Earn extra income

eToro’s Stock Lending programme allows you to potentially generate more income from the shares in your portfolio

Why lend your stocks?

The stocks you hold could be working harder for you. Stock Lending, also known as securities lending or share lending, is a common practice that earns you income by allowing another party to temporarily borrow stocks you already own.

How does Stock Lending work?

When you join our Stock Lending programme, eToro loans your shares to reliable third-party financial institutions and investors, generating additional income for you — while you maintain your rights to collect dividends and sell your shares at any time.

What to keep in mind

Net earnings from Stock Lending may vary based on market demand and the specific stocks in your portfolio.

Stockholders lose voting rights on loaned stock.

Your stocks are not guaranteed to be lent out.

In some jurisdictions, manufactured dividends are taxed differently than dividend payments.

Be sure to read the Share Lending Risk Disclosures and Terms and Conditions.

FAQ

- What is Stock Lending?

-

Stock Lending allows eToro to lend your fully-paid, non-leveraged stocks to other market participants. This helps these investors with trade settlements and short selling and, in return, you earn extra income.

- Who can join the Stock Lending programme?

-

The programme is currently available to eToro users residing in the UK and EU.

- How do I participate in eToro’s Stock Lending programme?

-

If you are eligible for the stock lending program, make sure you understand and are comfortable with the risks. Visit this link and log in to complete the opt-in process.

- Which stocks can be lent out?

-

Only fully-paid, non-leveraged stock positions in your portfolio are eligible. CFDs, fractional positions, crypto positions, pending orders, and extended hours positions do not qualify.

- Can CopyTrader positions and Smart Portfolio investments be eligible for lending?

-

No. Stocks held via copy and Smart Portfolios are not included in the Stock Lending programme at this time.

- Can I choose which stocks to lend out?

-

No, you can’t select specific stocks. When you enable Stock Lending, your entire portfolio is considered for lending based on market demand.

- Will all my positions be loaned out?

-

Stock lending works on supply and demand. Stocks that are in short supply and high demand are more likely to be borrowed. You can lend any number of shares, with no minimum or maximum limits, but there’s no guarantee that all of your shares will be lent out.

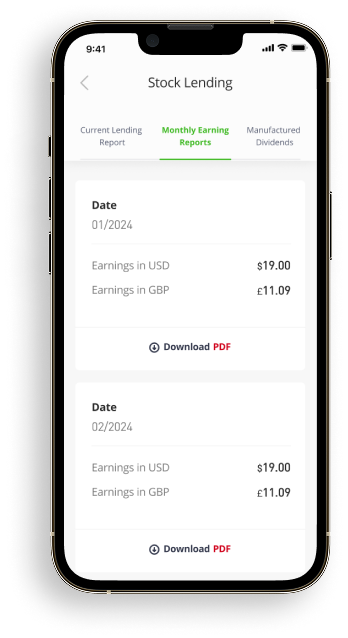

- How does eToro calculate monthly earnings from Stock Lending?

-

Participants will receive monthly payments, equivalent to 50% of the net revenue eToro earns and receives from our partners for lending transactions.

The actual income from stock lending will likely vary from month to month depending on a number of factors, including:

- Which stock positions in users’ portfolios are loaned out

- The number of stock units lent

- The lending fee paid for each stock lent

- Market demand to borrow the stock

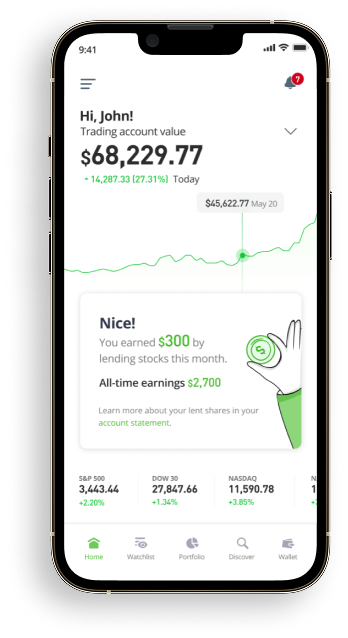

- When and how do I get my earnings from Stock Lending?

-

Earnings from Stock Lending are paid out around the 10th of each month and should be in your available cash balance in USD by the 15th.

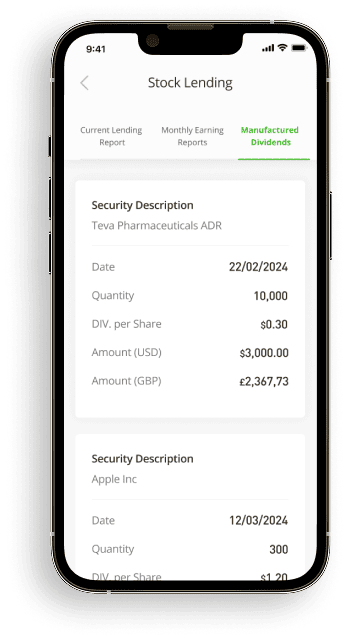

- Will I receive dividends on my loaned shares?

-

Yes, you’ll receive a payment in lieu of cash dividends and stock dividends as usual. Cash dividends might be taxed differently than qualified dividends.

- Where can I find more information regarding my stocks on loan?

-

You can find more information regarding their Stock Lending activity in Settings > Account > Documents > Stock Lending Activity Report.

- Can I sell my shares while they’re on loan?

-

Yes, you can sell your shares at any time. The stock value isn’t fixed to the loan price and may fluctuate.

- Can I vote on corporate actions for my lent stocks?

-

No, the borrower has the right to vote. You won’t receive voting-related emails during the loan period.

- Are there any risks involved?

-

Fully paid stock lending may not be suitable for everyone. Clients with short-term liquidity needs or those who do not fully understand the risks should carefully consider whether this program is right for them.

One of the primary risks is counterparty default. BNY Mellon serves as the agent in eToro’s Stock Lending programme, providing collateral in the form of US Treasury Bonds valued between 100% to 105% of the lent inventory’s updated value to ensure the safety and security of loaned stocks. In the unlikely event that a counterparty defaults, you would have access to the collateral held to secure your lent stocks. Be sure to read and understand all relevant risk disclosures, and only proceed if you are comfortable with the risks.

- How are my loaned stocks protected?

-

BNY Mellon, our lending agent, provides collateral in the form of US Treasury Bonds, valued between 100% and 105% of the lent inventory’s updated value to ensure the safety and security of loaned stocks.