Price slippage relates to the difference between the expected price of a trade and the actual price booked in the market. It can apply to any asset you are trading and developing a better understanding of what slippage is — can help you to protect your returns.

“Price slippage,” often referred to as “slippage,” is an unavoidable hazard of the financial markets. Developing a greater understanding of what slippage is, and why it occurs, will help you to have the best chance of booking trades at the price you expect to.

What Is Slippage in Trading?

Slippage describes traders executing trades at prices which are different from those they expected. When you click “Trade” on your trading dashboard, if the price at which you execute your trade doesn’t match the indicative price showing when you were requesting to trade — that is slippage.

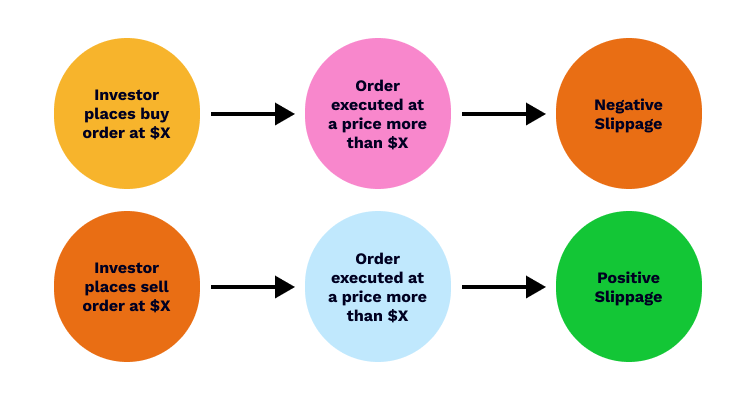

Slippage can occur in both buy and sell trades and can be found in all markets. If you book a buy trade expecting to pay $100 for your position and you end up trading at $100.25, you have experienced “negative slippage.” If the actual execution price is $99.85, you have benefitted from “positive slippage.”

Source: Corporate Finance Institute

Why Does Slippage Happen?

Slippage occurs because of the way the financial markets work. Unlike a high street shop where prices are set by a retailer and fixed, prices in the capital markets are set by buyers and sellers coming together and stating at what price they are willing to trade.

Take, for example, a market where there are thousands of sellers and buyers. Each of the sellers will have their own view on the level at which they are willing to trade, and the lowest price any of those sellers is willing to accept is termed the market “ask” price. The buyers will, at the same time, also have different views on what is fair value with the highest price any of them being willing to pay being known as the “bid.”

Only when bid and ask match does a trade get executed. The amount of units being traded also needs to be considered. If you place a market order to sell 500 shares in Tesla, Inc. and the highest bid price is for a trade size of only 100 shares, then your order will be partially filled (100 shares) at that first price. The remaining 400 shares will be filled at lower prices as your order works its way down through the order book until all 500 shares are sold. This would result in slippage as the average price on the entire order will be different from the price at which the first 100 shares were exchanged.

Tip: The gap between the “bid” and “ask” price is termed the “spread.”

Taking the scenario one step further involves factoring in that not all buyers and sellers will want to trade the same quantity. If one seller holding 100 shares is willing to trade at $150 and all the other sellers want to trade at $150.25, then, if a buyer looking to buy 400 shares comes in with a market order — an instruction to buy a certain amount of stock at the lowest prices available — they may initially think they are going to pay $150. Instead, only 100 shares will be bought at $150 and 300 shares will be traded at the higher price — resulting in an average trade price of $150.1875 ((100 x $150) + (300 x $150.25))/ 400. In this example, the trader has experienced negative slippage.

Markets Impacted by Slippage

Slippage can occur in any market. Whether you are trading stocks, bonds, forex, crypto or CFDs, there is a risk that the price you end up paying won’t match the price you initially expected.

A more pertinent point is that any market will, at any different time, experience greater or lower levels of slippage. As the trading conditions change, so does the probability of expected and actual dealing prices matching up.

Slippage in Forex Trading

If you are trading the forex markets, for example, the USD/HUF currency pair, the bid-offer spread will narrow and widen as market liquidity increases and decreases. If spreads are wider, then any trade which crosses the spread will incur greater slippage.

The US dollar-Hungarian forint currency pair is regarded as an “exotic” and average trading volumes are lower than those of one of the “major” currency pairs such as EUR/USD. Whatever market you are active in, if you choose to trade when they are quieter, for example, during the summer holidays when many traders are away, you can expect a greater chance of slippage occurring.

Slippage in Crypto Trading

Slippage is also more likely to occur in markets that experience greater price volatility, making it a feature of cryptocurrency markets, which are known for experiencing dramatic price swings.

