You don’t have to reinvent the wheel!

You should definitely conduct your own research and analysis before purchasing stocks. However, there are plenty of great tools that can enhance your investment decisions. We recently added three tools to the eToro platform which should benefit you.

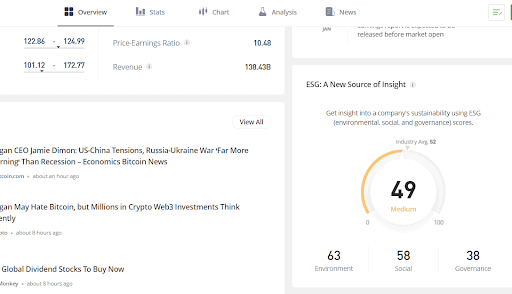

ESG scores

ESG is a growing trend in the investment world. How do we know? Consider this piece of data: The investment management industry claims that at least a third of their assets, around $35 trillion, are monitored according to ESG criteria.

ESG, which stands for Environment, Social and Governance, is a system for evaluating companies based on aset of indicators which can provide insights into the resilience of a company. Investors can use these categories to gain insights into the company which could not be ascertained from just looking at the revenues.

In partnership with ESG Book, we now showcase ESG scores for more than 2,700 stocks on our platform. You can find individual scores for each of ESG’s three components — environment, social and governance — as well as an overall score on each stock’s asset page in the overview tab.

You can use the score in a number of ways when deciding how to invest:

- The score can be a filter. If you care about environmental issues, then a low or a high E score can guide you toward stocks that align with your values.

- A low or high ESG score can give you insights into the resilience of a company. A low overall ESG score can serve as an alarm regarding a certain company. It can serve as a trigger to investigate the company further before deciding if it is a good investment for you.

- It is like looking under the hood of a car. A car may look good, even drive well, but before you purchase it, you may want to see what’s really going on. The S and G score will provide you insights into the culture of the company which may impact its performance in the long term.

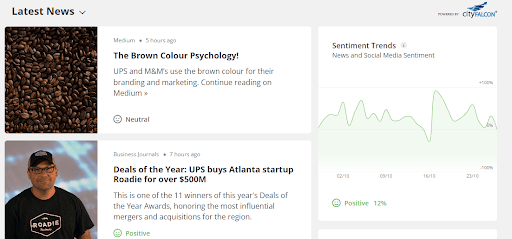

News Sentiment

Companies are affected by news reports. Negative reports can drive a company’s share price down; positive reports can send prices up. On each asset page, we have a news tab where you can see the latest stories written about the specific company. Teaming up with City Falcon, we now show the sentiment of each article. This means that when you scroll down on the news tab, each article will show a sentiment of positive, negative or neutral next to the title of the article. On the right-hand side of the page, you can see the sentiment trends for the past month as well as a sentiment score for each day.

Understanding the current sentiment towards companies ensures that you have one more tool which can give you a more complete picture of the company in question and help you make a better-informed investment decision.

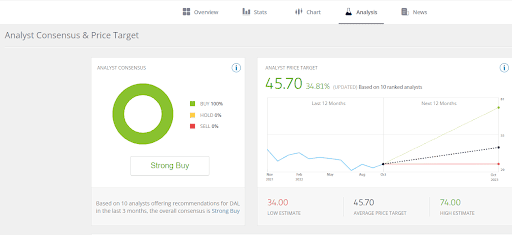

Analyst Consensus

Analyst consensus is another component that affects stock prices. Being aware of analyst consensus and price targets can better inform your investment decisions. On each stock page, there is a tab titled “Analysis” where you can see how analysts rate the stock; what they are writing about it; and the target price they provide for it. You can also find information on whether hedge fund managers are adding or reducing the stock in their portfolios and how corporate insiders are interacting with the asset.

The tools mentioned in this article allow you to tap into three areas that could affect the stock price. ESG provides a non-traditional analysis of a company’s resilience long term. News sentiment gives you the day-to-day outlook on how the company is being perceived and reported. Through analyst ratings, you can easily see how traditional analysts are predicting the future of an asset.

This content that will be discussed is intended for information and educational purposes only and should not be considered financial product advice or any recommendation.

EU Disclaimer: Your capital is at risk. This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.