Climate change – which can be defined as the rise in global temperatures accelerated by human-induced emissions of greenhouse gases and the resulting large-scale shifts in weather patterns – is one of the biggest challenges the world faces today.

Over the last century, humans have had an unprecedented impact on the earth’s climate system and caused an enormous amount of change. Even worse, this change is now having worrying repercussions. Not only is it increasing the frequency and intensity of extreme weather events such as floods, storms, wildfires and droughts, but it is also affecting a wide range of natural ecosystems and accelerating the extinction of a wide range of species. It’s affecting every single country and disrupting economies and lives in the process.

Government action to combat climate change

In recent decades, governments around the world have acknowledged that to mitigate climate change, greenhouse gas emissions need to be reduced. With that in mind they have worked together to decarbonise the economy.

The first agreement between countries to mandate reductions in greenhouse gas emissions was the Kyoto Protocol, which was completed in Kyoto, Japan in 1997 and came into force in 2005. This requires industrialised countries and economies in transition to limit and reduce greenhouse gas emissions in accordance with agreed individual targets. Nearly all nations have now agreed to this treaty, with the notable exception of the US.

More recently, we have seen the Paris Agreement come into force. This is a legally-binding international treaty on climate change that aims to limit global warming to well below two degrees Celsius above pre-industrial levels. The emission goals of the Paris Agreement require all parties to reduce their carbon footprints by more than 50% by 2030 and eliminate them by 2050. This treaty was adopted by 196 parties in December 2015 at the United Nations Climate Change Conference (COP 21) in Paris.

Individual countries have also introduced carbon taxes in an effort to combat climate change. These taxes are intended to make the ‘hidden’ costs of carbon emissions more visible. Finland was the first country to introduce a carbon tax in 1990. Since then, 18 other European countries have followed. Currently, Sweden has the highest carbon tax rate.

Additionally, we have seen major climate change campaigns from non-governmental organisations in recent years, with Race To Zero being a very good example. This is a global campaign launched by top climate change experts. Its goal is to gain support from businesses, cities, regions, and investors in order to achieve a zero-carbon recovery that prevents future threats and unlocks inclusive, sustainable growth.

Where are greenhouse gas emissions coming from?

It’s clear that to combat climate change, we need to rapidly reduce greenhouse gas emissions globally. However, to do this, we first need to understand where the emissions are coming from.

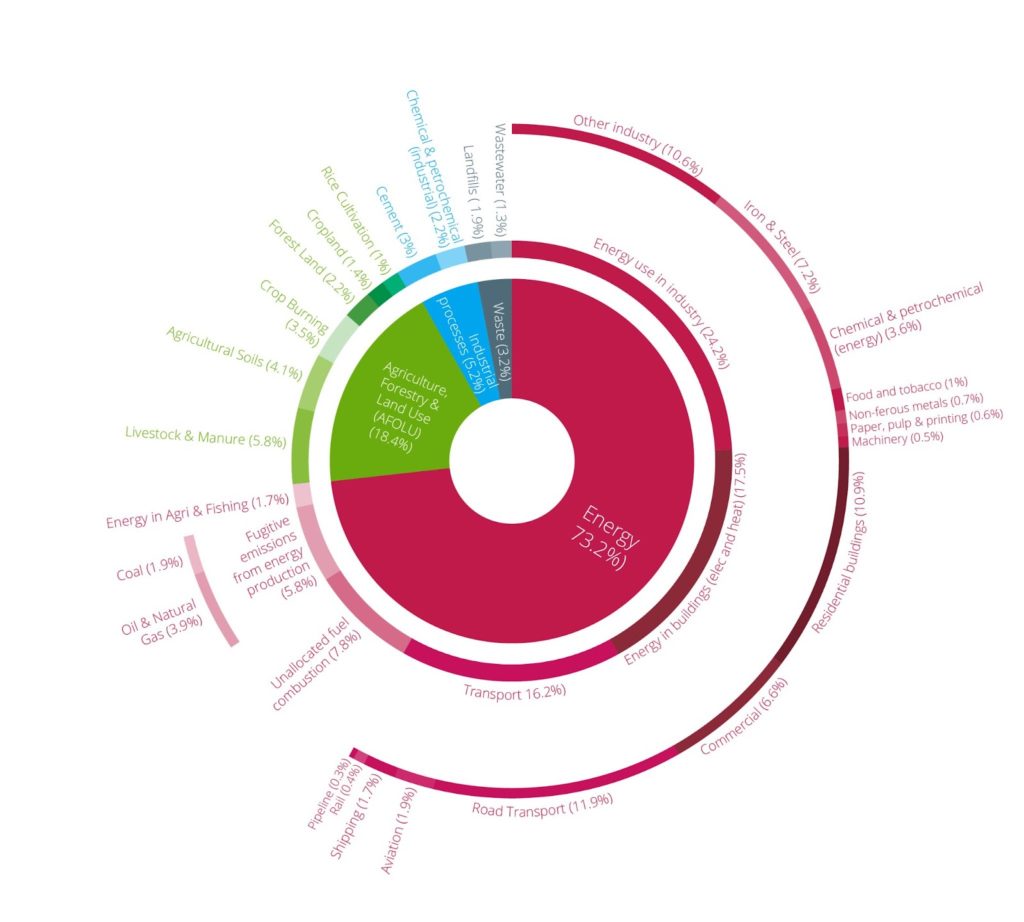

The chart below provides some insight into this matter, showing the breakdown of global greenhouse gas emissions in 2016.

