Pairs trading is a strategy that looks to profit from exploiting short-term anomalies in the prices of different but similar assets. It also offers a way to hedge against market risk, the chance that a widespread correction will reduce the value of your portfolio. Want to learn more? Read on!

In this article, we will explore the following:

- How a market neutral strategy works

- The underlying principles involved in pairs trading

- The assumptions and risks of pairs trading

- A worked example of a pairs trade using real market values

As we all know, financial markets can go up and they can go down. With straightforward methods of trading, you take a position in a financial instrument and gain exposure to its price. This means you profit if the market moves in your direction — but you also take on market risk, namely, the risk that if the price moves adversely, you lose money.

Pairs trading

Pairs trading offers a way to generate investment returns whilst limiting exposure to market risk. The basic principles of pairs trading are:

- Find two instruments whose prices are highly correlated

- Wait for the price relationship between the two to diverge from historic norms

- Short sell the instrument that appears overvalued and buy the one that appears undervalued

The aim would be to exit the positions if and when the price relationship returns to a more normal value. Let’s run through these steps.

Picking correlated instruments

A starting point would be to investigate two instruments that we might reasonably expect to have some degree of correlation between their prices.

A classic example of this would be two companies operating in the same industry, doing similar lines of business, in the same general locations and selling to similar types of clients. For example, this could mean UK banks, German automotive manufacturers or US telecoms.

Let’s say you were looking at Natwest Group and Lloyds Banking Group. As an illustration, you might expect adverse changes in UK financial regulations to negatively affect both, or a pickup in demand for banking services to boost both.

You then need to investigate whether the data actually bears out this supposed correlation.

For the purposes of this example, we will use the correlation coefficient as calculated by spreadsheets such as Microsoft Excel and Google Sheets — mainly because it is relatively simple. Note there are many ways to calculate the relationship between two data sets and more complicated measures may work better in practice.

Let’s look at some actual price data.

The following table shows the correlation in share prices between a small selection of company pairs using a year’s worth of price data from January 2022 to January 2023:

| Companies | Industry | Correlation |

|---|---|---|

| Lloyds | Banking | 0.70 |

| Barclays | ||

| Sainsbury | Retail | 0.79 |

| Tesco | ||

| Legal & General | Insurance | 0.61 |

| Aviva | ||

| HSBC | Banking | 0.63 |

| Standard Chartered | ||

| Anglo American | Mining | 0.87 |

| Antofagasta | ||

| Barratt Developments | House building | 0.98 |

| Taylor Wimpey | ||

| Haleon | Consumer goods | 0.75 |

| Unilever | ||

| HSBC | Banking | 0.53 |

| Natwest |

(Data based on adjusted closing prices)

A value of 1 shows a perfect correlation, while a value of 0 shows no correlation. These are all FTSE 100 stocks, paired with peer companies, and all display at least some level of correlation. We can see, though, that the correlation for some pairs is stronger than others.

Antofagasta/Anglo American is one of the pairs with a high correlation value; let’s run with this pair to illustrate a hypothetical strategy.

The longer we can see the correlation has persisted, the stronger our confidence might be in the relationship. If we dig further back into the data, we find that the correlation between their share prices over five years, from January 2018 to January 2023, is even stronger at 0.91.

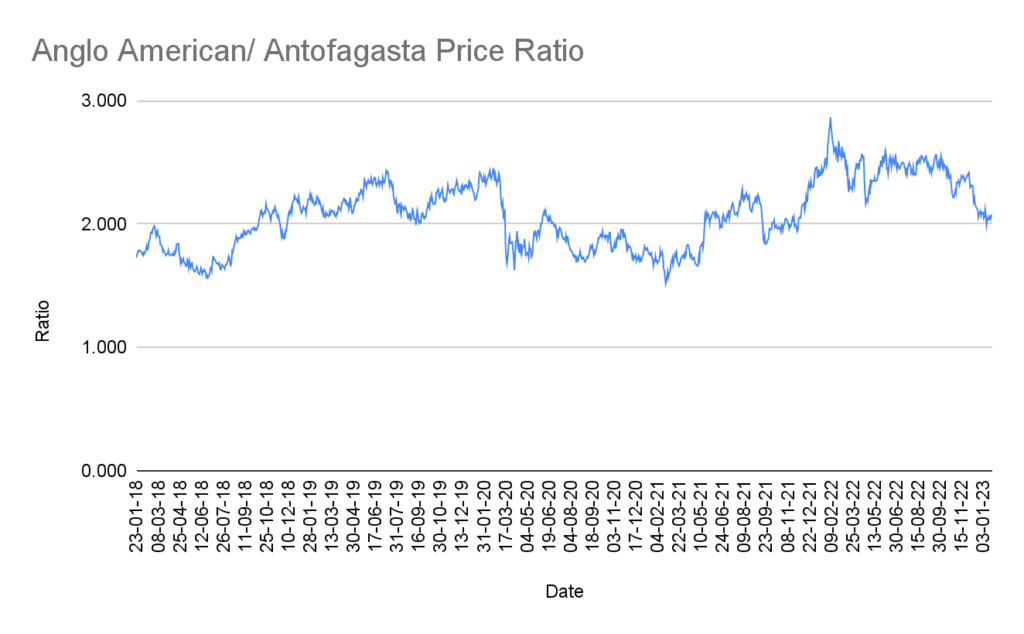

One way we can keep tabs on whether the current price relationship is normal or abnormal by historical standards is to look at the price ratio between the two instruments over an extended time period. The below chart does just that, and plots the ratio of the two share prices over a multi-year period.

