Currencies are definitely making the headlines, but they are also becoming increasingly popular among traders. Why? It’s because currencies are experiencing extreme volatility, which can bring significant price moves. This can be advantageous to those traders that are sitting on the right side of the trade. In this article, we’ll explore currencies, the drivers moving them and how you could capitalise off of these big moves.

The history of currencies

It’s generally agreed that money in some form or another has been around for at least 5000 years. Before that time, a system of bartering took place, your fish for my wheat. Deal. But creating a single vehicle by which people could buy and sell became an obvious necessity.

There are currently 180 currencies circulating in 197 countries and many of them, for reasons which we will cover later in this article, are now volatile, meaning susceptible to major movements in value. This can be good if you are on the right side of the fence.

Currency exchange is more than just a trading tool or a way to get cash for your trip to a foreign destination, it’s also an area that is very sensitive for international companies that do deals abroad. Here’s an example: If you’re an American car manufacturer and you’re selling cars to Turkey, and therefore being paid in the local currency, the Turkish Lira, then you’re accepting a weaker currency, while your USD is getting stronger. This lowers your profit margin for sales in that particular market. If your currency however is weak, you can be getting a whole load more by transacting with another country whose currency is stronger.

The currency market, or as it is commonly known, the Forex market, which stands for Foreign Exchange market, is the most active area of trading today with over $6.6 trillion dollars passing through it daily. That means a lot of liquidity, which means low costs and minimal pricing gaps.

The most liquid currencies are called the majors. These include the USD, EUR, GBP (British Pound), JPY (Japanese Yen) and CHF (Swiss Franc). They are the most commonly traded ones. So why is everyone focusing on currencies now?

The great market instability

Inflation

Let’s be honest, these days the global economic situation is not at its best. Two years of COVID-19, during which time plenty of governments printed additional money (stimulus) in order to help their citizens, led to many losing their jobs or not being paid during lockdowns. While this stimulus did provide momentary relief, it created a problem for the long-term, as there is now more money in circulation versus the, more or less, same demand. This is known as inflation, and it is what has caused a number of currencies to lose value.

When there is demand for any product, its value rises. Once that product appears on the market (think $OIL), buyers have more options and sources from which they can obtain it as supply increases, and that makes its value decrease. The situation is the same when it comes to money.

Generally speaking if there is inflation in a country, it can devalue the currency there since inflation can mean a decrease in buying power, eg. things cost more, so your money doesn’t stretch as far. For that reason, countries experiencing high inflation can see their currencies weaken relative to other currencies.

Geopolitical driver

Following the COVID-19 pandemic, the world was hit by another major crisis when Russia invaded Ukraine on February 24th, 2022. As a massive producer of gas, certain metals, and other products, Russia has played a large role in the global market. All that ended after countries around the world stopped trade with and introduced sanctions against Russia. The immediate consequences of this move, and moves against Russia that followed have led to long-term consequences, which are still largely unknown, however it is suspected that they could be catastrophic for the state of the global economy. The invasion caused major price swings and volatility in the EUR, due to the proximity of the Eurozone, investor sentiment and to the fact that Russia, a major supplier of Oil and Natural Gas might retaliate to sanctions by cutting off the much needed energy supplies the Eurozone was so reliant on. Meanwhile, the Russian ruble, as you might expect, has experienced high volatility but has since recovered. It is also worth noting that during periods of uncertainty and risk, investors will flock to safe havens. The USD, as the world’s reserve currency, has experienced massive inflows this year because investors want safer places to invest.

Oil and Inflation

Oil and energy prices were greatly impacted by the invasion too, with the repercussions being felt across the globe. Oil and energy make up a constituent of the CPI index, (the consumer price index), which shows us whether inflation is cooling down or heating up. Therefore, high oil prices have the power to push inflation higher, thus impacting global currencies.

The important part to take away from that, is that all of this has made the economies of the world even more unstable, and that has been reflected in the state of currencies, as well.

Which currencies to focus on?

The USD

You may have noticed that the USD is pretty much the only currency that is seeing a sharp rise in value at the time of writing, and the dollar index (a basket of currencies pitted against the dollar) hit a fresh 20-year high in the aftermath of the latest Federal Reserve Bank (the USA’s central banking system, commonly referred to as the Fed) rate hike. Fed rate hikes are helping boost the value of the USD as investors feel confident that the Fed will go to great lengths to support the US economy. This led to the USD becoming more valuable than the EUR for the first time in years.

