In 2022, investors had to face several challenges. In a generally turbulent year, inflation surged to 40-year highs in the US and Europe. Global central banks hiked interest rates aggressively, for the first time in over a decade and the US dollar soared. This has contributed to a drop of major stock indices such as the S&P 500 by nearly 20% in 2022, in what has been the worst year for stocks since 2008.

In challenging times like these, many investors turn their attention, and their funds, to commodities. Doing so at the beginning of 2022 proved to be an effective move, as the S&P GSCI Index, a recognised commodity benchmark, outperformed other asset classes during 2022, with a gain of over 20%. Meanwhile the broad-based Bloomberg Commodity Index, which tracks 22 major commodities, rose 14% in 2022. Commodities was the only major asset class to rise last year.

The gains across large parts of the commodity market partly relate to commodities typically being seen as potential hedge against inflation. In addition, Russia and Ukraine are major producers of a number of important commodities; and the embargo on Russian oil and natural gas has led to concerns over a limited supply driving significant price increases.

What to expect of Q1 2023

When looking ahead to Q1 2023, there are several factors indicating that investors can consider investment opportunities in the commodity market. Although China is opening up and US inflation seems to be cooling down, it is still at record high levels, meaning that commodities may continue to be regarded as a safe haven in Q1 2023.

Bearing that in mind, this article will cover five of the leading commodities to invest in for Q1 2023:

