = $8.26 × 112 = $925.56

The third-party facilitation and maintenance fee (%) is currently set at 15% but may change in the future.

The lending fee rate can change for the same lent shares over the duration of the loan. In securities lending, the fee rate is often variable and can be adjusted periodically based on market conditions, supply and demand for the shares, and other factors. For example, if the lending fee rate starts at 1% and then changes to 1.2% halfway through the loan period, you would calculate the revenue for the first half using the 1% rate and for the second half using the 1.2% rate, then sum the two amounts to get the total revenue.

Final thoughts

The stock lending market has historically been out of bounds for retail investors. The sometimes complex mechanics of the process made it economically unfeasible for those with smaller portfolios to take part. This is changing, and the user-friendly functionality of modern platforms allows traders and investors to explore the potential of the stock lending market.

Visit the eToro Academy to learn more about securities lending.

FAQs

- Why do holders of an asset loan it out to borrowers who want to sell short and suppress its price?

-

Security lending is facilitated by large institutional investors that take a long-term view. They loan stock out to make their assets work harder for them in the short-term, and hope that periods of downward price pressure are intermittent and don’t impact their overall long-term aims.

- What determines the rate of stock loan fees?

-

As with other markets, stock loan fees are driven by the fundamentals of supply and demand. The greater the amount of short interest in a stock as a percentage of the total number of shares available, the higher the likely fee for borrowing it.

- Can users enter voluntary corporate actions (voting) on their lent stocks?

-

No. The borrower of the securities, not the lender, has the right to vote. So users will no longer be eligible to vote in any voluntary corporate actions pertaining to the stocks that are on loan.

- Do you have to sell short if you borrow stock?

-

No, the deal to borrow stock, and a short sale in the market, are two different transactions. Some traders might stockpile hard-to-borrow stocks to be in a position to implement a strategy that shorts them at a future date.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.