There is a common misconception that the only way to make a profit on an asset is if the price of that asset goes up. However, this is not the case. Short selling involves borrowing an asset, selling it, and then purchasing it back later at a lower price. Short selling instruments such as stocks, currencies and commodities can enable traders to potentially profit if the value of the asset falls.

Developing a short selling strategy could be a good alternative for investors, although there are various risks attached to it. Discover what it means to short an asset and learn about the difference between long and short positions.

When short selling, there are a number of factors to consider, including various elements of risk, so it is worth getting a better understanding of what short selling means and asking the question: “what is shorting a stock?”

What does shorting a stock mean?

Put simply, short selling involves selling an asset that you believe will drop in value, with the intention of buying it back in the future at a lower price. It is perhaps worth using a real-world example to demonstrate what it means to short a stock specifically.

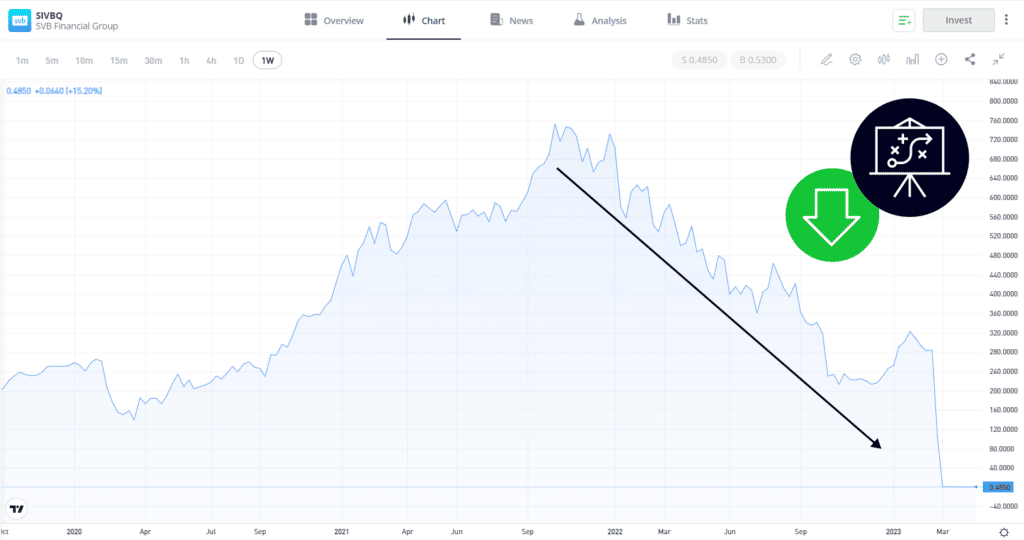

In January 2022, stock in Silicon Valley Bank was trading at around $447 per share. Economic fundamentals, including a dramatic surge in interest rates, impacted the firm’s business model, causing the stock price to fall. By March 2023, the bank had failed, and its stock was worth considerably less than it was around a year prior.

For illustration purposes only. Past performance is not an indication of future results.

Source: eToro

If you had shorted SVB stock in January 2022, you would have made a profit. If the price had risen, then the strategy would have made a loss. Short selling strategies involve trying to spot trading opportunities such as the one mentioned above.

Tip: As with long positions, the return on your short positions will be determined by the difference between the entry and exit point of your trade. However, in the case of short selling, the entry price is where you sell something, and the exit price is where you buy it back.

How does selling short work?

In terms of trading mechanics, selling short works by finding the target market on your preferred trading platform and clicking “sell,” rather than “buy.” Once you have done that, you will make a profit if the price of the asset falls, and a loss if it rises.

The most popular method for short selling is to use Contracts for Difference (CFDs). CFDs allow you to sell an asset that you don’t already own, as the “contract” in question is with your broker. Both parties agree to pay each other the “difference” on the price move.

Tip: For those interested in short selling, it’s worth practising with a demo account first to ensure you understand all of the different aspects of going short.

Difference between long and short positions

The key difference between long and short positions is that investors will profit if the price of an asset rises on a long position, whereas the opposite is true for a short position. Otherwise, the processes are very similar.

There are, however, additional factors to consider. The majority of investors in the financial markets are long-term investors who have adopted a buy-and-hold approach. If you’re considering shorting stocks, or any other assets, remember that potential losses on short positions are infinite, as there is no real limit to how high the price of an asset can go.

On the other hand, losses on long positions are capped at the amount of capital you invest, because the price of a stock can’t go lower than zero.

Historical data suggests that certain asset classes, such as stocks, tend to gradually increase in value over time. Of course, there will be moments when the price of stocks fall, allowing them to be sold short, but as the price movement is generally upwards, this can be a risky proposition.

Selling short also allows investors to manage risk, diversify a portfolio and hedge positions, but it should be noted that short selling can be a high risk-return proposition.

How to develop a short selling strategy

Short selling can be used to balance out a portfolio’s performance, and reduce overall risk, by acting as a “hedge”. Consider how a market neutral long or short strategy works. Most experienced investors will likely believe one stock to be a better long-term prospect than another.

For example, you might favour Apple Inc. over Microsoft Corp and Shell Plc over BP P.l.c. If this is the case, and if you restricted your approach to long-only strategies, then you would probably buy AAPL and SHEL stock over the other two.

On the other hand, if you adopted a long-short strategy, you might consider selling MSFT and BP short, at the same time as buying AAPL and SHEL. Net returns would be the sum of the returns on all four trades. If all four stocks were to rise in value, but Apple and Shell outperformed their rivals, you would still make a profit, with the gains on those trades counteracting the losses on the Microsoft and BP positions.

Tip: If you apply a long-short strategy, you can still potentially make a profit if all of the stocks in your portfolio, or the markets in general, go up or down. Your strategy will be market neutral, and your return will be based on the relative performance of each position.

How to hedge a short position

When shorting a position, there is always a risk that the price of your chosen stock will rise. Experienced investors will often hedge a short position to try and lower this risk. Buying a long position, perhaps in a stock index, is one way to counteract the risk of a short selling.

For example, if you believe that the price of Amazon stock will fall, you could short that position. To hedge against this investment, you could take a long position in the S&P 500 Index, which tracks the performance of the 500 largest companies in America, Amazon included. If the price of AMZN falls, your short position could profit. If the price of AMZN rises, then it could be linked to wider market moves, leading to the value of your S&P 500 increasing.

Final Thoughts

Markets can always go down, as well as up, and short selling offers a way to take advantage of times in which investor sentiment turns bearish. Selling short also allows investors to manage risk, diversify a portfolio and hedge positions, but it should be noted that outright shorts can be a high risk-return proposition, and should be approached with caution. Consider the risks of negative price spirals and settlement failures, among others.

Find out more about short-selling strategies by heading to the eToro Academy.

FAQ

- What is a short squeeze?

-

A short squeeze involves a market having a lot of short interest, causing it to experience a price rise. To close out a short position, traders must complete a “buy” trade, which may cause the price to rise further and short sellers to panic and exit their positions. This causes a cycle to form, with the price continuing to increase, sometimes dramatically.

- What is pairs trading?

-

Pairs trading is another name for a long-short strategy, and involves matching a long position with a short position. The two assets will usually have a high correlation, and the net profit of the trade is based on the performance of the two positions, rather than wider market movements.

- When do I have to buy a short position back?

-

There are no standard rules or regulations that dictate for how long you can hold a short position. Certain brokers may have a maximum length of time that a short position can be open. Sometimes, ad hoc restrictions can be implemented on short selling during times when markets are distressed, in an effort to restore stability to the financial system.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.