Oil

Gold

Silver

Copper

Coffee

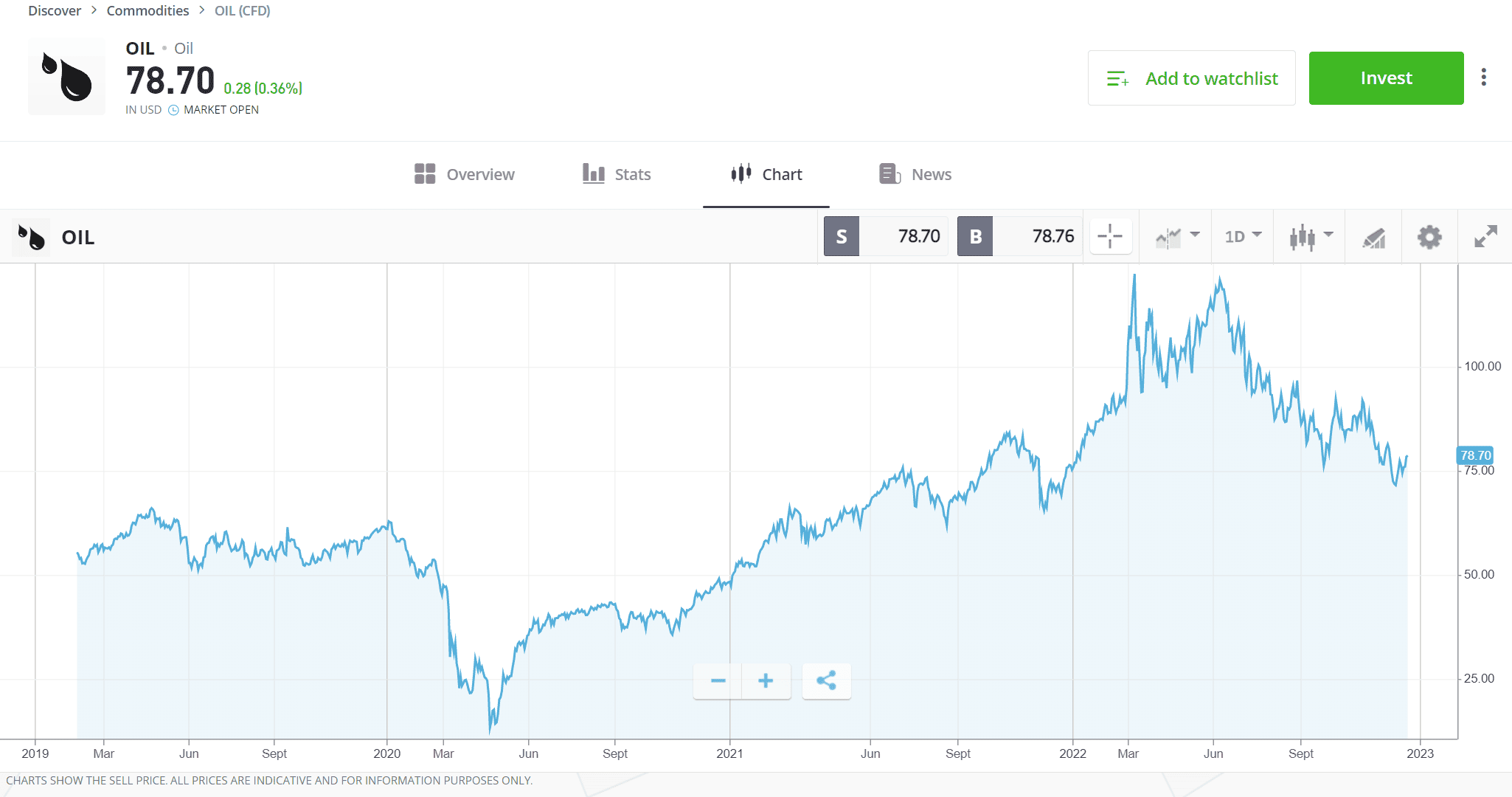

Oil

Past performance is not an indication of future results

- 2022 was a rather volatile year for oil prices, which was good for day traders who could benefit from the price movements. In fact, oil was flat in Q4 2022, but ended the year with its 2nd straight annual gain.

- Over 2022, Brent Crude rose 10% and WTI recorded an increase of 7%, despite prices retreating from the surge in March, and which were close to an all-time high, following the worst global energy supply crisis in decades.

- Entering 2023, oil prices are almost back to their usual rates, but there are silver linings on the horizon such as the rise of China’s industrial output, increasing demand to pre-Covid levels.

- This may support demand from the world’s largest oil buyer and, thus, result in higher prices. Even though Q1 2023 will be entered with much uncertainty on the markets, oil prices may also benefit from tighter supply, after new G7 sanctions and OPEC cuts.

- Investors bullish on oil may consider oil stocks such as Exxon.Mobil and Chevron, as well as oil ETFs like the United States Oil Fund, alongside eToro’s OilWorldWide Smart Portfolio. Bearish investors may consider CFD positions in oil.

81% of retail investor accounts lose money when trading CFDs with this provider.

