Learn all you need to know about buying stocks in the UAE. This guide offers insights into stock market dynamics, the regulatory landscape that governs them, and how you can make better-informed investment decisions.

In the UAE, the world of investing is vibrant and the market offers various opportunities for portfolio growth and diversification. Buying stocks in the UAE is an investment in a rapidly expanding economy, known for its robust financial markets and innovative business environment.

Whether you’re a local enthusiast or an international investor, this guide simplifies the investment journey in the UAE, helping you to navigate the stock market with a well-informed approach.

Understanding the UAE stock market

The infrastructure of the UAE’s stock market supports various types of investors, ranging from retail investors to large institutions, offering opportunities to invest in shares of companies across sectors, from technology to healthcare to consumer goods.

Understanding the stock market structure and the key stock exchanges in Dubai and Abu Dhabi is crucial for anyone looking to invest in stocks in the UAE.

Dubai Financial Market

The Dubai Financial Market is a leading stock exchange in Dubai, known for its diverse listing of local and international companies. It’s a dynamic marketplace where investors can trade shares of public companies, bonds and other securities.

The DFM is committed to transparency and corporate governance, attracting investors looking for growth opportunities in the Middle East.

Abu Dhabi Securities Exchange

Located in Abu Dhabi, the capital of the UAE, the Abu Dhabi Securities Exchange is a vital hub for investing in the country’s economy. It lists a wide range of companies, including some of the region’s largest and most stable entities. The Abu Dhabi stock market is renowned for its innovative market service approach, focus on sustainable investment opportunities, and status as a rising fintech hub.

Potential risk vs reward

The UAE stock market offers a blend of opportunities for growth and stability, making it an attractive choice for investors. This being said, when looking for the best investments in the UAE, it is important to be mindful of the inherent risks and considerations.

| Potential risk | Potential reward |

|---|---|

| Regulatory changes: Changes in regulations or laws can affect market operations, sectors and individual companies, potentially impacting your investments. | Robust infrastructure: Established financial markets and robust regulations for exchanges ensure a secure investment environment. |

| Currency risk: For international investors, fluctuations in the exchange rate between their home currency and the UAE dirham can affect investment returns. | Investor-friendly policies: The UAE’s investor-friendly policies encourage investment in the region. These include tax incentives for investors, such as a lack of capital gains tax. |

| Liquidity concerns: Some stocks may have lower trading volumes, making it difficult to execute large trades quickly without affecting the stock price. | Diverse opportunities: Investors in the UAE can access a dynamic economy, and invest in leading companies across various sectors such as real estate, banking and tech. |

| Geopolitical influences: Regional and global political events can impact market stability and investor confidence, leading to market shifts. | Opportunities for all investors: The infrastructure of the UAE’s stock market supports various types of investors, from retail investors to large institutions. |

| Market volatility: Stock prices can fluctuate widely due to internal market dynamics or external economic factors, potentially affecting the value of your investments. | Relative safety compared to other markets: Investing in the UAE is considered relatively safe compared to many other markets, due to a stable economy. |

Investing in UAE stocks means tapping into the potential of a large and dynamic economy. It is wise to diversify your portfolio with a mix of traditional and emerging sectors to spread risk and increase the opportunity for potential returns.

Tip: Before investing in the UAE, establish a clear financial goal, keeping your risk appetite in mind.

How to buy shares in the UAE: a step-by-step guide

Here’s a step-by-step guide to help you to get started investing in the stock market in the UAE, including how to open a brokerage account, depositing funds, conducting research and making your first investment.

Tip: Consider using a demo account to practise buying stocks risk free, before parting with any of your own capital.

