If you think healthcare sector stocks might be your next investment move, you are in the right place. From the sector’s risks and benefits to its historic performance, here is everything you need to know.

The healthcare sector comprises a range of subsectors, from pharmaceuticals and biotechnology to insurers and retailers, making it one of the largest and most complex sectors of the economy. In this guide, you will learn about the many industries that comprise the healthcare sector, the investment opportunities available, and what to watch out for as you invest.

What is the healthcare sector?

The healthcare sector comprises businesses that provide medical services and medical insurance, manufacture medical equipment, and produce and supply pharmaceuticals. There are two main industry groups in Australia: the healthcare equipment and services industry and the pharmaceuticals, biotechnology and life science industry.

Healthcare stocks belong to the healthcare sector of the stock market and consist of a number of industries that can be broken down into the following:

This includes hospitals, nursing homes, health facilities and laboratories.

This refers to businesses that provide and underwrite health insurance policies.

Medical equipment companies create and manufacture equipment that is used across the health sector such as surgical masks, pacemakers and stethoscopes.

ceuticals.

Biotechnology and pharmaceutical firms research and develop drugs and vaccines.

The healthcare sector is large and varied, which makes it suitable for most investors looking to build a diversified portfolio. Each sector of the healthcare industry essentially functions as its own mini sector which means that its performance and volatility varies depending on factors such as:

- Government regulation

- Scientific and technological developments

- Changing demographics.

Is the healthcare sector worth investing in?

Healthcare is something we all depend upon. Investing in strong and reputable healthcare stocks can provide you with a level of security in an investment portfolio. Here are a few reasons why it could be worth investing in this sector.

Potential for strong growth

From advances in biotech to an ageing population of baby boomers, the healthcare sector has been growing for decades. Look at how quickly a company’s revenue has grown in recent years. If a company has been able to deliver strong revenue growth, there is a good chance it will continue to do so in years to come.

Potential to hold up in economic downturns

Even during times of economic crisis, healthcare stocks tend to do well, partly because there is always demand for them and because the sector consists of so many different subsectors.

Constant demand

There is always a demand for healthcare services, regardless of how other industries are coping. Historically, this has always been the case.

Large domestic market

Whether investing in global or local healthcare companies, there are myriad options available in every country.

Ageing population

The population is ageing around the world. As one example, Australia’s over 65s population is expected to increase to 16.8% by 2022, which means even greater demand for health services in this country.

Growing demand overseas

As our population ages and becomes more wealthy, high-quality and specialist healthcare services are increasingly in demand.

Investment in digital health

Digital healthcare, also known as telehealth and eHealth, has seen substantial growth during the pandemic, and is expected to keep growng with the global market expected to be worth US$660 billion by 2025.

A sector worth exploring

The last few years have highlighted the importance of healthcare as the world came to grips with a global pandemic. As research and technology advance in this sector, we may see accelerated performance from these companies as a result of continued demand.

How have healthcare stocks performed historically?

Despite the uncertainty and volatility of the last few years, there are several reasons to be hopeful about healthcare. For example, the value of Australian healthcare stocks has risen by a massive 500% in the last 10 years, outperforming the ASX 200 index by 150%. Global healthcare stocks have also seen growth over the last decade.

COVID-19 disruptions

While healthcare stocks have fared much better than other areas of the market, the health industry has not been immune to the impact of COVID-19. Many surgical procedures and non-essential treatment in hospitals were cancelled in 2020 and 2021. As a result, hospital companies, insurers and suppliers, such as medical equipment companies, were hit hard.

Not all areas of the healthcare sector have been as negatively affected by COVID-19. Pharmaceutical companies have still generally been able to get their prescriptions out and provide critical treatments for illnesses, such as cancer therapy.

Biotech advances

In the late ‘90s, biotech went through a boom-bust cycle similar to the tech sector. However, huge advances in biotechnology have led to improvements in the performance of the healthcare sector. Thanks to significant advancements in understanding diseases, less strict regulation and greater competition, biotech is now considered a very reliable area for economic growth.