The bid offer spread is likely to be wider in more volatile markets. This is because investors who are looking to sell, will have in the back of their minds, the chance of the price rising higher than it currently is. At the same time, buyers might temper their enthusiasm for paying more for an asset which is highly volatile and could soon be trading at considerably lower price levels.

Slippage in stocks

Popular stocks such as the shares of the NVIDIA Corporation, for example, are traded in large volumes, making their markets highly liquid and they are also known for having relatively tight spreads. Even in these market conditions, slippage can still occur.

Prices of stocks typically become more volatile during the period when an exchange has just opened or is about to close. This reflects investors wanting to trade in and out of positions to capture a potential intraday move, or ensure their holding is at an optimal level before the market closes. Trades booked during less volatile periods of the day can be expected to have a lower chance of incurring slippage.

Tip: Stock prices can become more volatile around the time that a company makes its earnings announcement.

How To Avoid Slippage

There are measures you can take to minimise the likelihood of slippage impacting your trading. These involve considering what you trade, when you trade, and how you trade.

- Liquidity — markets that have greater liquidity tend to have lower levels of slippage. You could, therefore, choose to trade markets with greater trading volumes, or at times during the trading session when more traders are actively trading.

- Volatility — The price data from some markets marks them out as having relatively high levels of price volatility. Take the cryptoasset Dogecoin, for example, a market you might have to accept might be associated with higher levels of slippage.

- News events — Even low-slippage markets can suddenly become more volatile and see liquidity dry up when major news announcements are released.

- Limit orders — A limit order allows you to set a price at which you are willing to trade. This differs from a market order, which is an instruction to buy or sell a certain quantity of an asset at the best available price. Limit orders allow you to trade with greater discipline, but there is a risk that your order will remain unfilled, because the market price might not reach your predetermined target level.

- Stop-loss orders — If you are looking to close out an open position and avoid slippage, you could use stop-loss instructions. There is no guarantee that slippage will be avoided, but having orders in place to trade at certain price levels does mean being better prepared for trading out of positions.

- Trade in small size — Running through the order book and hoovering up trade deals at prices away from the current level is more likely to occur if the size of your trade is large in relation to the average trading volumes. You can avoid slippage by booking smaller-sized trades or being patient and drip-feeding your orders into the market.

Tip: Guaranteed stop-loss orders usually require a premium to be paid to your broker for providing a non-standard service.

What Is Slippage Tolerance?

Slippage tolerance is a setting on trading platforms that allows you to instruct your broker about how much price slippage you’re willing to accept on your orders. If the market does slip, your order will not be filled.

Slippage tolerance is a useful risk management tool, but it is important to understand how it works. It is your responsibility to monitor the tolerance levels you apply and check whether orders which are partially filled are then cancelled and need to be refreshed.

Final thoughts

Slippage is important, and needs to be managed, but also needs to be put into perspective. Matching the market you trade to your ultimate aims is more important.

If, for example, you have a high win-loss ratio — trading a market which has relatively high slippage, you might be tempted to switch to another one with lower slippage. But if the characteristics of that new market don’t suit your strategy or approach, and you book losing trades, the marginal gains on lower slippage will be offset by more significant losses.

Visit the eToro Academy to learn how to improve your trading technique.

FAQ

- What kind of strategies are most affected by slippage?

-

Those running short-term trading strategies need to pay particular attention to slippage. Booking a trade at the “wrong” price is much more of a problem for those trading in and out of positions on a frequent basis and targeting small gains. That being said, even long-term investors can optimise their returns by trading when market conditions are more favourable.

- What is the ‘order book’?

-

The order book is a list of the number of assets being bid on or offered at each price level. Accessing the order book through a dashboard monitor will allow you to get a clearer picture of the depth of a market — and, therefore, what size of trade could significantly move the market price.

- Should I always use stop losses when trading?

-

Stop-losses are a useful risk management tool, but there are instances where using them could be disadvantageous. If you are a buy-and-hold investor with a long-term investment horizon, a spike in short-term price volatility could see your stop-loss triggered and your position closed at a loss before price returns to its previous level. This “whipsawing” price action can occur around the time of major news announcements.

- Can I predict times when there might be spikes in market volatility and an increased chance of slippage?

-

News events can be tracked using an Economic Calendar. The calendar will outline the exact time that reports will be released on factors such as unemployment levels, interest rate decisions, and economic output. These can impact investor sentiment and result in increased trading activity. There will also be announcements which are specific to assets you hold rather than to the broader market. If you are trading stocks, for example, you can expect increased volatility in the names you are holding when those companies release their earnings figures.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.