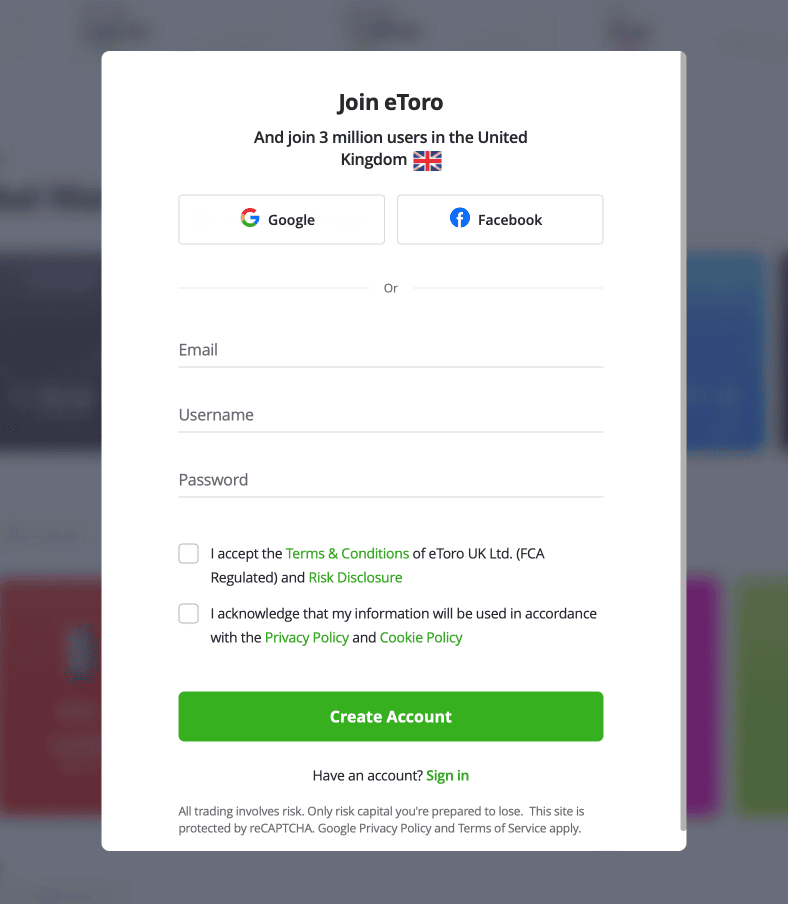

- Opening a brokerage account

The first step to buying stocks in the UAE is to open a brokerage account. Choose a regulated broker that offers access to the UAE stock market, complies with all regulations, with robust security measures in place to protect your investments.

Your broker will also help you to obtain a DFM Investor Number (NIN), which is a requirement for trading in the UAE.

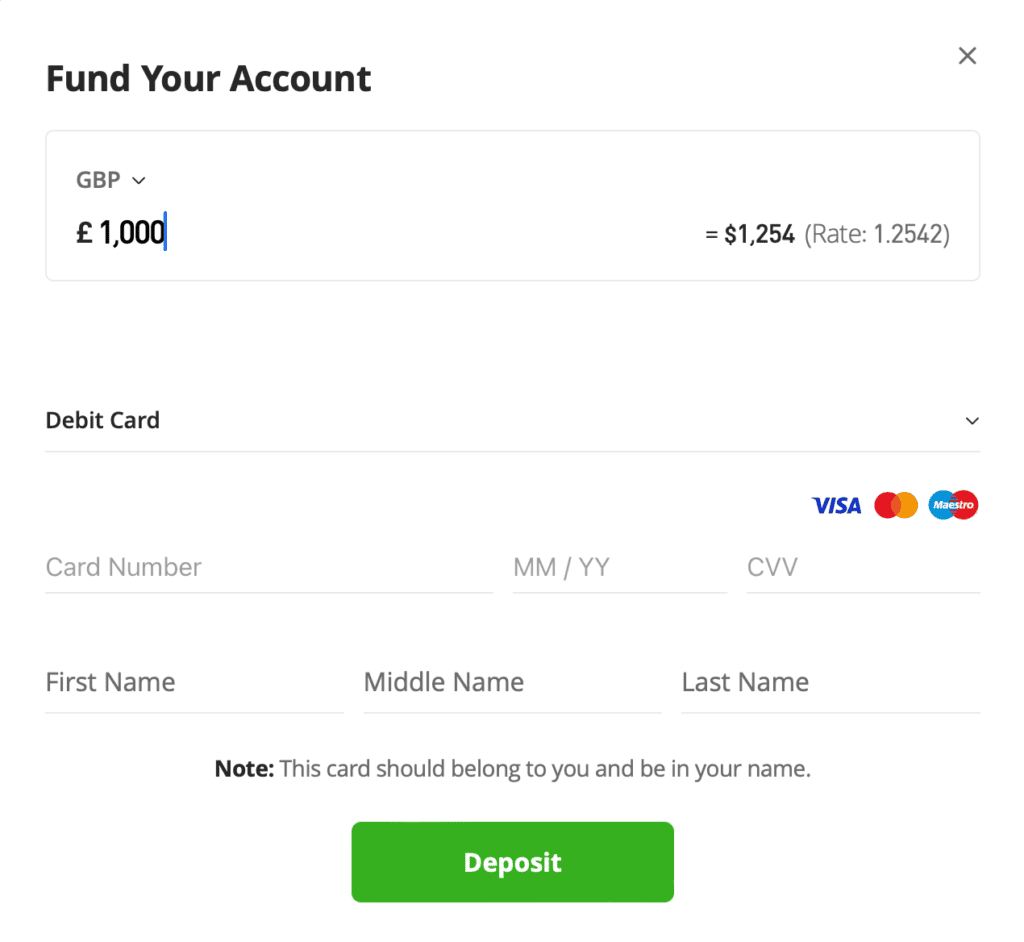

- Depositing funds

Once you’ve opened your account, the next step is to deposit funds. Consider the deposit options available, such as bank transfers, credit cards and e-wallets.

