Course Start Investing with Nas Daily & eToro

Course Advanced Aspects of Trading: Harnessing Technical and Fundamental Analysis

Course Investing Techniques

Course Dividend Investing Strategies

Course Invest in Commodities

Course Stock Investing Strategies

Course Macroeconomics

Course Investing 101

New Copy Trading vs Mirror Trading

Hedge Funds Explained

Investing in Bond ETFs

Using Stock Screeners

How To Invest in Bonds

How To Read Financial Reports

Microeconomics for Traders & Investors

How To Measure Portfolio Performance

Understanding Tax on Investments

Guide to Tax-Efficient Investing

Alpha and Beta Investing

Tax-Efficient Investment Strategies

Cash ISA vs Stocks & Shares ISA

Using AI for Analysis and Strategy

A Guide to Cash ISAs

Building Generational Wealth

What Are Tokenized Stocks

Target Date Funds Explained

Financial Independence Retire Early (FIRE)

Understanding Fractional Shares

Market Corrections: Strategies for Investors

Invest In Quantum Computing Stocks

How To Invest in Quantum Computing

Saving To Invest: A Practical Guide to Financial Growth

Managed ISAs vs DIY Investment ISAs

The Money Challenge

Cash Isn’t King

Fixed Income

Recurring Investment Strategies

What Are Recurring Investments?

Stocks and Shares ISAs Explained

eToro’s 2026 Investment Hotlist

The Importance of Rebalancing Your Portfolio

Bonds and Fixed-Income Investments

Understanding Delisting of Assets

Investing Techniques: Course Summary

Dollar Cost Averaging

Deciphering Divergences

The Buy-and-Hold Investment Strategy

The Compounding Effect

Exploring Alternative Investments

Understanding Behavioural Finance

Dividend Investing Strategies: Course Summary

Creating a Dividend Investing Strategy

How to Build a Dividend Portfolio

Dividend Funds vs Dividend Stocks

How to Identify Dividend Stocks

What Is Dividend Yield?

How Do Dividends Stocks Work?

Creating Core-Satellite Portfolios

A Guide to the Consumer Price Index (CPI)

Guide to Capital Gains Tax in Denmark

Guide to Capital Gains Tax in Germany

Guide to Capital Gains Tax (CGT) in Spain

Guide to Capital Gains Tax in Portugal

Guide to Capital Gains Tax in Switzerland

Guide to Capital Gains Tax in Norway

Guide to Capital Gains Tax in Sweden

Guide to Capital Gains Tax in Austria

Guide to Capital Gains Tax in France

What Is Tax Harvesting?

Guide to Capital Gains Tax in Italy

Introduction to Event-Driven Investing

What Is an IPO and How To Invest in One

Long-Term S&P 500 Investment Strategies

Guide to UK Capital Gains Tax (CGT)

Tax on Capital Gains in the Netherlands

How To Build a Watchlist

Understanding Retained Earnings

Get to know the S&P 500 Index

What is an ETF?

Invest in Commodities: Course Summary

How to Invest in Energy Commodities

Investing in Renewable Energy Stocks

A Beginner’s Guide to Investing in Silver

A Beginner’s Guide to Investing in Gold

Investing in Agricultural Commodities

Beginner’s Guide to Investing in Precious Metals

What Affects Commodity Prices?

An Investor’s Guide to Commodity Stocks

Stock Investing Strategies: Course Summary

Understanding Fundamental Analysis

Passive and Dividend Investment Strategies

How To Develop a Value Investing Strategy

| Value investing focuses on capitalising on undervalued stocks. Follow this guide to learn how to start value investing. |

Understanding Multiples and Ratios in Trading

Investment Strategies Explained

The 3 financial reports

Discover the Benefits of ETF Investing

What is Hedging

How to Develop a Growth Investing Strategy

Economic Cycle: Stock Sectors and Factors

Economic Factors and How To Measure Them

Macro Matters: Importance of Macroeconomics

Macroeconomics: Course Summary

Market and Economic Cycles: How They Work

Regional Characteristics of Macroeconomics

What Is Macroeconomics?

How to Build Your Portfolio in 5 Steps

Discover Your Investor Type

Building a Balanced Investment Portfolio

Building Your Portfolio: Course Summary

What You Need to Know About Commodity ETFs

Five REIT Types and Which to Invest In

Growth vs Value Stocks

A Guide to Momentum Trading & Investing

Investing 101: Course Summary

How to Choose What Asset Class to Invest In

Why Should I Start Investing?

Psychology of Investing

Investment Terms You Need To Know

5 Golden Rules of Investing

What Are Financial Years and Fiscal Quarters?

How to Manage Risk

How to Build Your Portfolio

The Psychology Behind Investing

Trading vs Investing

Which Asset Class to Invest In?

The 5 Golden Rules of Investing

Investment Terms You Need to Know

Why should you consider investing?

Guide to Fixed-Income Investments

Understanding Stock Gapping – A Guide For Traders

How To Invest in Stocks

eToro’s Popular Investors program

Becoming a Popular Investor on eToro

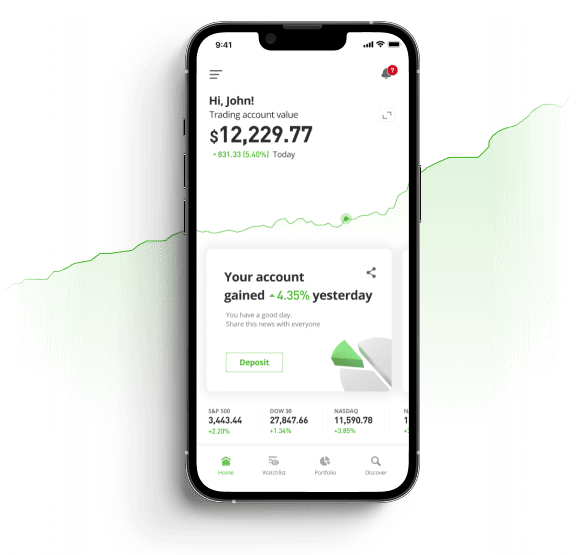

What You Get When Investing On eToro

Assets Under Management: A Guide

Getting Started On eToro – Part 1

Starting Your Investing Journey

What to Know When Starting to Invest

Tools For Experienced Investors

What type of investor are you?

Trading disruptions

ESG Investing: What Is It All About?

What is Thematic Investing?

Financial Independence

Money Markets vs Capital Markets

Bull vs Bear Markets

What Are Dividends?

Institutional vs. Retail Investors

How to Calculate Return on Investment

9 Portfolio Strategies to Protect Your Portfolio

How to Build A Diversified Investment Portfolio

Ethical Investing Methods: SRI, ESG and Impact

Stock Trading And Investing For Beginners

How to Buy and Trade Gold

Investing vs Trading — The Differences

How to Manage Risk as a Trader or Investor

Ready to get started?

Open your investment account today and put your newfound knowledge to work. Registration is free!