Source1

From this chart, we can see that almost three-quarters of emissions come from the energy sector. Within the energy sector, transport is responsible for 16.2% of emissions and within transport, road transport (cars, trucks, lorries, motorcycles, and buses) is responsible for about 11.9% of emissions. Around 60% of road transport emissions come from passenger travel while the remaining 40% is from road freight.

The chart also shows that almost one-fifth of global emissions are from agriculture, forestry, and land use. Here, livestock and manure are the largest contributors to emissions at 5.8% of total emissions. The reason agriculture makes such a large contribution to emissions is that animals like cows and sheep produce greenhouse gases when their digestive systems break down food. So, the production of beef and lamb tends to have a high carbon footprint.

Overall, it’s clear from this chart that there are two main industries responsible for the majority of global greenhouse gas emissions. With governments and companies facing pressure to change their behaviours in order to stop climate change, we can expect to see plenty of disruption in these industries in the years ahead.

The opportunity to invest in green companies

With climate change being such an important issue, companies all over the world are racing to develop innovative solutions that can help decarbonise the global economy. Right now, a tidal wave of investment from the private sector is flowing into cutting-edge technological solutions that enhance sustainability, from renewable energy technology to plant-based meat. This is creating lucrative opportunities for private investors. The companies finding genuine solutions to climate change are generating strong investment returns.

Those interested in investing in climate change solutions may want to consider some of eToro’s Smart Portfolios. Three portfolios that contain exposure to companies developing sustainable solutions include:

The RenewableEnergy Smart Portfolio

The RenewableEnergy Smart Portfolio allocates capital to companies that are striving to develop more sustainable energy solutions. It provides exposure to leading renewable energy companies that use clean sources of energy such as solar, wind, and hydrogen, as well as companies developing the technologies behind the systems used for renewable energy production.

The global renewable energy market looks set for strong growth in the years ahead due to the fact that the carbon footprint of solar, wind, and hydrogen power is many times lower than that of fossil fuel power. By 2025, the market is forecast to be worth around $1.5 trillion, up from $928 billion in 2017.2 The industry is expected to grow the fastest in the Asia Pacific region, however, there are likely to be opportunities globally.

The Driverless Smart Portfolio

EToro’s Driverless Smart Portfolio provides exposure to companies developing autonomous vehicles and electric vehicles (EVs). With this portfolio, investors can gain exposure to the businesses that are helping the automotive industry become more sustainable.

Both electric vehicles and autonomous vehicles will help fight climate change in the years ahead. Electric vehicles produce zero direct emissions. This means that they can significantly improve air quality in urban areas. If the whole road transport sector went electric, we could potentially reduce global emissions by nearly 12%.

Because there is so much focus on sustainability right now, the electric vehicle market is growing rapidly. Last year, global EV sales rose by 43%3 to 3.2 million, despite the fact that overall car sales declined by 16% due to the coronavirus pandemic.

Looking ahead, we can expect the market for electric cars, buses, trucks, and other vehicles to continue growing at a rapid clip. One reason for this is that governments across the world are ramping up the pressure on automakers to stop producing traditional combustion-engine vehicles. Norway, for example, plans to phase-out sales of fossil-fuel vehicles by 2025. Meanwhile, Japan’s government has decided that all new vehicles must be hybrids or fully electric by the mid-2030s.

Autonomous vehicles will also play a role in combating climate change. As driverless technology becomes mainstream, we are likely to see companies offer ‘mobility as a service.’ This is likely to dramatically change the car ownership model and have a profound impact on urban efficiency. This, in turn, will reduce emissions significantly.

The FoodTech Smart Portfolio

The FoodTech Smart Portfolio allocates capital to companies that are helping to transform the food industry and make it more sustainable. It provides exposure to companies engaged in food innovation (i.e. plant-based meat), farming innovation (growing more with less), waste reduction, and supply-chain innovation.

In a quest to produce more food for the rising global population, the food industry has often disregarded the environment in the past. Today, food production is pushing the world to its natural limits. Mass meat production, for example, is one of the main causes of climate change. To protect the environment for future generations, food production needs to become far more sustainable. Many companies are working on innovative solutions at present.

In conclusion, all of these Smart Portfolios have an eco-friendly bias. All three offer investors the chance to position their portfolios to benefit from the long-term growth of companies developing sustainable solutions that will help the world reduce emissions and fight climate change.

Sources:

- https://ourworldindata.org/emissions-by-sector

- https://www.alliedmarketresearch.com/renewable-energy-market

- https://www.theguardian.com/environment/2021/jan/19/global-sales-of-electric-cars-accelerate-fast-in-2020-despite-covid-pandemic

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Smart Portfolios is a portfolio management product, provided by eToro Europe Ltd., which is authorised and regulated by the Cyprus Securities and Exchange Commission.

Smart Portfolios should not be considered as exchange traded funds, nor as hedge funds.

FCA: Smart Portfolios is a product that may include CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.