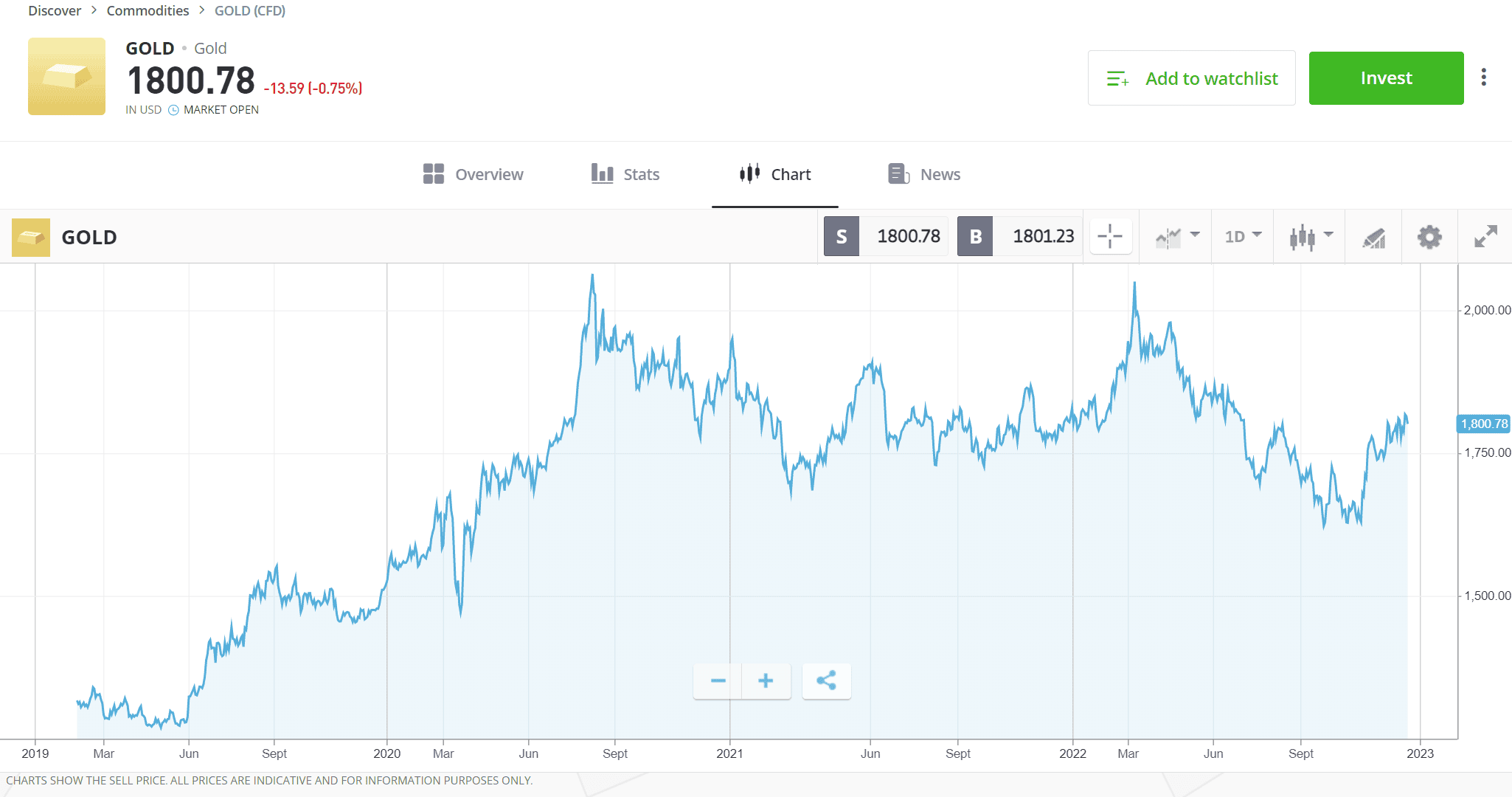

Gold

Past performance is not an indication of future results

- Having reached a peak in March 2022, gold ended the year flat against the US dollar, which surged to two-decade highs in September.

- Gold matched the performance of the US dollar and is entering 2023 with a tailwind, after its late-year rise.

- In general, gold prices and interest rates have an inverse relationship, which means that gold tends to fall when interest rates rise, so bullish investors can look at the yellow metal if they think a “pivot” is coming sooner than expected.

- If inflation rates start to cool down, that would give room to central banks to stop tightening and, therefore, gold could benefit, bearing in mind also the high levels of debt that make further rises in interest rates unsustainable.

- Investors predicting a bull run for gold prices in Q1 2023 may consider the mining stocks Barrick Gold and Newmont Mining Corporation, as well as the gold ETF SPDR Gold. Those who believe in falling prices may open CFD positions in gold.

81% of retail investor accounts lose money when trading CFDs with this provider.

