Looking to buy stocks in 2025? Then consider dividend stocks which can provide a steady source of income as well as capital growth. These are some of the top 5 dividend stocks to invest in — in 2025 and beyond — chosen by our expert eToro analysts.

Verizon (VZ)

Past performance is not an indication of future results

- The telecom sector is a favoured hunting ground of dividend investors and the fact that the share price of Verizon (VZ) has lagged behind that of its main rivals AT&T and T-Mobile US can be taken as a reason to buy it now..

- The relatively low share price means that the annual dividend yield on VZ stock is a very appealing 7.17% compared to 5.2% for AT&T and 1.67% for T-Mobile.

- The suppressed share price also leaves room for capital gains and should VZ rally from current levels to test the previous price highs of 2020, investors would then record a return in the region of 60%.

- The question is whether Verizon can improve its underlying performance to bring about gains for its shareholders — and there are reasons to believe that this will be the case.

- A new management team has outlined that they want the company to focus on generating growth in wireless service revenue, free cash flow, and earnings. That claim is backed up by forecasts that the number of fixed wireless access subscribers in 2028 will be 8–9m, compared to 4–5m this year.

- Expenditure on 5G licences and the acquisition of Frontier Communications in 2024 made a dent in Verizon’s cash pile, but dividend performance can be expected to improve as synergies between the company’s divisions are translated into increased revenue.

- However, the potential that Verizon’s main market is potentially close to being saturated is a risk factor to consider. Total customers jumped from 120m to 140m in 2021, but since then that number has flatlined.

Your capital is at risk. Not investment advice.

Exxon-Mobil (XOM)

Past performance is not an indication of future results

- If you are looking at tapping into the income streams of companies found in the energy sector, one pick for 2025 is integrated energy giant ExxonMobil (XOM).

- Some oil and gas companies specialise in one area of the sector, such as drilling, but ExxonMobil is involved in the upstream, midstream, and downstream elements of the oil and gas sector.

- The fact that ExxonMobil’s income streams come from a diverse range of sources means the company is less exposed to fluctuations in the underlying prices of energy commodities.

- XOM’s financial health will, of course, be influenced by prices in global energy markets, but the business divisions which process and distribute oil and gas generate returns regardless of the peaks and troughs in the market, and overall income streams are expected to grow 1.38% next year, from $7.95 to $8.06 per share.

- The company’s commitment to carbon energy and reluctance to invest in renewables will win it few friends among the green community, but sticking to what it knows best means Exxon has an attractive trailing dividend yield of 3.56%.

- Reliability is key in dividend investing and Exxon has raised its dividends for more than 25 consecutive years and , therefore, qualifies for membership in the exclusive “dividend aristocrats” club.

- There is potential for non-income returns as well. Should XOM stock meet analyst expectations and reach $135, that would represent a +26% capital gain on the current share price.

- Like other firms in the oil and gas sector, ExxonMobil has benefitted from the price of crude remaining relatively high over the past few years. The risk of an economic downturn or an improved geopolitical outlook need to be considered as both could cause oil prices to weaken.

Your capital is at risk. Not investment advice.

NextEra Energy (NEE)

Past performance is not an indication of future results

- NextEra Energy (NEE) offers a degree of diversification for investors who are firmly committed to building a dividend- based portfolio.

- The current annual dividend yield of approximately 2.8% is low in relation to some other popular dividend stocks, but NEE is committed to dividend growth. Over the last 20 years, it has grown annual compound dividend rates by +10% and predicts that trend will continue through 2025 and 2026.

- This impressive dividend growth is driven by a long-term shift in consumer sentiment. NEE’s investment in green energy includes projects which allow it to grow its renewables and energy storage capacity from around 38 gigawatts (GW) today to 81 GW by 2027. And that is capturing market share as more users express a preference to shift away from carbon fuel sources.

- The utility sector ETF — Utilities Select Sector SPDR ETF (XLU), has a dividend yield closer to 2.7%. That means the sector is not necessarily a natural home for dividend investors. As a result, investing in NEE offers an opportunity to avoid going overweight in those sectors which are better known for generating cash returns.

- One of the reasons behind NextEra’s ability to grow its dividend, an expanding customer base, is fuelled by a long-running demographic trend which shows little sign of ending. Florida, the company’s core market, remains one of the top four states for incoming migration, a ranking it has held since 2015.

- NextEra’s cost to capital is at a level where it is struggling to refinance existing loans or secure capital for new investments at an attractive rate. The not inconsiderable risk that interest rates stay higher for longer would result in the firm facing continuing headwinds.

Your capital is at risk. Not investment advice.

Coca Cola (KO)

Past performance is not an indication of future results

- Given the long-established reputation Coca Cola (KO) has as a dividend stock, any dip in the share price, such as the one seen now, can be regarded as an opportunity to buy in at a level which secures an improved dividend yield.

