Do you know how to identify the different market conditions you might encounter? Learn about the idea of matching a style of trading to market behaviour.

Financial markets are changeable; at any one time, the market may behave in a certain way that can differ from characteristics it has previously displayed.

A key skill a trader needs, therefore, is to be able to recognise the prevailing conditions of the market and adapt their own behaviour accordingly.This is because different trading approaches may work more effectively under certain conditions.

Different market conditions

Let’s look first of all then at overarching conditions in which you might find a given financial market. A market can either be:

volatile (prices changing rapidly) or- muted (price changes occurring only slowly)

A volatile market will exhibit steep, deep swings from peaks to troughs with large daily ranges, whereas a muted market is one where price ranges tend to be narrow.

Along with these conditions of how fast or wildly prices are swinging, markets can either be trending in a direction or moving sideways (also known as a “consolidation phase”).

This gives us four different combinations for possible market conditions:

- Volatile and sideways

- Volatile and trending

- Muted and trending

- Muted and sideways

Volatile and sideways

In this condition, prices are stuck within a range. Although daily ranges can be sizeable, the net result is of no real significance over larger spans of time.

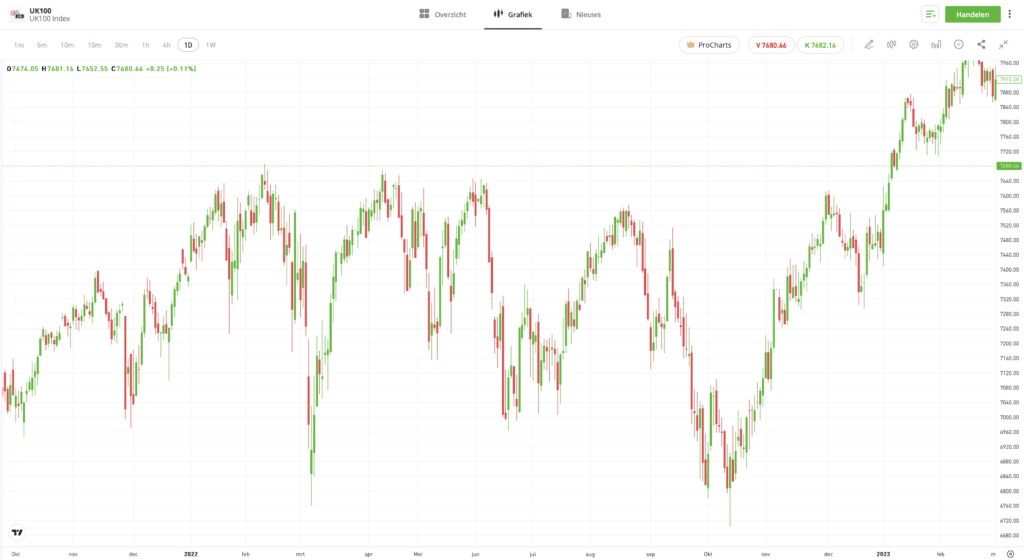

The chart of the UK100 index below is an example of a volatile and sideways market. The price whipsaws close to a thousand points from lows to highs over the course of the year, but ends 2022 at a similar level to where it began.

Source: eToro

Volatile and trending

In this condition, the market changes significantly in value, but in the course of the net shift in price, there are also corrections (temporary reversals) that can make the overall trend harder to perceive.

The chart below of the oil market shows varying conditions. There is an uptrend in price that lasts from December 2021 through to June 2022. Over this period, the uptrend becomes volatile from March, when we see wild swings in price, including some deep

This volatility eventually results in a new trend in the opposite direction that lasts from July through to the end of the year, when it begins to show signs of a possible consolidation.

Source: eToro

Muted and trending

Overall, in this condition, the market drifts in value either up or down without any significant corrections.

The first part of the trend in the oil chart above is an example of muted and trending. From December 2021 through to March 2022, the price is clearly trending higher, but it has little volatility and no major corrections.

Muted and sideways

In this condition, there are only small variations in price within a narrow range with no overall trend in the price.