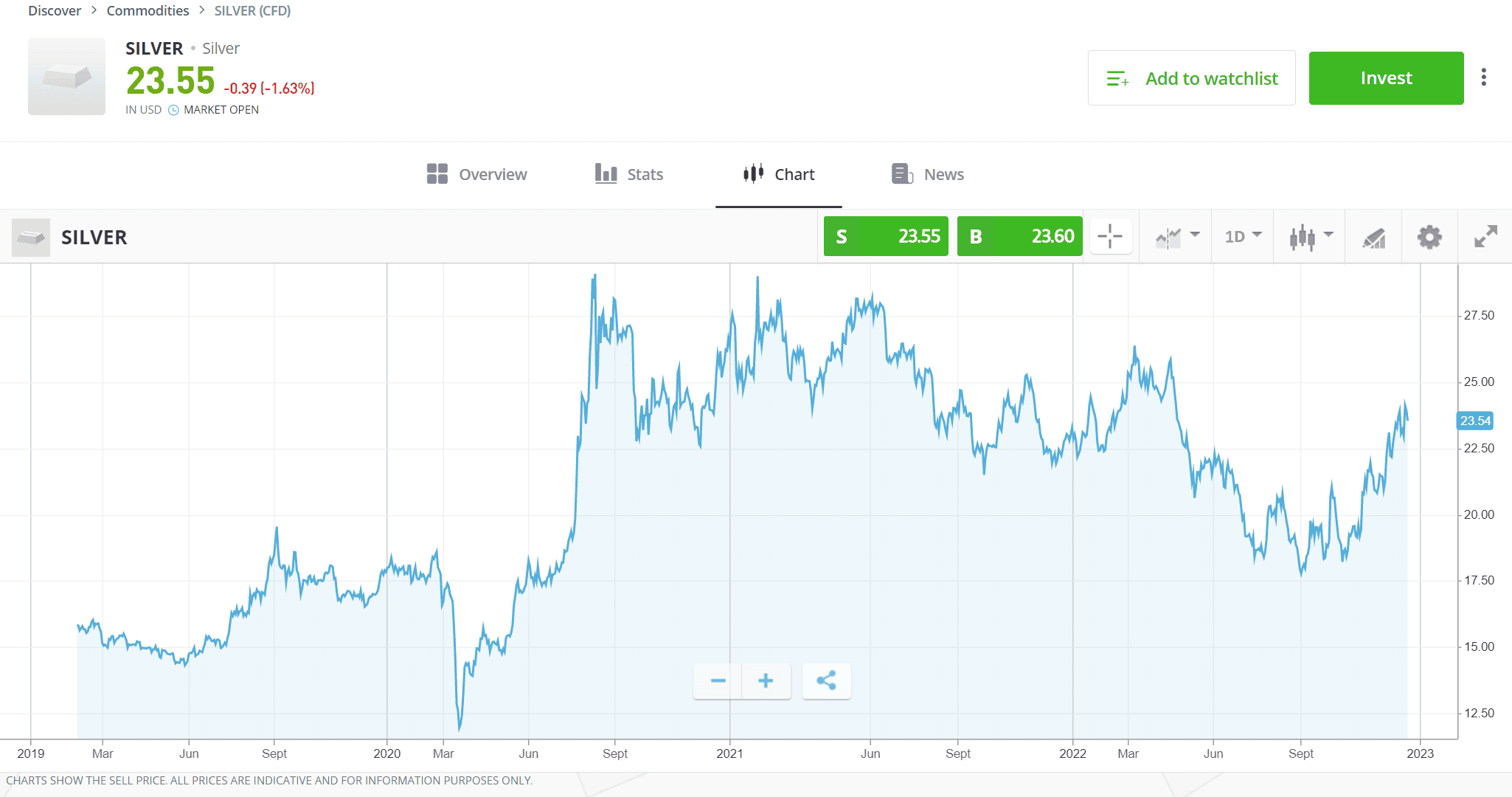

Silver

Past performance is not an indication of future results

- Silver prices finished the year marginally up aginst the US dollar, and its performance during the year has been very similar to gold, given their obvious similarities.

- Silver prices tend to be more volatile than those of gold, and 2022 has been no exception. After also hitting its year high in March, silver prices have fallen back, but still ended the year in positive territory.

- Just like gold, silver prices are significantly impacted by US interest rates and the US dollar outlook. Over the last two months, there was a strong trend in silver prices, which increased by as much as 30%; eased inflation and Fed interest rates may mean this growth could continue — leaving options for taking bullish positions in silver.

