Trade local trade global

Discover eToro’s EUR account: get the advantages of a local broker and a global investment platform — all in one

The best of Both worlds

On eToro, you’ll have access to leading local and global assets — plus insights from analysts and investors in your area, as well as from around the world. When you open a EUR account (also known as an eToro Money account), you add the flexibility to deposit, hold and fund trades in EUR or USD — whichever suits you at any moment.

Diversify cost-effectively with hundreds of European stocks

Trade EUR-based assets without FX fees

Get discounted FX fees when converting funds

Access hundreds of local assets

Start investing in a variety of the best assets Europe has to offer — with more being added all the time

Say goodbye to FX fees

When opening a position, simply fund the trade in the asset’s currency (whether EUR or USD).

When depositing and withdrawing, use whichever eToro account (EUR or USD) matches the currency of your bank, to avoid unnecessary conversion fees. How to add funds to your EUR account.

Need to convert? No problem.

When opening a position in a different currency, convert only the funds you need — keeping FX fees to a minimum.

When transferring between your EUR and USD accounts, receive lower FX fees than any other method of payment. eToro Club members pay even less with discounted rates, see here.

Preserve the value of your funds

Hold funds in EUR or USD — or both — to manage currency exposure based on your investment strategy and stay ahead of rate fluctuations.

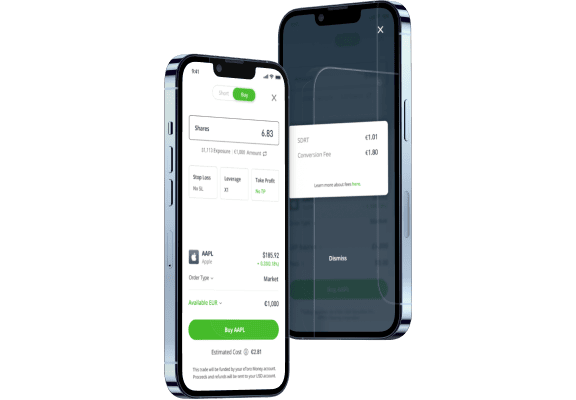

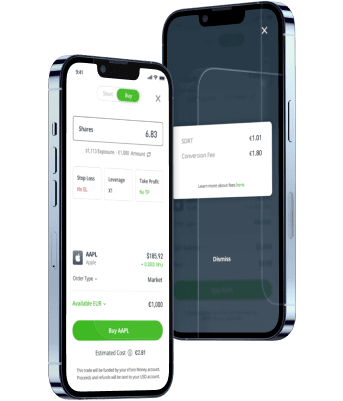

How to fund trades with EUR

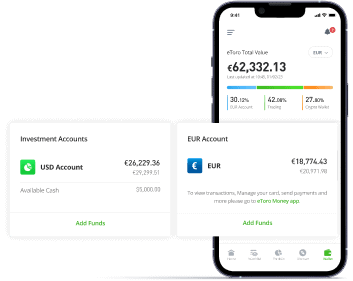

Both EUR and USD accounts appear in the Wallet tab. The choice is yours!

Currently available for trades with underlying assets, or USD-based CFDs.

Choose between Available EUR or Available USD from the dropdown menu.

Your position is now open and appears in your portfolio.

choose which currency account you want your funds returned to.

*Closing positions to the EUR account not yet available in all regions.

More freedom on the go

Your eToro Visa Debit Card connects to your EUR account, so your funds are available to spend anytime, anywhere

No FX fees | No added fees abroad | Keep track of your spending

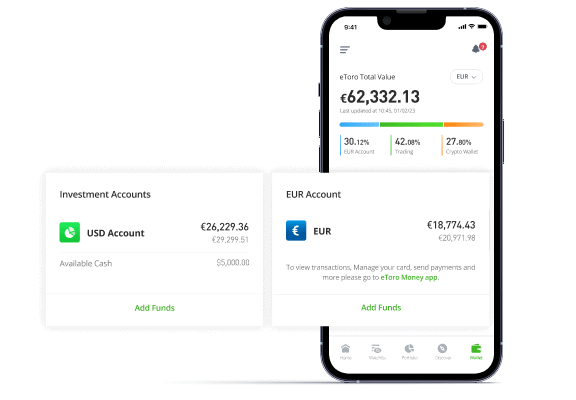

Everything all in one place

Managing your funds on eToro just got easier, faster, and more flexible.