Ageing population

Overall, one of healthcare’s primary reasons for growth remains intact: the population continues to age. With Australia as one example, in 2017, there were 3.8 million Australians aged 65 or older, which represents an increase of 1.3 million since 1977. That number is only expected to grow.

People are living longer, which means they will need to use health services, facilities and access insurance for longer.

What are the benefits of investing in healthcare stocks?

Diversity

The breadth and diversity of the healthcare sector make it an attractive place for trading and investing. Investing in a number of healthcare stocks can allow you to build a more diversified portfolio to reduce the risk of losing everything when the unexpected occurs.

With the healthcare sector, you can diversify your investments in many different ways. Take, for example, the medical equipment industry. It includes a wide range of products and services ranging from surgical masks and bandages to diagnostic equipment.

There are many other areas of investment with different growth profiles and returns, including biotechnology, health insurance and pharmaceutical companies.

Viability of the industry itself

In addition, several companies in the healthcare sector are growing earnings well above the average of the ASX 200. Unlike many other areas of the economy, they also tend to fare well during times of political and economic uncertainty, such as during the US presidential election or China’s bans on Australian exports.

Investment opportunities

Moreover, there are numerous investment opportunities in healthcare, from genetic research to better medical products and health services. Similar to investing in tech, the healthcare sector is often at the forefront of innovation. For instance, virtual healthcare services have become increasingly common since the emergence of COVID-19.

Tip: Make sure you put in the time to research before investing and consider diversifying your holdings with investment vehicles such as ETFs.

Positive difference

There is another benefit to investing in the healthcare sector. It is an opportunity to make a positive difference and if you plan properly, socially responsible investing can still be very profitable. If this is an aspect of investing that is important to you, consider investing in healthcare sector companies that are dedicated to having a lasting impact on society.

What risks are involved in investing in healthcare stocks?

There are risks to investing in any kind of stock, even healthcare stocks.

Healthcare is highly regulated

Some areas of the healthcare sector, such as pharmaceutical and medical equipment companies, are highly regulated by the government. If there are regulatory changes, it can affect a healthcare stock’s growth prospects.

Some areas of the healthcare sector, such as pharmaceutical and medical equipment companies, are highly regulated by the government. If there are regulatory changes, it can affect a healthcare stock’s growth prospects.

Litigation risk

Some health stocks face litigation risk. For instance, pharmaceutical companies and healthcare providers can be sued if a patient believes their products or services have caused them harm.

It can be beneficial to have a good understanding of the industry

Biotech and pharmaceutical firms can require a good understanding of their medical developments before it would be wise to invest in their stocks. This is because these businesses often spend a significant amount of revenue on research and development, and their results are far from guaranteed with 90% of drugs failing clinical trials.

As a result, it is often necessary to have a good understanding of the underlying condition that a specific drug treats, the number of people the condition affects and the availability of the product.

Competition

While the industry has good overall growth potential, competition between companies regularly leads to consolidation, which can cause pricing and profits to fall.

Tip: Investing in biotech stocks can be lucrative. If you watch a company’s stock price as they successfully launch a new product, you may spot a rise in their share price.

What is next for healthcare stocks?

The healthcare sector is expanding at a faster rate than the economy as a whole so there is a lot of growth potential for healthcare stocks.

Healthcare stocks are traditionally part of an investment category known as defensive stocks. This means that they provide consistent returns, regardless of what state the general economy is in. However, that does not mean it is guaranteed to grow. When investing in healthcare, you should keep the following trends in mind:

- An ageing population

- Advances in treatment allowing people to live longer

- Advances in biotechnology

- Government regulation

- Introduction and growth of medicinal cannabis treatments.

While there has been a lot of focus on the treatment and prevention of COVID-19 — a factor worth keeping in mind when investing — the broader outlook for the healthcare sector remains strong. Stocks have continued to outperform the market, even during times of social and political uncertainty.

Researching the history and future potential of a stock is important in helping you to be wise in your investments.

Who are the big players in healthcare stocks?