- KO stock currently offers a yield of 3.18% and that is complemented by the firm which also consistently engages in share buybacks.

- That same dip in the share price around the turn of the year also offers the opportunity for capital gains, with the consensus price forecast among analysts being $72.75 per share.

- Coca Cola’s almost legendary brand-recognition also insulates it from competitors and provides some protection against the risk of an economic downturn.

- With inflation and interest rates looking likely to remain higher for longer, it’s worth noting Coca Cola’s impressive ability to pass on to consumers any price rises triggered by its own suppliers. The Q3 2024 earnings report revealed that when product prices were hiked by 10%, sale volumes only dipped by 1%.

- While Coca Cola’s ability to pass on rising costs to consumers is impressive, it is not bulletproof. Over the course of 2024, it reported an increase of $2.1bn in terms of operating charges. The extent to which the company can continue to rely on brand loyalty propping up demand is a risk factor for investors to keep in mind.

Your capital is at risk. Not investment advice.

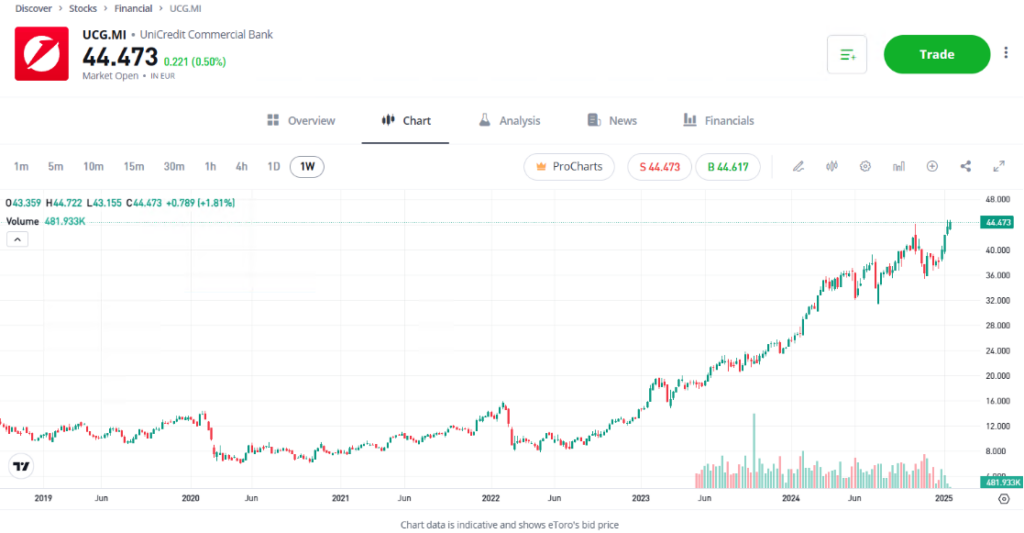

UniCredit (UCG.MI)

Past performance is not an indication of future results

- Keeping dividend investment simple and focusing on one of the most straightforward dividend investing metrics — annual yield, leads to stocks such as commercial bank UniCredit (UCG.MI), which going into 2025 has an impressive annual yield of 4.56%.

- The dividend payout made by UCG does have a reputation for fluctuating, but more importantly, it is sustainable. The firm’s balance sheet reveals a payout ratio of 30.6%, which shows that dividends are based on strong fundamental performance and could easily be stepped up without impacting the long-term prospects of the company.

- Investors with a long-term view could also benefit from UniCredit expanding its operations through acquisitions. The firm now owns almost 10% of German “cash cow” Commerzbank (CBK.DE) and while a finalised buyout of the German rival would impact short-term cash flow, a collaboration between the firms would be good news for investors with a focus on stable income streams.

- The Q3 2024 earnings report showed that in the first nine months of the fiscal year net revenue and net interest income have grown by 5.4% and 3%, respectively.

- Rounding off the reasons for Unicredit being seen as a solid dividend stock is the relatively low cost of risk management, with the bank scoring a relatively low 9 basis points in that category in the Q3 financial statement.

- Italy relies heavily on imports of oil and other energy sources and there is a risk that higher energy costs could start eating into consumer spending. Fiscal and monetary policy initiatives have so far propped up domestic spending,but such schemes tend to be short-term in nature.

Your capital is at risk. Not investment advice.

Final Thoughts

One challenge facing investors looking to buy stocks in 2025 is that an established upward trend has now been in place for some time. Concerns that all the good news is already priced in can’t be dismissed, but nor can anyone say with great confidence that the current bull run won’t continue.

Given the state of the markets, sensible investing options point towards building a diversified portfolio made up of stocks with strong income streams and impressive long-term prospects. Any research using those parameters will inevitably bring dividend stocks into consideration. The way they combine regular income and capital growth potential gives them an “evergreen” appeal and makes them an important part of any well-diversified portfolio — which, in turn, makes 2025 a good year to scale up on exposure to the sector.

Discover stocks and other assets on eToro.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.