If you’ve ever wondered whether futures trading might be for you, this analysis of the sometimes distinctive functionality of futures could help you to answer that question. We’ll explore what futures are, how they work, and how to trade them using an online broker.

Futures trading offers a straightforward way to invest in a wide range of different markets. There are, however, some important features to be aware of to make sure you pick the type of futures contract that suits your style of trading.

This guide will outline what futures are and explain what steps are needed to put on your first futures trade.

What is futures trading?

Futures trading is buying and selling futures — legally binding contracts to exchange an asset, at an agreed price, at a future date. Trading futures is very similar to trading many other instruments — the primary difference being that some, but not all, futures contracts involve traders having to deliver a physical item when the trades are settled.

There are a wide variety of futures markets available to trade. You can trade futures to gain exposure to commodities, stocks, and forex. In fact, futures can technically be applied to any financial instrument.

Tip: Futures are derivative instruments — you are trading the right to buy or sell an underlying asset, rather than the asset itself.

How does futures trading work?

If you have carried out research or seen posts online that point to the price of oil rising, one way to take a long position in the market is to buy an oil future. As the price of a future is derived from the price of an underlying asset, should the oil price rise, the price of oil futures will rise as well. Of course, should the price of oil fall, the P&L on your long futures position will fall as well.

Tip: Futures involve settlement at a future date, but your exposure to the market starts from the time you open a trade.

The simplest form of futures trading uses futures which involve cash settlement rather than physical settlement and don’t have an expiry date. If you trade one of these instruments, the P&L on your trade will be determined by the difference between the price at which you opened your position and the price at which you closed it out.

Tip: Futures trading involves using leverage. You will have to ensure that your account has sufficient funds to avoid a margin call.

Examples of a futures contract

Futures contracts have been adapted to perform particular functions. One major distinction is that some parties buy and sell futures because they want to own or sell the underlying asset at some point in the future, while others trade them solely to pursue speculative trading strategies.

- Physical Futures — On futures’ expiry date, the buyer and seller of the contract are obliged to arrange for settlement of the contract and for the physical delivery of goods such as cotton, wheat, or gold.

- Cash Futures — A cash settlement is made on the expiry date. No physical goods change hands.

- Expiring Futures — Futures which have a predetermined settlement date after which they can no longer be traded.

- Non-Expiring Futures — These contracts can be traded indefinitely; they don’t have an expiry date.

- Listed Futures — These are futures which are traded on a regulated exchange. The terms of the contracts are standardised.

- OTC Futures — Sometimes called “forwards,” these are where two parties set up a bespoke agreement to exchange an asset for cash at a future date. These OTC (Over the Counter) instruments are not listed on an exchange.

- CFD Futures — It is also possible to trade CFDs which track the price of futures contracts.

Futures trading evolved out of the commodity markets and the desire of farmers and industrialists to have certainty over when they would exchange goods for cash and at what price. The Chicago Mercantile Exchange (CME) is one of the largest futures exchanges in the world and still supports that form of futures trading, but also supports trading in other types of futures contracts. As a result, futures cover a wide range of underlying instruments, including stocks, indices, and bonds, as well as commodities.