- Conducting research

Before making any investments, it is crucial to research and understand the stocks available, in order to make a well-informed decision about what stocks to buy in the UAE.

This analysis should involve analysing the company’s financial health, market position and growth prospects using both technical and fundamental indicators.

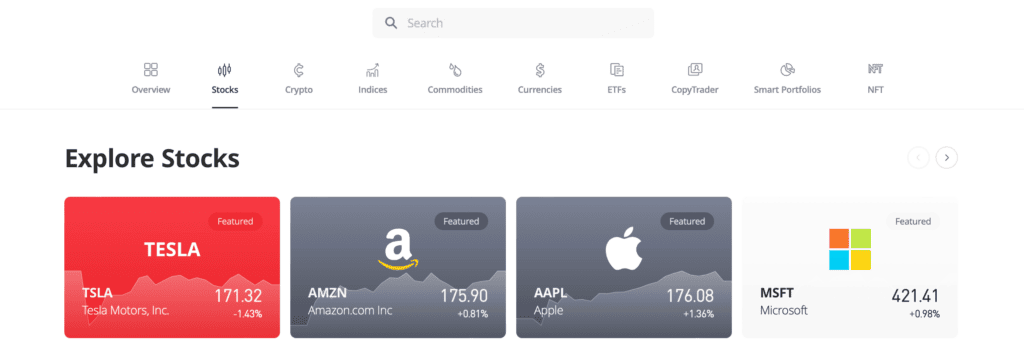

You may also evaluate alternative investment options, such as whether to buy gold in the UAE. Reputable brokers offer a wealth of resources and educational content, including market analysis, stock performance history and expert opinions.

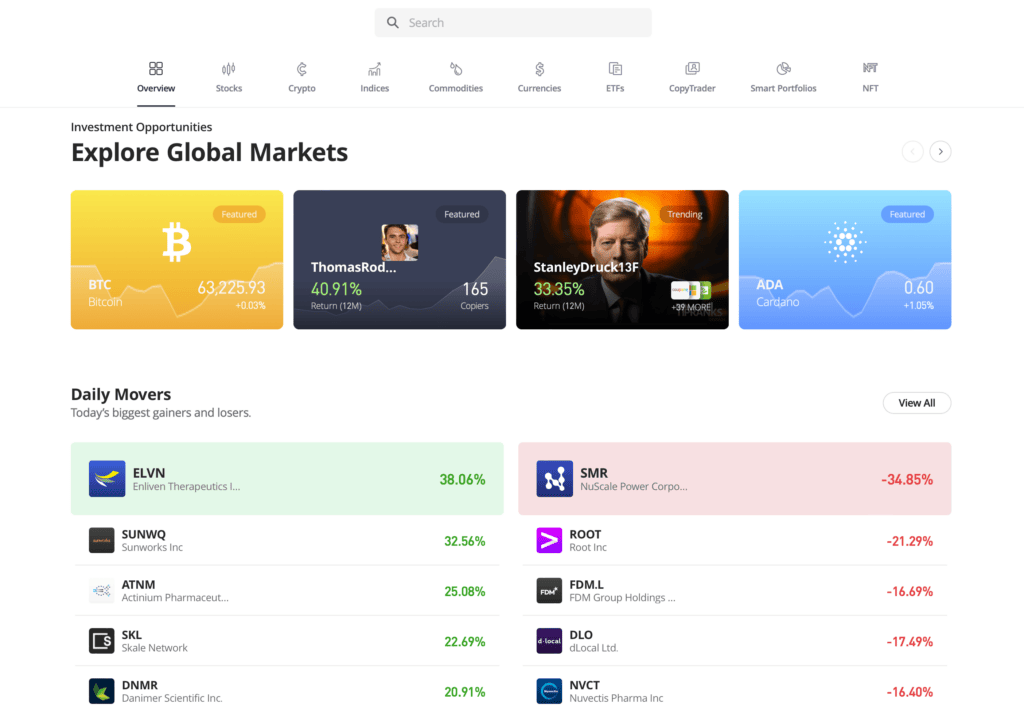

Many brokers offer the option of investing in multiple different types of assets on one platform, to make the process of picking your investments and diversifying your portfolio user-friendly.