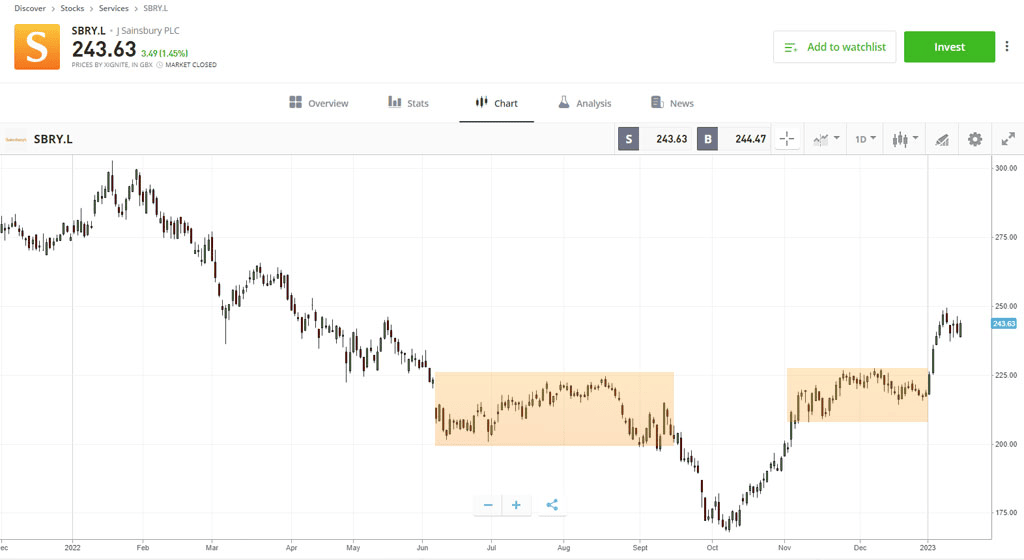

The highlighted sections in the chart below of Sainsbury’s show periods where price movement is muted and sideways.

Source: eToro

Trend-following

Trend-following systems look to benefit from substantial changes in price that occur over multiple months. The strategy aims to enter the market early in a new trend when the market begins to establish new highs or lows.

Trend followers, therefore, operate by buying into prices that are at historical highs or selling into prices at historical lows.

Though such breakouts only occasionally result in a new trend, the trend-following trader attempts to make sufficient profits from being long over a sustained uptrend or short over a sustained downtrend to outweigh the numerous losing trades when a new trend does not occur.

A trend follower will only close their trade when the market changes direction for an extended period.

Source: eToro

Trading styles

If we consider our two major styles of

Countertrend trading

Countertrend trading seeks to profit from reversals, largely operating in an opposite manner to that of the trend-following trader.

Rather than buying into new highs and selling into new lows, the countertrender instead targets historical highs as an opportunity to go short and historical lows as an opportunity to buy, counting on previous levels of support and resistance continuing to hold.

Naturally, trend-following systems are suited to those times when markets are trending, and will lose money when the market is moving sideways. Of the four conditions, muted and trending best suits a trend-following strategy. The low volatility in such conditions mean that it is easier to hang on to a trade, as a trader will be less impacted by adverse swings.

A volatile, sideways market best suits a countertrending strategy — there are plenty of price swings from which to make money, but the price remains generally bounded within a range.

- Potential for impressive profits as the size of moves are large

- Many technical tools are geared for trend identification.

- Large trends occur infrequently.

- High volume of losing trades

- Method gives back a portion of profits when the trend reverses.

- Can require “deep pockets” to operate optimally.

On account of the disadvantages listed above, many traders may find trend-following a difficult strategy to stick with. As countertrending takes an opposite approach, traders can find it a less stressful strategy to follow, but it requires excellent risk management to avoid getting punished by breakouts or ending up on the wrong side of a trend.

Although trend-following and countertrading are two major styles of trading, they are not the only styles available.

Swing trading

Swing trading can be thought of as a kind of shorter-length subset of trend-following.

It follows a similar methodology to trend-following, as it tries to “ride the wave” when a price breaks out either up or down (the swings that give the strategy its name), but uses charts with shorter periods.

Rather than looking at daily charts with a view to holding a position for weeks or months, a swing trader might look at fifteen-minute charts or hourly charts with a view to identifying, and following, trends that last a few days.

Another approach that some traders take is to opt for market-neutral strategies. These strategies seek to mitigate market risk as best as possible. We will talk about this more in our next article and look at an example of a specific strategy with this approach.

Conclusion

How the market behaves is changeable and an inflexible trader who stays loyal to only one approach may find themselves stuck using the wrong strategy. Be adaptive, therefore, and use whatever style best suits the way the market is behaving.

This article is the third in a five-part course aimed at providing education about trading that goes beyond basic skills. The next part in the series explains How Pairs Trading Works.

Learn how to effectively plan and apply risk, return, and different trading strategies to your trades through eToro Academy.

FAQ

- Do I have to stick with just one trading style?

-

Different market conditions may make certain trading styles appropriate at any one time. You do not have to stick to one trading style, but you should ensure that it suits your own aims and requirements

- Do volatile conditions suit countertrending?

-

Price swings seen in volatile conditions present profit opportunities for countertrending traders, especially at times when the market is in a sideways phase.

- Is trend-following a long-term or a short-term trading strategy?

-

Trend-following is a long-term strategy.

Quiz

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research.

Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. The availability of all the above-mentioned products and services may vary by jurisdiction and country.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.