Experienced traders often fail to get the most out of their funds.

Experienced traders recognise the need to diversify their portfolios and invest in a wide range of assets, balancing their higher risk trades with lower risk investments. Most of the traders that I know want to maintain a high level of control over each investment and retain the ability to react to real time market changes. They practice additional risk management by investing cautiously, only placing a small amount of their equity in individual trades.

This careful application of risk management and close focus on individual trades can definitely help to reduce losses, regardless of whether you’re trading long/short strategies, using one or two instruments for trading and trying to predict the market direction, or systematically building a wide and diversified portfolio. One issue that many traders aren’t aware of is that they are only investing a small proportion of their equity (account balance) at any given time.

Uninvested equity is basically unexploited wealth (especially now, when global interest rates are effectively negative). It used to be possible to put your money in a savings account with your local bank and basically forget about it, expecting a small return every year. These days, traders need a more creative and energetic approach to money management; ‘warehoused money’ won’t grow. Dormant funds left in old fashioned financial institutions may even be reduced by account charges. Traders need to take a wider view and consider the potential gains from their entire funds, rather than just their invested funds.

Can you make your non-invested account balance work for you?

One way to utilise dormant funds is to invest them in copy trades. You can set your account to automatically copy any trader or Popular Investor at a ratio that suits your budget and risk level. Whenever they open or close a trade your account will do the same. You can apply a high level of risk management by carefully analysing each Popular Investor’s Stats, risk level and by talking to them personally. Set the Copy Stop Loss tool to automatically halt any copy trade that doesn’t meet your financial expectations.

One can use our Discover People Tool to find people to copy, and use 40%-60% from the uninvested balance to work for him. Not using all the equity in the account balance, deliberately leaving a cash reserve to enable to react to market movements.

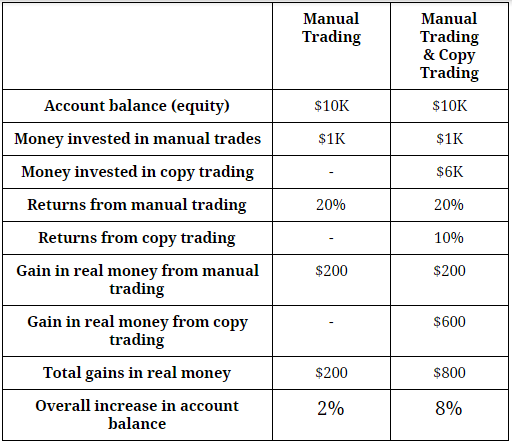

This is just one hypothetical example of how effective copy trading can utilise uninvested account balance. To use copy trading as an investment strategy you have to take the time to analyse the trading and goals of the people you want to copy – and be prepared to take some losses along the way. Many social traders recommend diversifying their People Portfolio in the same way that they diversify their manual trading portfolio.

Let’s see an example of how simple this can be:

You can also add Popular Investors to your Watchlists and monitor their performance until you are ready to copy them.