Now, you can see all your eToro accounts in one place on your Wallet tab.

All your eToro holdings visible in one place

Quickly and seamlessly transfer funds between your eToro accounts

View your funds on eToro in your preferred currency

Legal bits: EUR account (eToro Money Malta Ltd.) services are only available to EU residents via SEPA bank transfers only. eToro Money services are designed for the purpose of making payment transactions. Funds in your EUR account are safeguarded per regulatory standards, but are not covered by the Depositor Protection Scheme (DCS in Malta). Please refer to the safe and secure page for further information.

Currently only crypto-to-crypto conversion is available. FX conversion fees for withdrawals from the eToro investment platform to the EUR account can be found here. Withdrawals made from the eToro investment platform to the EUR account are faster in comparison to other withdrawal methods available on the investment platform. Club members will continue to enjoy Club offers alongside the eToro Money benefits.

eToro Money Terms & Conditions

Terms & Conditions | Acceptable Use Policy | Fees and Limits | Privacy Policy | Complaints Policy

Developers

View our Open Banking guide and Open Banking API documentation. Only registered Third-Party Providers (TPP) can access production data.

Indemnity claims (contact details for bank partners only)

Banking indemnity claims (Toll free): +44 20331 84618 | Indemnity claims: indemnity_claims_eu@etoro.com

Customer service queries

Visit our Help Centre here.

FAQ

- What are the benefits of using funds from my EUR account for trading on eToro?

-

The EUR account offers you a more localised trading experience, and means that you can deposit, hold and fund trades in your local currency, rather than having to convert to USD by default upon depositing. This allows you more choice, plus you don’t have to pay conversion fees when you trade EUR-based assets.

There are several potential advantages to making trades using funds from your EUR account:

- Convenience: You can access your funds in EUR, and invest directly from the trade execution screen with no need to manually deposit or withdraw to or from your USD-based investment account.

- Choice of currency: You can hold funds in EUR (in your EUR account) or USD (in your eToro investment account), which allows you to decide how to manage both your currency strategy, and exposure between USD and EUR.

- Reduced conversion costs: There are no conversion fees when you fund trades of EUR-based assets, with your EUR account. There are also no conversion fees when you transfer (i.e., deposit or withdraw) between your own local bank account and your eToro EUR account.

- Who can use EUR account services?

-

EUR account services are only available to EU residents.

Note: Popular Investors are currently restricted from trading with funds from their EUR accounts. This ability is planned for future releases.

- Can I have both a USD and an EUR account?

-

Yes. You can hold EUR currency in your EUR account and USD currency in your eToro investment account concurrently. This allows you to decide how to manage your currency strategy and exposure between USD and EUR.

- Can I have both an EUR and a GBP account?

-

Not at this time.

- What type of trades can I fund with my EUR account?

-

Currently available for trades of stocks, cryptoassets, and ETFs with underlying (“real”) assets, or USD-based CFDs.

- What process does my money go through when I open a position using funds from my EUR account?

-

It’s important to understand how the currency conversion and trade execution process work, when you open a position on eToro using funds from your EUR account (eToro Money).

- When you open any position on the eToro investment platform with funds from your EUR account, your EUR funds are converted to USD, and moved to your USD account (eToro investment account), from where your trade is executed. (There are no conversion fees incurred for the conversion to USD described above.)

- If the asset you are buying is USD-based, then no further currency conversion is required.

- If the asset you are buying is EUR-based, we will convert your funds to EUR, but we will not charge you any conversion fees.

- When buying assets based in EUR: while your order is pending, changes to the USD exchange rate at the time of conversion may impact the price of the position you are trading, affecting the cost to buy, or the proceeds you receive.