- The bullish case for silver comes from the fact that the metal may benefit from the green transition, as it is widely used in relevant technologies, for example, in batteries and solar panels.

- Investors who believe in a bright future for silver may invest in silver stocks such as Pan American Silver or the ETF iShares Silver Trust, whereas bearish investors may open CFD positions in silver.

81% of retail investor accounts lose money when trading CFDs with this provider.

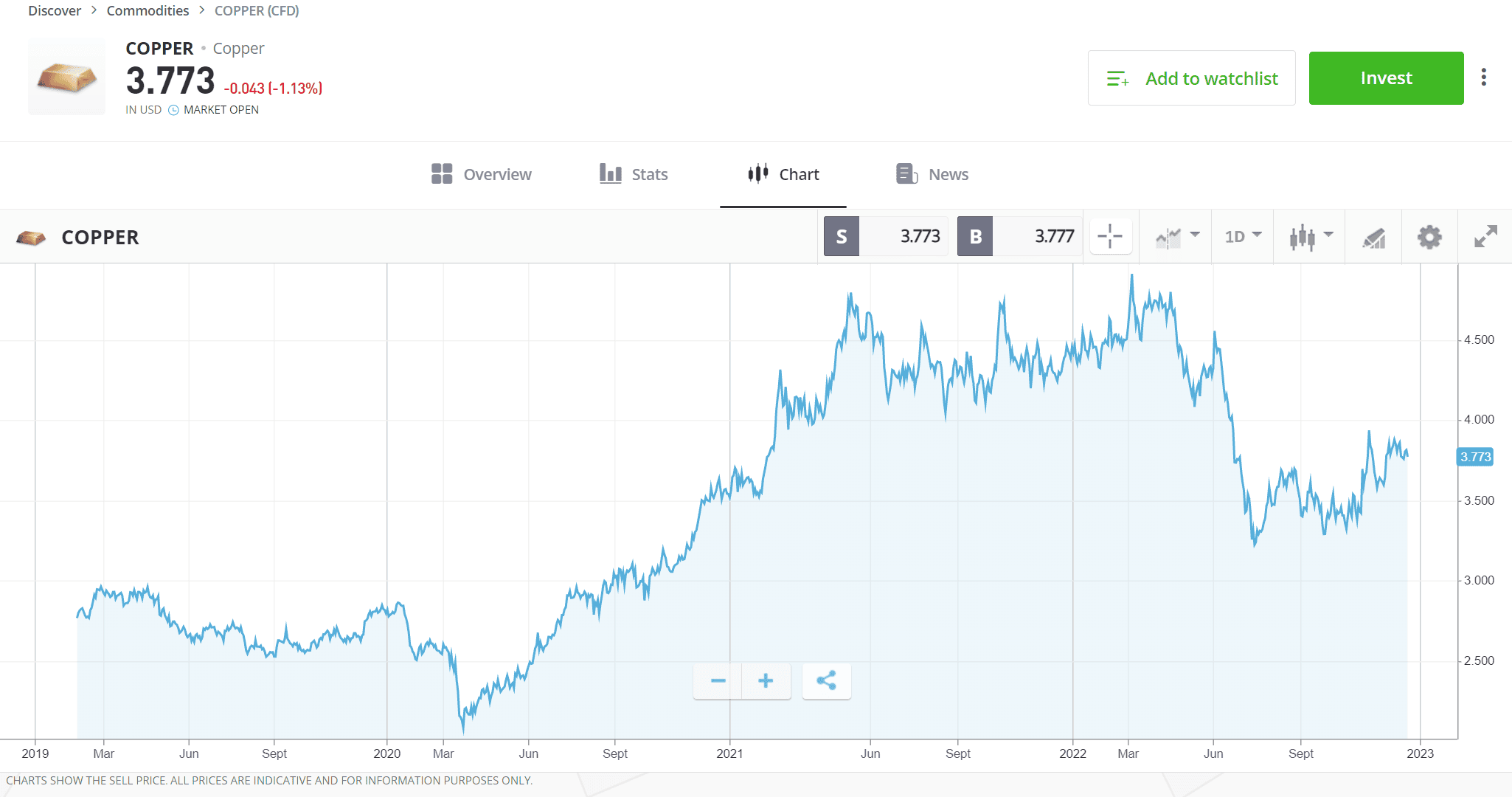

Copper

Past performance is not an indication of future results

- Copper is a metal linked mostly to industrial activity and, therefore, highly impacted by any rumours of recession. However, despite a poor start to the year, prices have risen since October and are continuing to show growth.