There are so many popular healthcare stocks, medical companies and medical development stocks that you could invest in. From renowned international brands to global leaders in medical technology, there is a diverse range of companies you can be involved in through stock trading. Some of the most popular stocks are:

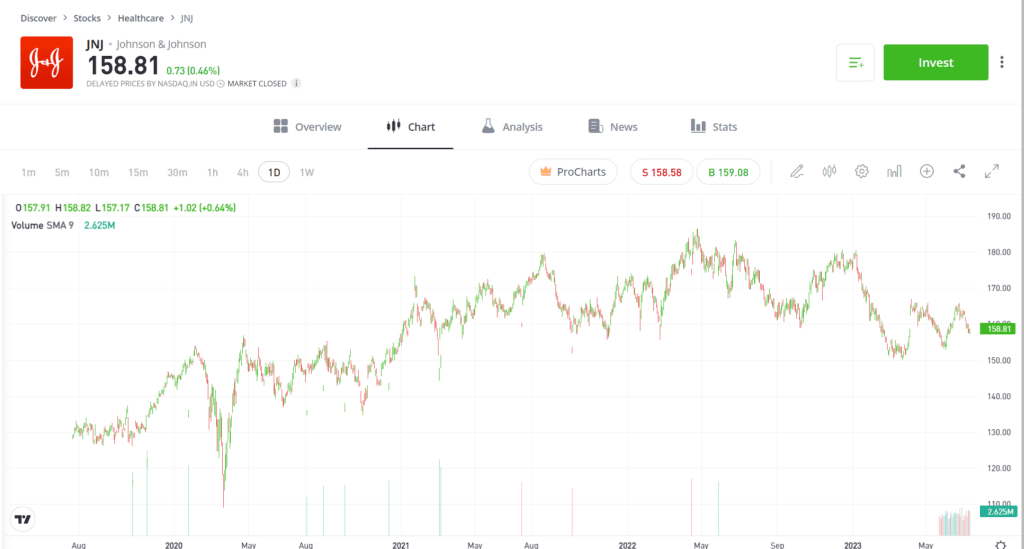

Johnson & Johnson (JNJ)

Past performance is not an indication of future results

- Johnson & Johnson researches, develops, manufactures and sells consumer health products, pharmaceuticals and medical devices, including Johnson and Aveeno baby brands, Listerine and Band-Aid.

- It was founded in 1886 in New Brunswick, New Jersey and hit all-time highs in June 2022.

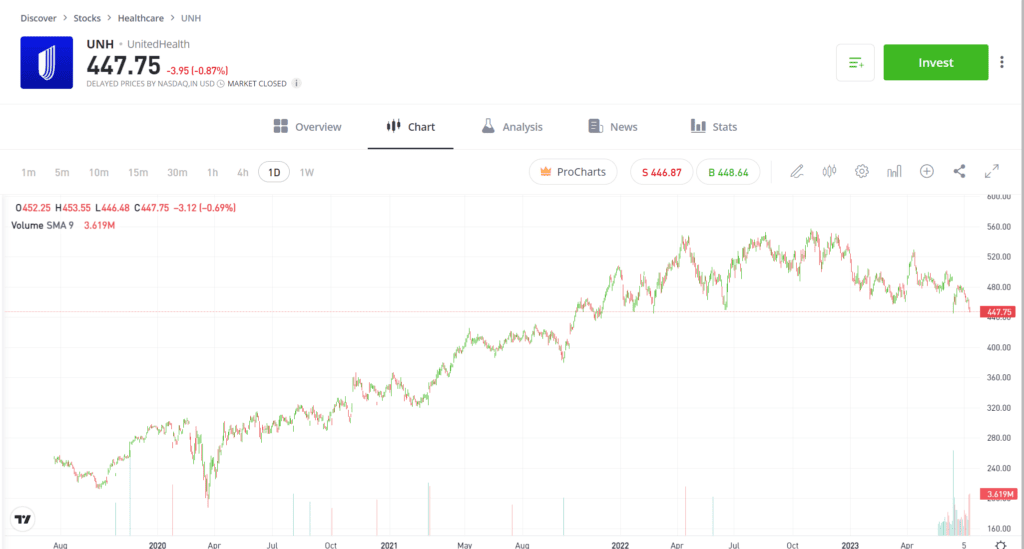

UnitedHealth Group Inc. (UNH)

Past performance is not an indication of future results

- UnitedHealth Group Incorporated is a diversified healthcare company based in the US.

