Technical analysis indicators can help you to make better-informed trading decisions. High quality brokers provide these powerful software tools to their clients as part of the standard trading platform package; the trick is learning which technical indicators to use, and when. This article will help you learn what technical indicators are and how to use some of the most popular technical analysis tools to your advantage.

Technical analysis indicators can help you to make better-informed trading decisions. High-quality brokers provide these powerful software tools to their clients as part of the standard trading platform package; the trick is learning which technical indicators to use, and when.

Tip: Some technical indicators are more effective in trending markets, while others are more effective in ranging markets.

What are technical indicators?

Technical indicators are trading tools based on mathematical and statistical formulas . They analyse historical price chart data to provide traders with an up-to-date view on market conditions, providing an indication as to the direction in which a price might move.

Price history is the key data point for technical indicators. While the indicators generally use this same source data, the underlying formula means that it is interpreted differently by different indicators.

Some indicators also incorporate other data sources, such as trading volumes. Traders can access a range of user-friendly trading indicators that can be used to spot trade entry points in both trending or range bound markets.

Tip: Technical indicators can be used to trade any asset class, from forex and stocks to commodities and crypto.

Popular tools and indicators

There are hundreds of technical indicators available to traders. Understanding what they enable is the first step towards incorporating them into your trading strategy.

Moving averages

Moving averages calculate the mean value of the price of an asset over a given set of time intervals. For example, the 20-day simple moving average (SMA) on a daily price chart demonstrates the average price of an asset over the last 20 days.

It is important to use SMA time frames that match your investment approach. Day traders running shorter term strategies are more likely to focus on the 1-hour SMA, rather than an SMA that is based on longer term price moves.

Tip: The exponential moving average (EMA) gives more weight to recent data points.

Bollinger Bands

Bollinger Bands add an additional layer of analysis to moving averages. They have two additional lines or bands: one above and one below the SMA. These outer bands highlight standard deviations of price and, statistically speaking, price should trade within these bands most of the time.

Tip: Some technical indicators are more effective in trending markets, while some are more effective in ranging markets.

Oscillators

Oscillators analyse price data to establish the extent to which an asset’s current price is within its “normal” range. They study how price gravitates between two levels on a price chart, providing an insight into the momentum behind a price move. Oscillators can, therefore, be used to spot whether a trend is likely to continue or reverse.

Tip: Some tools are typically more accurate when used on longer time frames, although they can also work in the short term.

Relative Strength Index

The Relative Strength Index (RSI) is an oscillator indicator that compares the magnitude of an asset’s recent gains, relative to its losses. The RSI presents its findings as an index score ranging between 0–100.

The closer the RSI is to 100, the greater the chance that the market is currently “overbought”. An RSI closer to 0 points to a market being “oversold”.

Stochastics

Stochastics adopt a similar approach to oscillators, but give greater weight to the closing price of any time interval. In theory, if the closing price in a market is nearer to the peak of the intraday range, it is a sign of further upward price momentum, and vice versa.

Tip: Some indicators can be used to establish the strength of momentum behind a price move.

Ranging markets tools and indicators

Some indicators are better suited to trading ranging markets — times when prices move across the chart, rather than forming an upward or downward trend.