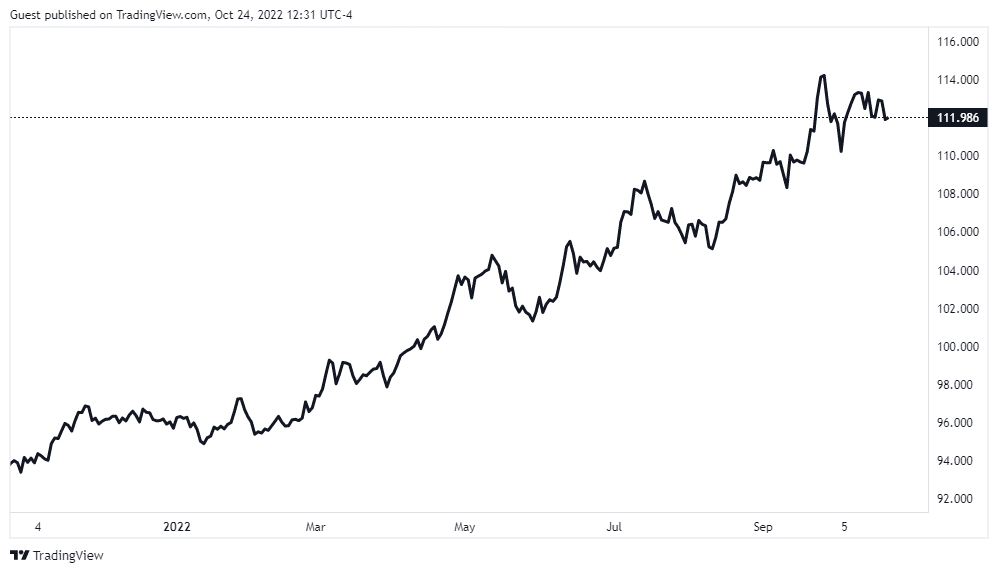

Take a look at the USD Index 1-year chart, which shows a rise of over 20% in 1 year. The last year has been kind to the USD. That’s also due to a very hawkish Fed, which is aggressively trying to tackle inflation by raising interest rates to support the economy.

U.S. Dollar Currency Index

Past performance is not an indication of future results. 5-year performance: 18%

The EUR

Meanwhile, the Fed’s policy impacted the EUR too, because the Fed was much more aggressive in its stance, hiking rates more hawkishly than the European Central Bank (ECB), which led to a further weakening of the euro to the dollar. The war in Ukraine and instability it caused also brought weakness to the entire region and specifically to the EUR, due in part to the eurozone’s proximity to Russia and the Ukraine and to the fact that Russia could cut off energy supplies to the Eurozone.

The GBP

The UK has had its fair share of problems, from instability in the Government, to a cost of living crisis, which is weighing on activity, and could potentially lead to a recession, as well as energy prices getting out of hand for consumers. This led to the GBP reaching 38-year lows against the USD and hitting parity with the EUR.

The JPY

Meanwhile, in Japan, the central bank had not intervened in the monetary policy in 24-years, that was until the JPY hit a record low against the USD. Since then the JPY has moved to a 32-year low. The Bank of Japan (BOJ) finally took action in raising interest rates, however they are far lower than in the US. It took a very divergent approach to the other central banks and this dramatic weakness in the currency is a result of that.

What can you do in this situation?

As long as you understand what moves the various currencies, you can dive into the market. You now understand that the USD has been soaring on the back of a very hawkish Fed, while the opposite is true in JPY. If we take this one step further, what could we expect to see after a rate hike in the US, Japan or even the UK?

Well, it depends on whether reality meets expectations. For instance, if the markets are expecting a 0.75% rate hike and the central bank, no matter which one, only gives a 0.50% hike, then history shows that often (but not always) the local currency drops. Likewise, we have seen that aggressive rate hikes have been appreciated by the markets, prompting investors to buy the local currency. This buying pressure in turn pushes up the value of the currency.

There are certain factors that can move currency prices and if you understand these, then you can make more powerful trading decisions. These include:

- Geopolitical drivers

- The economic stability of the country

- The global economy

- Economic events and central bank policies

Diversification

Here at eToro, we are always emphasising diversification and believe me, it’s more than just a pretty word. Diversification is a way to spread yourself across regions, sectors and markets so you reduce your risk when compared to having all your capital allocated to one region, currency or asset class. The ‘all eggs in one basket’ phrase is really overused but does apply here. As such, currencies could be a good way for you to gain exposure to other regions as part of your diversification strategy.

The Bottom Line

As a currency trader, you can take advantage of central bank interventions to trade different currencies.

There are many benefits of trading currencies. The currency market is highly accessible, particularly through our intuitive platform, and it doesn’t require a high barrier to entry, which makes this area of trading suitable for beginners or more experienced traders. Currencies can be a highly liquid area of the financial markets, which means that often the real costs (spreads) associated with trading them are lower. Traders can use leverage to trade currencies, which allows you to reduce the margin required to open a position, allowing you to free up capital for other investments.

Additionally, the currency market is open 24 hours a day (apart from weekends), and so there is nearly always a market to trade from the Asian overnight, to the morning European session and then the US session.

There are opportunities for those who know how to take advantage of them and that’s where we come in with our in-depth educational resources, our webinars and videos and of course access to all the major and some more exotic currencies. Take advantage of currency trading with eToro today.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.