TRADE THE FUTURE, TODAY WITH FUTURES

Lock-in prices, hedge your portfolio, and capitalise on market moves.

Trade leading exchange-traded futures now

Explore these ten futures contracts available for trading and diversifying your investment portfolio

What is futures trading?

Futures trading involves buying or selling contracts to purchase popular assets at a predetermined price on a future date. Trading on regulated, exchange-listed futures contracts lets you lock in today’s prices to take advantage of upcoming increases or decreases in value.

Control a large value with a smaller upfront cost

Trade in both rising and falling markets

Avoid the hassle of physical asset delivery

Why trade futures on eToro?

Whether you’re experienced with trading futures or just starting out, eToro’s easy-to-use, intuitive platform is the perfect choice

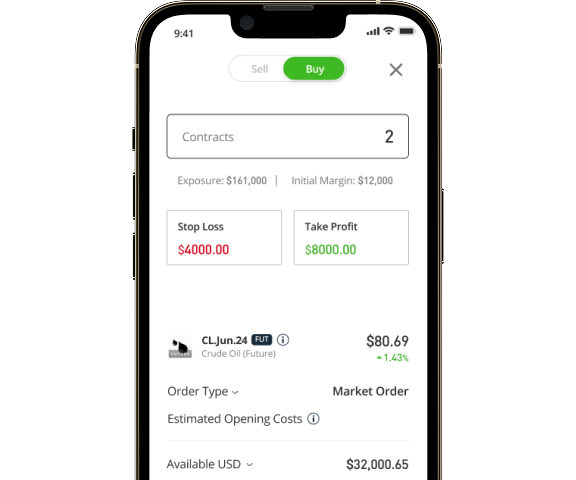

Smooth, seamless tradingExecute multiple contracts in one transaction. Manage all of your trades from one multi-asset portfolio, without multiple logins.

Pay a flat fee of $3–5 per position.

Trade futures 23 hours a day, 5 days a week. Place orders for immediate execution whenever exchanges are open.

Access free educational resources, advanced charts, real-time data and 24/5 customer service.

The power of locking in prices

When you buy or sell a futures contract, you lock in today’s prices — and can capitalise on market changes tomorrow. In a rising market, look to secure a lower price now. If prices are expected to drop, lock in a higher selling price today.

Here’s how it works: If you buy an oil futures contract today at $70 per barrel for delivery in two months, and the price rises to $80 by expiry, you still get it for $70, securing a $10 profit per barrel.

If you short an oil futures contract at $70 per barrel and the price drops to $60 by expiry, you still have the right to sell at $70, gaining a $10 profit per barrel.

Key features at a glance

Trade futures responsibly

Futures trading can be rewarding, but it also carries risks. Understanding the market is key — trade responsibly and stay informed.

- Read our guide to learn more about futures trading.

- Start small if you’re a beginner.