- It operates in four areas: UnitedHealthcare, OptumHealth, OptumInsight and OptumRx.

- The share price rose to an all-time high in October 2022.

Abbott Laboratories (ABT)

Past performance is not an indication of future results

- Abbott Laboratories was founded in 1888 in Chicago and discovers, develops, manufactures and sells healthcare products around the world.

- It operates in four areas: diagnostic products, established pharmaceutical products, nutritional products and medical devices.

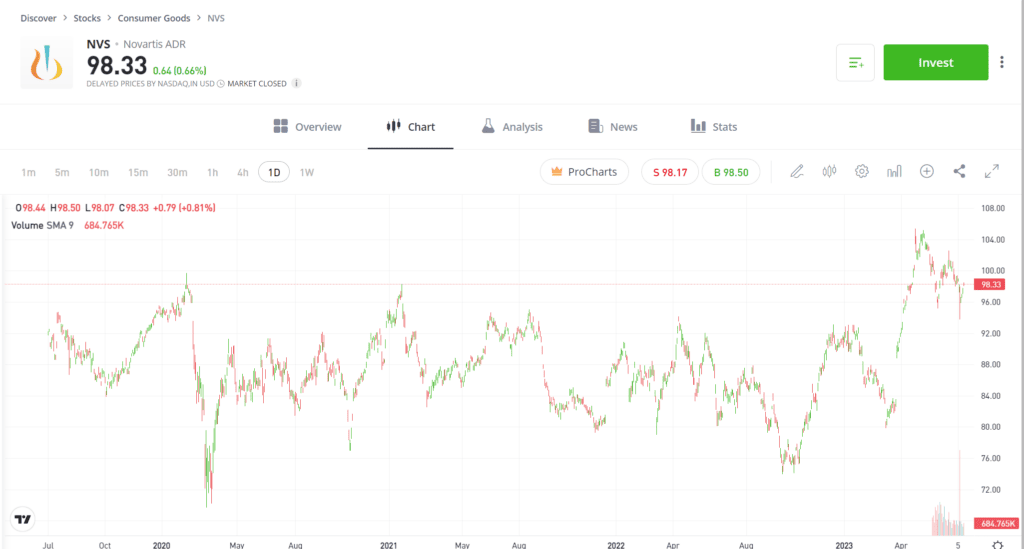

Novartis (NVS)

Past performance is not an indication of future results

- Novartis AG is a Swiss-based healthcare products researcher, developer, manufacturer and marketer.

- The company operates across two segments — Innovative Medicines and Sandoz, which includes providing prescription medicines, active pharmaceutical ingredients, antibiotics and other biotechnology-based products..

Eli Lilly and Company (LLY)

Past performance is not an indication of future results

- Eli Lilly and Company discovers, develops, manufactures and markets human pharmaceutical products.

- Its products include treatment for severe hypoglycemia, diabetes, type 2 diabetes, cancers, malignant pleural mesothelioma, and more.

Above statistics accurate as of April 26, 2023.

Due to its magnitude and diversity, the healthcare sector can be a good area for investment, but it is important to remember that it does not come without challenges.

Visit the eToro Academy to build your investing knowledge.

FAQs

- What unique risks does the healthcare sector face?

-

The healthcare sector faces a variety of unique risks, from the effects of changes in government policy and product legality to the rigorous drug approval process. These risks can make or break companies, influencing their long term success or failure.

- Are healthcare stocks defensive?

-

Historically, healthcare stocks have been considered a defensive stock option as there is a continuous demand for the industry’s products, regardless of market conditions.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.