- Buying stocks

Determine the size and conditions of your UAE stock purchase, either by entering a specific dollar amount and purchasing fractional shares of a stock, or by choosing a whole number of shares to purchase. Either way, select what you wish to invest in, and confirm your purchase order.

Most brokers also offer the option to set up buy and sell orders, and stop-losses.

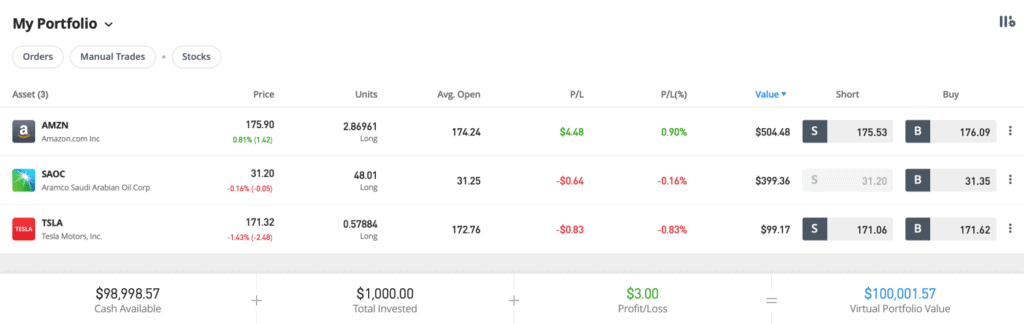

- Monitoring your portfolio

Regularly monitor your portfolio to track its performance and make informed decisions based on market changes. Effective portfolio management involves observing price movement, trends and investor sentiment, and staying updated on macroeconomic events, company earnings reports and sector trends that might impact your investments.

The UAE vs the US: Where should I invest?

We have established that the UAE is a potentially attractive investment destination, but ultimately, the decision about where to invest your capital depends on your individual financial goals and risk tolerance. Most investors are likely to be more familiar with the US stock market, so it can be useful to consider a brief comparison between the two:

| UAE | US | |

|---|---|---|

| Market Maturity | Emerging | Established |

| Growth Potential | High | Moderate |

| Volatility | Potentially higher | Potentially lower |

| Diversification | Access to a growing regional economy | Established global market with diverse sectors |

| Diversification Potential | Yes, within the UAE and regionally | Yes, across a wide range of sectors and global companies |

The UAE market is young and dynamic, fuelled by the region’s booming economy and focus on innovation. This translates to the potential for high returns, but also comes with a higher degree of risk. Stock prices can fluctuate more dramatically in emerging markets like the UAE. However, for investors with a long-term outlook, the UAE offers an opportunity for early investment in exciting new companies and industries.

On the other hand, the US stock market is a well-established giant. With its long history, well-known exchanges and famous brands, the US market offers a potentially safer option for risk-averse investors. Established companies tend to experience less dramatic price swings and the overall market may be less volatile. While the growth potential might be more moderate, the US market provides a more predictable investment environment.

The good news is that you don’t necessarily have to choose one over the other. Diversification is key to a healthy investment portfolio. By investing in both the UAE and US markets, you can balance the potential for high growth — with the stability of established companies, and in this way, you can potentially benefit from the dynamism of the UAE market while also mitigating risk with the stability of the US market.

What are some popular shares to buy in the UAE?

If you want to learn which are among the best stocks to buy in the UAE, consider a few top-performing stocks in the region:

- Investment management: International Holding Company PJSC

- Oil and gas: Aramco Saudi Arabian Oil Corp

- Telecommunications: Emirates Telecommunications Group Company

- Banking and financial services: Abu Dhabi Islamic Bank

- Aviation and airline: Air Arabia

Final thoughts on buying stocks in the UAE

Investing in the UAE stock market has the potential to present many opportunities if you are well-informed, approach investing with a clear strategy, and remain cautious of the need to manage your risk.

Visit the eToro Academy to learn more about investing in the stock market.

FAQs

- Can I buy stocks in the UAE?

-

Yes, both residents and non-residents can invest in the UAE stock market, which includes the Dubai Financial Market and the Abu Dhabi Securities Exchange. To start, you’ll need to open a brokerage account with a licensed broker in the UAE.

- Is it safe to invest in the UAE?

-

Investing in the UAE is considered relatively safe compared to many other markets, thanks to its stable economy and strict regulatory framework. However, like any investment, it comes with risks. It’s important to research and consider diversifying your investments to mitigate these risks.

- What are the UAE Stock Exchange trading hours?

-

Both the Dubai Financial Market and the Abu Dhabi Securities Exchange open from 10am to 2:45pm, Gulf Standard Time (GMT + 04:00), Monday to Friday.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.