- This correction could be an opportunity to obtain a good entry point before resuming the long-term bullish trend, as copper enters Q1 2023 with a positive tone, having risen by more than 10% in the last quarter of the year.

- Several factors are pointing towards the positive trend continuing, of which the gradual reopening of China after the COVID-19 crisis, is a primary driving factor. As an industrial metal, copper is heavily used in China’s real estate industry.

- Copper is also widely used in relation to clean energy and modern applications, ranging from solar modules to smartphones. The increased demand, but limited supply, may drive copper prices higher.

- Thus, investors looking for a long-term investment opportunity may opt for copper, for which prices are forecasted to rise by 50% by 2040.

- When looking ahead to 2023 and beyond, investors can choose copper stocks such as BHP Group and Southern Copper Corp. Investors believing that the harshness of 2022 will continue in Q1 2023 may open CFD positions in copper.

81% of retail investor accounts lose money when trading CFDs with this provider.

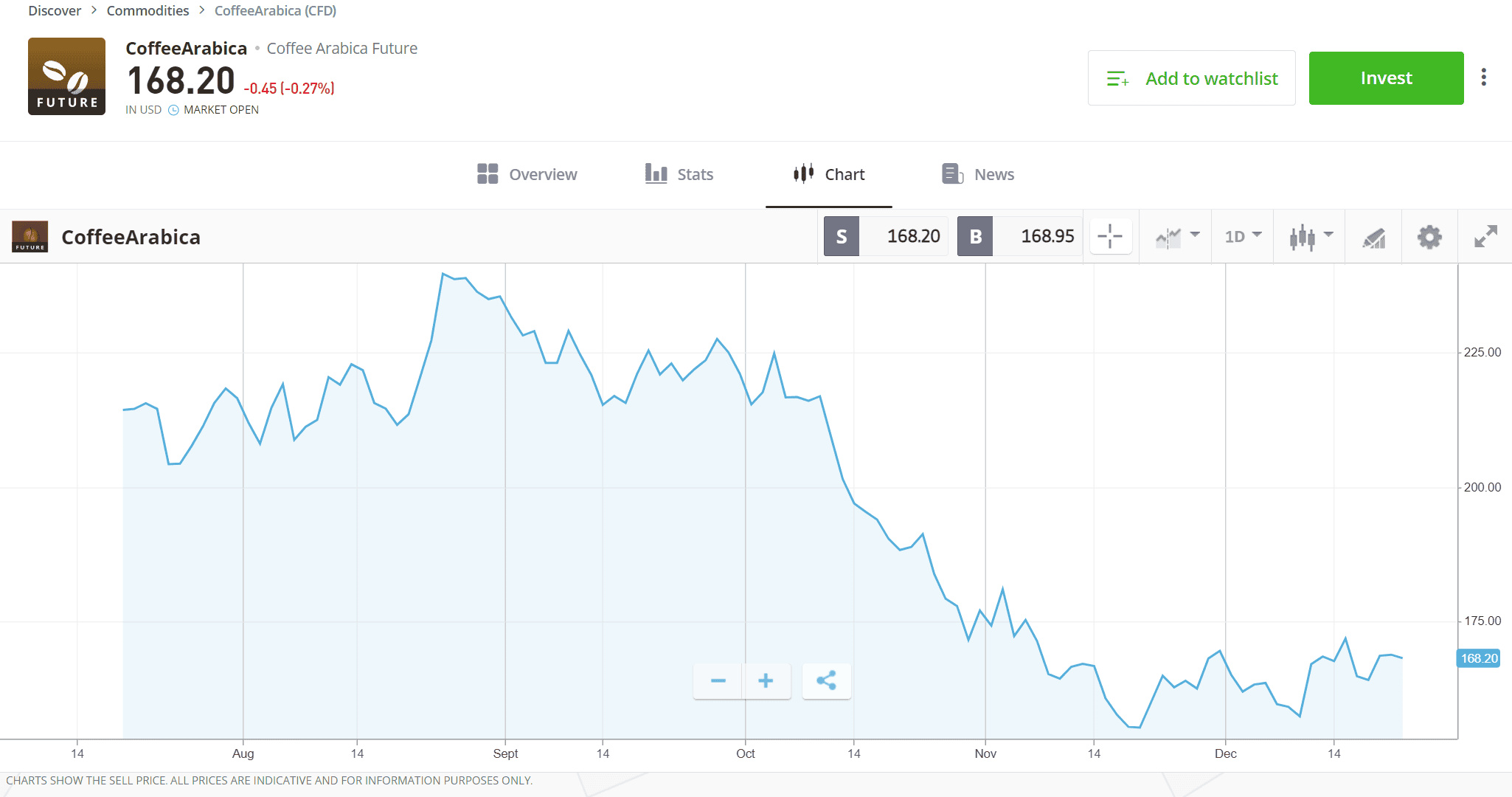

Coffee

Past performance is not an indication of future results

- Coffee prices opened 2022 strong, hitting a 10-year high in February. Since then, however, prices have fallen back and ended the year down around 25%.

- The decline is partly caused by concerns about market surplus, due to Brazil’s predicted bumper crop, as well as eased demand; however, there are more recent reports of a downward revision in coffee crop estimates, which would support higher prices going forward.

- Even though Arabica beans are a widely consumed commodity, they are not a necessity, meaning that the price may fall as the discretionary income rates of its consumers do. Coffee prices are simply sensitive to any changes in consumer buying patterns, therefore, as fears of a recession ease, the coffee trade should pick up.

- When looking ahead to Q1 2023 and beyond, analysts’ forecasts for coffee prices differentiate. While the Arabica coffee surplus seems set to remain, meaning lower prices, much will depend on the demand and recession outlook, especially in Europe, the world’s largest coffee drinking region.