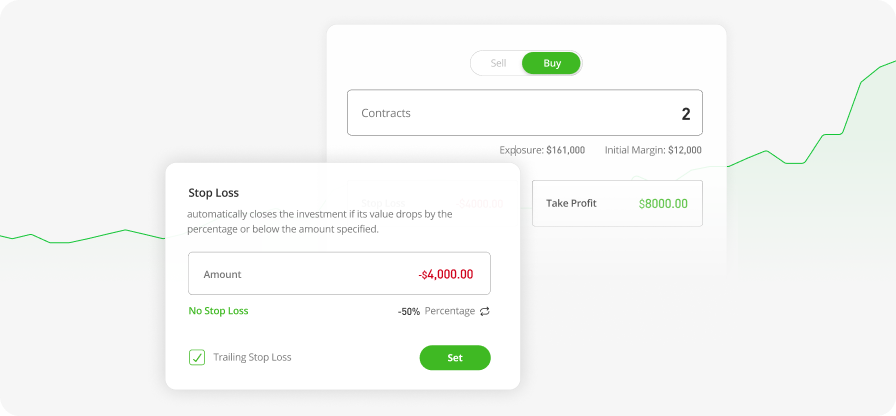

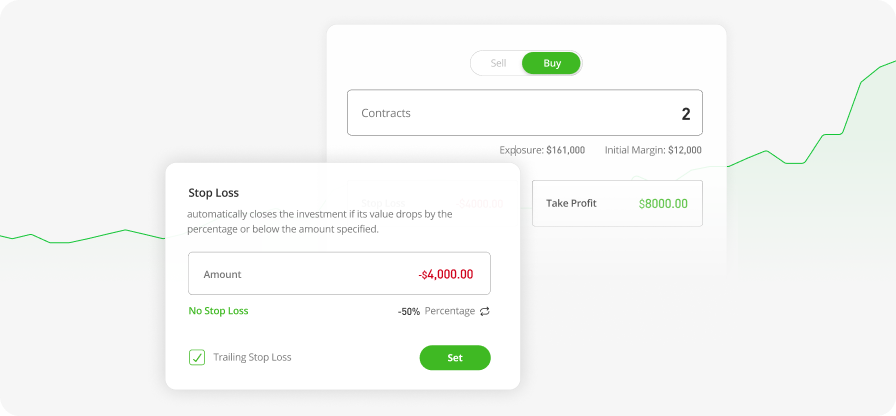

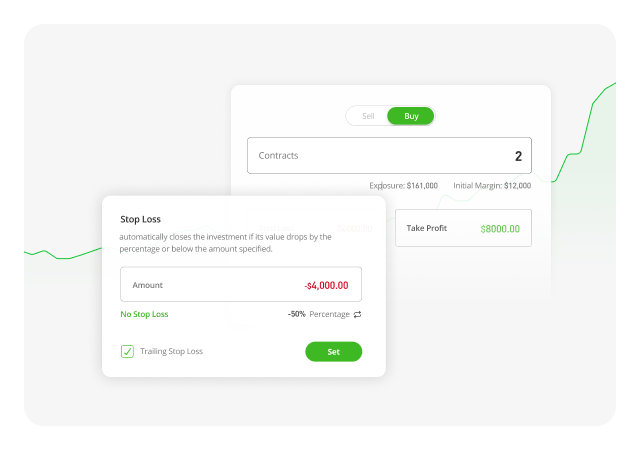

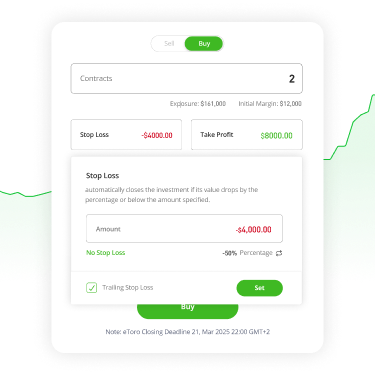

- Setting a stop-loss order is required to manage risk.

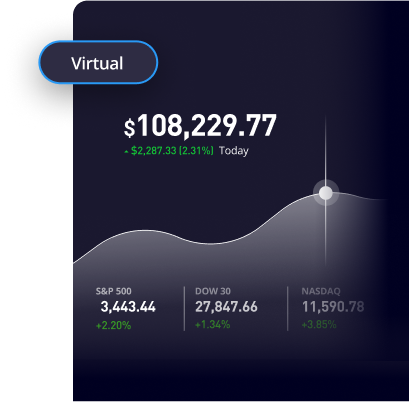

- Use eToro’s demo account to practise your strategy.

- Understand that trading with leverage amplifies both gains and losses.

- Be aware that prices can change rapidly, especially near expiry.

- Ensure that your account has sufficient funds to avoid a margin call, which can result in the forced closure of trades.

- Futures contracts are listed on the Chicago Mercantile Exchange Inc. (CME). Be sure to review CME’s terms and conditions here.

- Read the Futures risk disclosures to understand the risks.

FAQ

- What are futures?

-

Futures are exchange-traded financial contracts where two parties (trader and broker) agree to buy or sell an asset such as commodities, currencies, or stock indices at a predetermined price on a specific future date. Futures are standardised and traded on regulated exchanges.

- What are the fees for futures trading?

-

Futures trading on eToro has a flat fee of $3–$5 per action (opening, closing, or at expiry) during the promotional beta launch. There are no additional overnight fees, making it a cost-effective option for traders who want to avoid carrying costs over time. For more information on pricing, see our fees page here.

- Can I partially close positions?

-

If you hold positions with multiple contracts, you can close one or more contracts that are part of your position while keeping other contracts in the position open. This gives you flexibility to adjust your exposure based on market conditions or your trading strategy. Please note that the contracts themselves cannot be partially closed.

- What happens at expiry?

-

Futures trading involves contracts with a set expiry date, at which time all trades must be settled. Futures trades can be manually closed up to eToro’s last trading day, which may occur on or before the expiry date, depending on the settlement type.

- For contracts with cash settlement, users can hold the positions until the expiry date, at which point eToro will automatically close the trades.

- For contracts with physical settlement, all trades will be closed on eToro’s last trading day, which is also visible on the trade screen and typically a few days before the official expiry date. eToro does not support holding physical settlement contracts until the settlement date, as users will not receive the underlying assets physically.

- Is CopyTrader supported for futures trading?

-

At this time, CopyTrader does not support futures trading.