How to trade futures on eToro

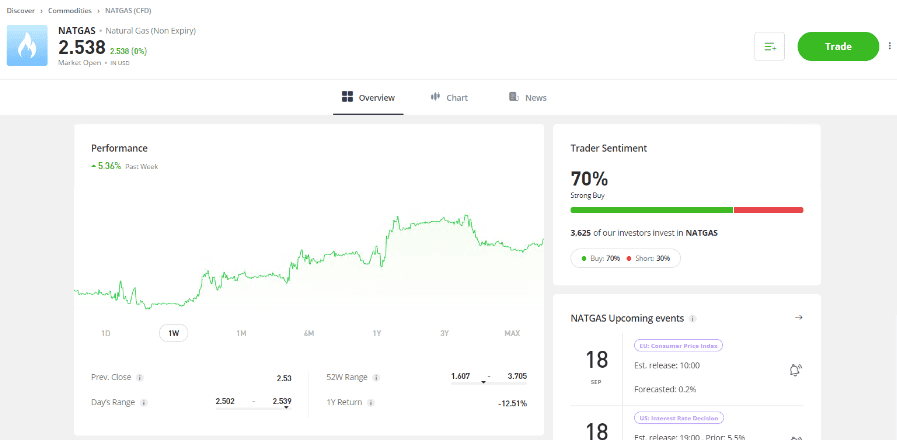

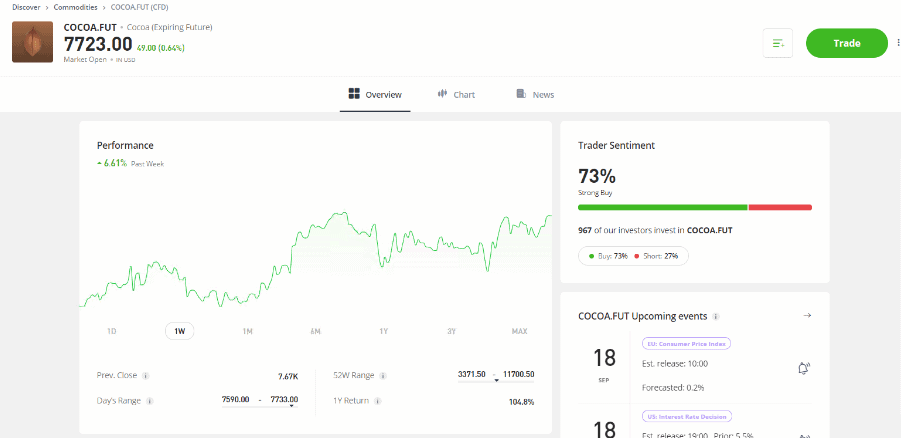

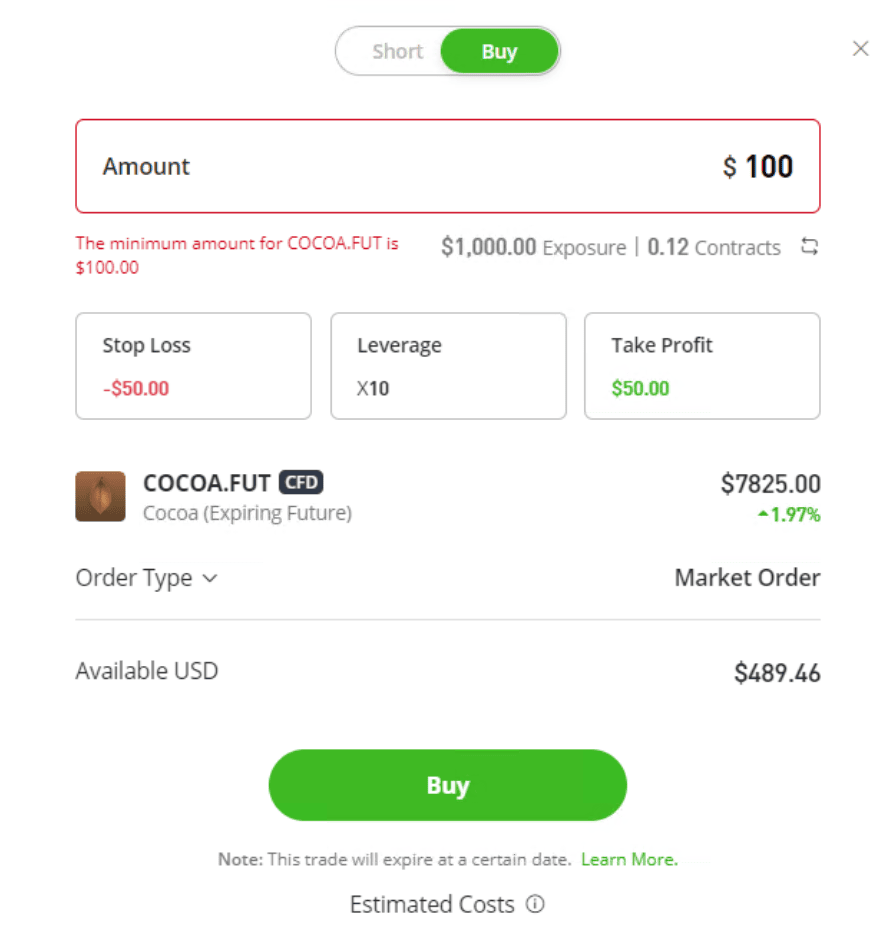

Futures trades booked on eToro use the same login, account, and trading functionality as any other instrument. The first step is to navigate to the market in which you want to invest. Whether you are trading the expiring Cocoa future or the non-expiring Natural Gas CFD future, the layout and functionality of the dashboard will be the same.

Past performance is not an indication of future results

Source: eToro

Past performance is not an indication of future results

Source: eToro

The home page for each market will provide up-to-date research and input from other traders who are following the market. From there you can analyse price charts, market sentiment, and upcoming news announcements before deciding whether you want to click on the “Trade” button to buy or sell.

Past performance is not an indication of future results

Futures available on eToro

The extensive range of futures markets available on eToro reflects the company’s position as a multi-asset broker which offers more than 5,000 instruments to its clients.

It’s possible to buy futures or CFD futures which cover sectors ranging from commodities to indices, from Orange Juice expiring futures, to non-expiring futures which track the S&P 500 Index futures.

Final Thoughts

Futures contracts are versatile instruments and the way they have been adapted to support different purposes can at first make trading them appear complicated. Once you understand the features of the different kinds of futures, you will be in a better position to use that versatility to your advantage, and invest in futures to achieve your financial aims.

Visit the eToro Academy to learn more about popular investment strategies which use futures.

FAQs

- Am I at risk of physical delivery if I trade futures on eToro?

-

No. All of the futures and CFD futures traded on eToro involve cash settlement. There is no risk of buying a futures contract which involves delivering or receiving the underlying physical item on the settlement date.

- Where do the prices of eToro futures come from?

-

Futures and CFD futures listed on the eToro trading platform are priced using data sourced from the leading global exchanges such as the CME.

- What are popular futures trading strategies?

-

Commonly used futures trading strategies include mean reversion, and spread trading, but the instruments are particularly popular with investors following trend-following strategies.

- What is a futures “rollover”?

-

The term “rollover” describes the practice of selling a futures contract that is close to expiring and at the same time, buying another futures contract with an expiry date which is further away in time. This allows traders to maintain continuous exposure to the market.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.