- For out-of-hours and limit order trades, the funds will be converted to USD when you create the order and will be held in USD while your order is pending. Note that if you cancel the order, the funds may be returned to your USD balance, and not to your EUR account.

- Trading with your EUR account is only available for real stocks and cryptoassets. CFDs, Copy and Smart Portfolio investments can only be made with USD funds.

- If your USD account has a negative balance, the option to select your EUR account on the trade screen will be disabled. You will need to add funds to your USD account, to bring it back to at least zero in order to enable trading with your EUR funds.

By opening a position using funds from your EUR account, please note that the eToro Money Malta Ltd entity is transferring funds to the eToro (Europe) Ltd entity for execution. Note that if the execution of the trade fails, the funds may remain in your eToro investment account (in USD).

- What process does my money go through when I close a position and send funds to my EUR account?

-

- Closing a position with proceeds going to your EUR account follows a similar process to when you open a position using funds from your EUR account.

- The proceeds from your closed trade are first converted to USD (if not already in USD), then to EUR, and then transferred to your EUR account.

- If your position is based in EUR, we charge no conversion fees to send the proceeds.

- If you wish to send funds from your copy investments to your EUR account, you can use the Stop Copy and Keep feature, which will put the underlying assets in your eToro investment portfolio, and from there, you can close the position to your EUR account.

- How are fees applied when using funds from my EUR account?

-

Trading Fees

- When opening and closing positions with funds from your EUR account, our regular trading fees apply. Learn more here.

- These fees are initially calculated in USD, then converted to EUR, and included in the amount taken from your EUR account upon opening or closing a position.

Conversion fees

- There are zero conversion fees when trading EUR-based assets using funds from your EUR account.

- Conversion fees may apply when trading non-EUR-based assets using funds from your EUR account.

- How do I add funds to my EUR account?

-

To deposit funds to your EUR account:

- Log in to the eToro platform.

- Click on the Wallet tab.

- Under eToro Money Account, click Add Funds.

- Enter the amount you want to deposit and follow the instructions.

- How do I transfer funds between my EUR account (eToro Money) and my USD account (eToro investment)?

-

There are several ways in which you can transfer funds between your EUR account and your USD account.

To transfer funds from your EUR account to your USD account:

Using the Wallet tab:

1. In the eToro platform, select Wallet in the main menu.

2. Click Add Funds under Investment Account.

3. Select EUR account (eToro Money) from the dropdown menu.

4. Enter the amount you want to transfer to your USD investment account.

5. Click Deposit.

Using the Deposit Funds option:

1. In the eToro platform, click Deposit Funds in the main menu.

2. Select EUR account (eToro Money) from the dropdown menu.

3. Enter the amount you want to transfer to your USD investment account.

4. Click Deposit.

To transfer funds from your USD account to your EUR account:

Using the Withdraw Funds option:

1. In the eToro platform, click Withdraw funds from the main menu.

2. Select EUR (eToro Money) account as the location to which you wish to withdraw your funds.

3. Enter the amount you want to transfer to your EUR account.

4. Click Withdraw.

- How are funds in my EUR account protected?

-

EUR account services are provided by eToro Money Malta Ltd.

We keep your funds in a designated safeguarding account at a fully regulated bank in the EU. This approach ensures that your money remains safe and accessible, providing an extra layer of security for your assets. These funds cannot be used by eToro Money for anything other than facilitating your payment transactions, so, for example, we can’t go and invest it in the markets or lend it to other clients. This means that, in the unlikely event of insolvency, your funds held by eToro Money are covered in their entirety, other than the cost of returning the funds to you. Find out more about how we safeguard your funds here.

- What’s the maximum position size that I can close to my EUR account?

-

If you are closing a position worth more than 50,000 USD, you will not be able to close the position and send the funds to your EUR account (even though the option is shown). If you try to close the position to your EUR account, the funds will regardless remain in USD and be closed to your eToro USD investment account.

Important: No conversion fee is charged for this.

You will be sent a push notification updating you that these funds were closed to your USD investment account.