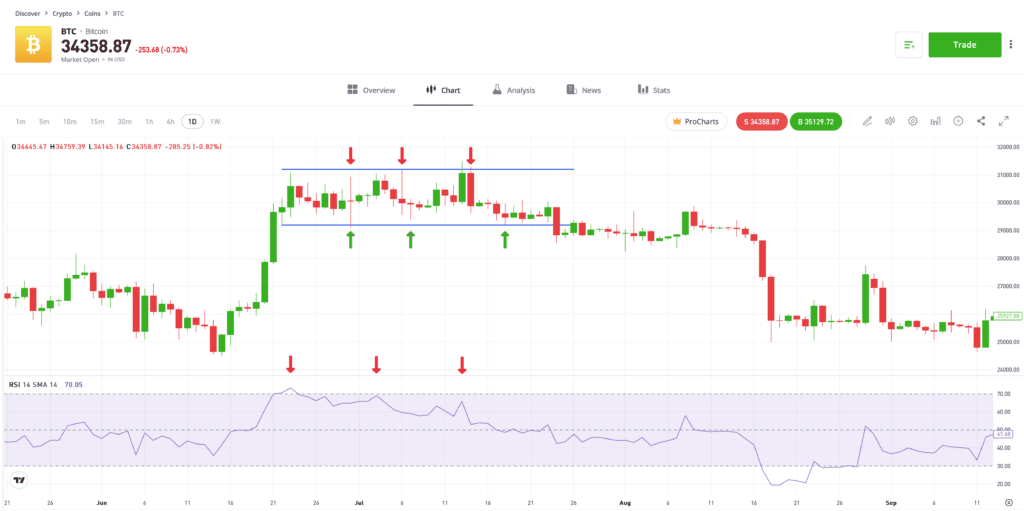

| Trading a ranging market — Bitcoin (2023) — Sell signals confirmed by the RSI as being overbought |

Past performance is not an indication of future results

Source: eToro

The outline of a ranging market will be formed by a pattern showing a lower supporting trendline and a higher resistance trendline. While the underlying market conditions remain the same, the aim is to buy at the bottom and sell at the top of the range.

Tip: Contracts for Difference (CFDs) allow traders to short-sell and potentially also profit from downward price moves.

Oscillators that point to a market being overbought or oversold when the price nears one of the outlining trendlines, would provide confirmation that a price reversal could be imminent.

Bollinger Bands are also suited to trading range-bound markets. Not only do the outer bands provide an indication of the possible limit of any price move, but the width of Bollinger Bands is also a key indicator. Narrower bands reflect lower price volatility and the probable continuation of the current situation. If bands widen, it shows that buyers and sellers are more active and that a breakout of the range could be imminent.

Tip: Trend trading strategies are likely to be more effective following a breakout to either side of a ranging market.

Trending markets tools and indicators

Identifying and trading in the same direction of a trend is a key aspect of investing, one that can potentially result in long-term gains. Some technical indicators incorporate data points that allow traders to spot times to enter trades and follow the trend, and ultimately when the trend might be about to reverse.

When setting up a price chart, it can be useful to show moving averages of different time periods. Many traders look to enter or exit positions when a short-term average, for example the 20-day SMA, intersects a longer-term one, such as the 100-day SMA.

In the Nasdaq 100 Index chart below, it is possible to see points during which the 20-day SMA could have been used to identify trade entry points in an upward trending market.

Past performance is not an indication of future results

Source: eToro

Final thoughts

When using technical indicators, context is everything. The first step should always be to establish whether a market is ranging or trending, as this will influence your decision on which indicators to use.

It is also important to use a number of different indicators when considering executing a trade. The greater the number of aligning signals, the more confident you can be in your decision.

Visit the eToro Academy to learn more about technical indicators and charting.

Quiz

FAQs

- Which technical indicators are most commonly used?

-

Simple moving averages are often referred to in analysis and news reports. SMAs are used by those interested in fundamental analysis, who might be looking to fine-tune a trade entry point, as well as traders solely using a technical analysis approach.

SMAs offer a clearer view on market conditions as they remove some of the distraction created by short-term price volatility. The 200-day SMA is one of the most keenly monitored technical indicators and is widely used by stock market traders and investors.

- What is the Average True Range?

-

Average True Range (ATR) is a technical indicator that gives an insight into price volatility levels in a market. It is often used in conjunction with indicators that indicate the likelihood of a price reversal, because the ATR can enable traders to speculate on how far a price might move, not just whether it will.

- Is it possible to use too many trade indicators at the same time?

-

Yes, while the golden rule of technical analysis is to use a combination of indicators, it is possible to use too many and cloud your analysis. The trick is to understand which are best suited to current market conditions and to practise using them on a demo account with virtual funds.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.

This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

Cryptoasset investing is highly volatile and unregulated in the UK and some EU countries. No consumer protection. Tax on profits may apply.