- Lower coffee bean prices could benefit the profit margins of big users like Nestle SA and Starbucks making those potentially long-term investments, whereas bearish investors may opt for opening CFD positions in coffee.

81% of retail investor accounts lose money when trading CFDs with this provider.

Summary

Commodity investors enter Q1 2023 with some uncertainty in the market after two years of strong commodity price performance. Major issues related to central economic and geopolitical factors, such as high inflation and the Russia/Ukraine conflict, remain and will impact price trends within the commodity sector.

While Q1 may be volatile due to continued economic uncertainty in the US and China, impacting demand, the outlook for 2023 as a whole, and beyond, is positive, as analysts predict a 43% gain for commodities in 2023. Thus, investors looking for long-term investment opportunities may opt for commodities as a way of diversifying their potentially high-yield portfolios.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Charts sourced from eToro platform 22/12/2022. All trading carries risk. Only risk capital you can afford to lose

Copy Trading does not amount to investment advice. Your investment’s value may go up or down. Your capital is at risk.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. OTC Derivatives are leveraged financial products and considered speculative. OTC Derivatives may not be suitable for all investors. You don’t own the underlying assets. You risk losing all of your investment. This information is general only and has been prepared without taking your objectives, financial situation or needs into account. Consider our Product Disclosure Statement and Target Market Determination (PDS and TMD). See full disclaimer.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

Zero commission means that no broker fee will be charged when opening or closing the position and does not apply to short or leveraged positions. Other fees apply including FX fees on non-USD deposits and withdrawals. Your capital is at risk. For more information, click here.