Currency trading, otherwise known as forex trading or FX trading, is one of the biggest markets in the world. Forex trading refers to the buying and selling of international currencies, with traders investing in currency pairs (selling one currency to buy another) in an attempt at making a profit.

Foreign exchange rates are continuously moving. This is due, in part, to changes in supply and demand. A variety of factors can influence the value of a currency, including geopolitical events, a country’s industrial growth or a central bank increasing money supply.

Forex trading involves spotting factors that cause the supply and demand of a currency to change and trying to determine the future value of one currency in relation to another. Forex traders will open a

Tip: It can be worth thinking of a currency as a measure of the success of a country’s economy.

Understanding the FX market

The forex market is made up of both retail and institutional investors. Of the approximately $6tn worth of currency trades made every day, central banks, governments, investment banks and multinational corporations will make up the vast majority. For example, a company may buy raw materials in one currency and sell products and services in another.

Forex trading involves taking a more speculative approach. By studying FX markets, investors can apply short-, medium- or long-term strategies with the intention of profiting from price moves driven by underlying

Trading forex involves simultaneously buying one currency and selling another, which is known as trading a currency pair. This does not have to be the currency of your country of residence. For example, if you are based in the UK and your wealth is denominated in British pounds, you can still trade the prospects of another country’s currency, such as the euro against the US dollar.

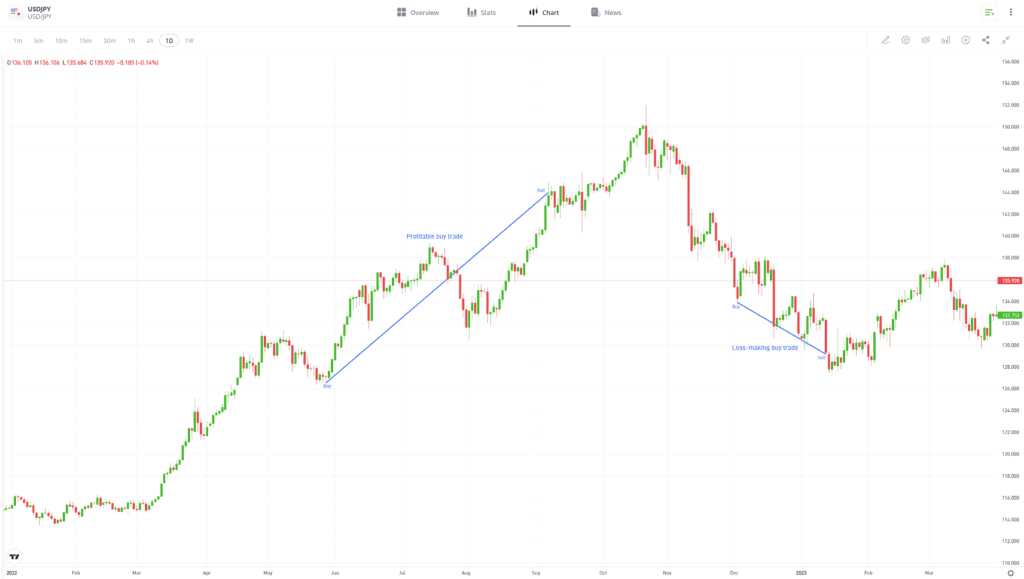

For illustration purposes only. Past performance is not an indication of future results

Source: eToro

A “buy” trade of the EURUSD

Tip: Different currencies and currency pairs have different characteristics. For example, the US dollar (USD) or Swiss franc (CHF) are widely considered to be

How to get started in forex trading as a beginner

To get started as a forex trader, you should first develop a clear plan and strategy. Your strategy should consider your

Setting up an account with a broker and booking your first forex trade is relatively straightforward. The user-friendly functionality of trading platforms makes them ideal for traders of all ability levels. Navigate to the desired currency market and open a trade in one of more than 40 currency pairs, such as GBPUSD, AUDUSD or EURJPY.

Tip: Beginners may want to initially start trading lower

How does forex trading work?

Forex trading works by purchasing currency pairs. When you “buy” a currency pair, you buy the currency expressed in the first part of the pair’s

For illustration purposes only. Past performance is not an indication of future results.

Source: eToro

Once the position is open, its value will fluctuate in line with price moves in the forex markets. This

Trading forex is similar to trading other asset classes, such as stocks or commodities. However, there are additional features associated with FX trading that help to explain its popularity.

Liquidity — The size of the forex markets and the volume of trades booked each day makes it easier to trade in and out of positions compared to other markets.- Cost — The high trade volumes in forex markets mean that trading costs are relatively low compared to other instruments.

- Research — With so many traders involved in forex trading, a community of investors, brokers, banks and independent research firms has formed, freely sharing ideas on which way prices might move.

- Flexibility — Whether you are looking to day-trade short-term price moves or identify and back a longer term trend, it is possible to find a forex trading strategy that fits in with your aims and strengths.

- Ease of access — You can start trading forex with a small amount of

capital . Those looking to scale up onrisk-return can use leverage to increase theirexposure levels.

Set up a demo account to learn the basics of how forex trading works using virtual funds.

Final thoughts

When trading forex, it’s your decision whether you keep things simple or spend time expanding your knowledge and learning about forex strategies and portfolio diversification. In theory, forex trading can be beginner-friendly, although it can also suit more experienced traders, depending on your chosen strategy.

Visit the eToro Academy to learn techniques to help your forex trading.

Quiz

FAQs

- What drives currency price moves?

-

Currency price moves tend to be driven by high-level macroeconomic factors, such as interest rates, inflation levels, economic performance, national debt and political stability. Investors react to these price drivers and take a view on whether one currency becomes a better or worse option than another.

- When are currency markets open for trading?

-

You can trade forex 24 hours a day, five days a week. Traders can start booking trades in FX pairs when

markets open in Sydney, Australia on Monday morning, and the trading week finishes when US exchanges close on Friday. - How much leverage can I use when trading forex?

-

You can find brokers offering maximum leverage limits in the region of 1:30 on forex trades. Forex price moves are often less extreme compared to other instruments, but there are still plenty of risks involved with leverage trading that should be considered before opening a trade.

- What is a pip in Forex trading, and why is it important?

-

A pip is the smallest price movement unit in a forex market. It forms part of the price that a trader will buy or sell a currency at and forms part of the overall P&L on a trade.

- How does leverage work in Forex markets?

-

Leverage works by traders depositing margin/collateral with a broker and gaining overall exposure to a financial market which is greater in size than the amount of margin/collateral deposited. It increases the size of both potential gains and losses.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research.

Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. The availability of all the above-mentioned products and services may vary by jurisdiction and country.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.