(Graph based on adjusted closing prices)

Source: Yahoo Finance

Over the observed time period, the ratio value fluctuates within a range. The higher end of the range is about 2.4 (although we do have a spike close to 2.9 in February 2022) and the lower end is roughly 1.6. We also see a tendency for the ratio to revert to the mean level, which is around 2.1).

We might utilise this knowledge to construct some rules for our hypothetical strategy. If we see the ratio rising to the higher end of the range, we sell Anglo American and buy Antofagasta. If we see the ratio falling to the lower end, we trade the other way.

This is what makes CFDs suited for pairs trading: we need the ability to go short as well as long.

Position sizing of a pairs trade

As the strategy aims to minimise market risk, you are looking for your two positions to hedge each other, so you want an equal exposure with each half of the pairs trade.

Going back to our example, let’s say it is May 20, 2022 and we have seen the ratio increase from near the mean up to a value of 2.4. We decide to go short Anglo American and long Antofagasta, hoping the ratio will drop with time. We trade the next day, selling Anglo American at 3575 and buying Antofagasta at 1450. Let’s say that we decide to trade £10,000 worth of each stock.

| Opening values: |

| Anglo American | Antofagasta | |

|---|---|---|

| Opening transaction | Sell 280 shares | Buy 690 shares |

| Share price | £35.75 | £14.50 |

| Asset value | £10,010 | £10,005 |

As time progresses, the ratio reverts closer to its five-year mean. On January 23, you decide to close your trade, buying Anglo American at 3588 and Antofagasta at 1760.

| Closing values: |

| Anglo American | Antofagasta | |

|---|---|---|

| Closing transaction | Buy 280 shares | Sell 690 shares |

| Closing price | £35.88 | £17.60 |

| Asset value | £10,046.40 | £12,144 |

| Result | £36.40 loss | £2139 profit |

Overall profit = £2139

-£36.40

£2102.60

Bear in mind that you would incur financing costs for holding the positions and you would have to take this into account.

Market Neutral Strategies

There is an approach, however, that seeks to mitigate market risk while aiming to make a profit from pricing discrepancies. Strategies that take this approach are known as market neutral strategies and are achieved by holding more than one position simultaneously, where the risk of one position helps to offset the risk of another.

Essentially the strategy works by identifying two (or more) instruments, the price movements of which have shown a historical tendency to correspond to each other, waiting for an opportunity where the price relationship is abnormal and then trading with the assumption that the price relationship will revert to the mean.

Now, these strategies can be complex processes, involving baskets of instruments and employing high-powered statistical algorithms, but they don’t have to be.

A pairs trade is a market neutral strategy that only uses two (hence the name) instruments at a time. The following worked example — using real market prices — is designed to explain the principles involved and illustrate a possible methodology for a simplified pairs trading strategy.

Assumptions and Risks of Pairs Trading

A major assumption of the strategy is that the historical price relationship will continue to hold in the future. Hand in hand with this is an assumption that when the price ratio diverges away from the mean, it will revert with time.

There is a risk, therefore, that something fundamentally changes to affect the pricing of one stock and not the other, or something happens that affects them both in a different way. It is important that you closely monitor news affecting the companies you choose.

The longer you hold a CFD position, the greater your financing costs become. It is possible this might exceed your trading profit, so you also need to keep a close eye on this aspect.

This article is the fourth in a five-part course aimed at providing trading education that goes beyond basic skills. The final part in the series outlines the Anatomy of a Trading System.

Quiz

FAQs

- Does pairs trading remove all risk?

-

No. It aims to reduce market risk. You are still exposed to other risks, such as counterparty risk, systemic risk, and that your strategy fails.

- Can I only pairs trade with equities?

-

No. Pairs trading is devised as a strategy that can work with any two correlated instruments.

- Can I use a pairs trading strategy through a conventional stockbroker?

-

Pairs trading relies on being long one instrument and short another. A mechanism for going short the price of an instrument, such as offered by a CFDs provider, is therefore required.

- If a pair of instruments have shown correlation in the past, does this mean they will continue to correlate in the future?

-

No. Price relationships between instruments are always changing and can also be impacted by higher level macroeconomic factors.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.