Inflation is a topic that has dominated the financial news lately. With the world now reopening after the coronavirus pandemic, and cashed-up consumers unleashing pent-up demand, inflation is beginning to rise. In the US, inflation jumped 4.2% in April — the largest increase since September 2008. Investors are worried that higher inflation will force the world’s central banks to raise interest rates.

Inflation, a measure of price increases within an economy, and higher interest rates, can hurt an investment portfolio. Just look at what has happened to high-growth stocks since mid-February. The sharp pullback in this area of the market is almost entirely due to inflation concerns. This is because when interest rates rise, the present value of projected future earnings are worth less.

So, what can investors do to protect their portfolios from inflation? What are the assets that are likely to perform well during periods of rising inflation?

Oil: a key driver of inflation

Oil is one asset that can potentially provide protection against inflation. Oil and inflation are closely linked because the commodity is a key driver of inflation. Oil is the lifeblood of the global economy. It powers vehicles and planes, heats homes and buildings, produces electricity, and is used to make plastics, chemical products, and synthetic materials. When economic conditions are strong — as they are likely to be this year — demand for oil tends to rise, pushing its price up. This, in turn, pushes inflation up.

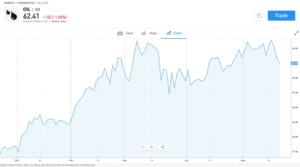

In 2021, the price of oil has climbed as coronavirus vaccines have been rolled out and economic activity has begun to pick up. In May, the price of WTI Light Crude Oil rose to $66 a barrel amid expectations of a surge in demand for the commodity later this year.

Oil prices may increase even more. According to the International Energy Agency (IEA), oil consumption is set to increase significantly in the second half of the year as the economy picks up speed. A report earlier this month stated: “As vaccination rates rise and mobility restrictions ease, global oil demand is set to soar from 93.1 million barrels per day in 1Q21 to 99.6 million barrels per day by year-end.” The IEA added that due to supply constraints from OPEC members, the ‘bloated’ oil inventories that built up during the pandemic have now returned to more normal levels.

When it comes to adding oil to your investment portfolio, there are a number of possible approaches.

- Open a direct position on the price of the oil itself through a Contract For Difference (CFD). A CFD is a financial instrument that allows you to capitalise on the price movements of an asset without actually owning it (i.e., a barrel of oil).

- Invest in oil-producing companies. Some examples include Exxon-Mobil, Royal Dutch Shell, and Chevron. Oil stocks tend to rise parallel to oil price increases, since higher oil prices translate to higher profits. With this approach, however, there is always some ‘stock-specific’ risk. One way of reducing this risk is to invest in an oil stock-focused exchange-traded fund (ETF) such as the SPDR S&P Oil & Gas Exploration & Production ETF. This ETF tracks the performance of US companies operating in the oil and gas exploration and production industries.

- Invest in eToro’s OilWorldWide Smart Portfolio. This is a fully allocated portfolio containing exposure to stocks of leading global companies involved in oil mining, exploration, and production and oil-related products, as well as oil stock-focused ETFs and oil futures. Similar to an ETF, it minimises stock-specific risk since capital is spread out over a wide range of companies. In addition, it also offers broader diversification through the combination of equities and direct asset exposure.

Gold: a hedge against inflation

Gold is another commodity which can be hedged against inflation. When prices are rising and the value of money is being eroded, investors tend to gravitate to ‘hard assets,’ such as gold, for protection. Gold is considered to have intrinsic value due to its finite supply. Unlike currencies, such as the US dollar and the euro, its supply cannot suddenly be increased significantly by central banks. So, it is often one of the better performing assets when investors are concerned about rising inflation.

After a period of weakness early in 2021, the price of gold has started to rise in recent months, breaking above a key resistance point of $1,800/oz. Concerns regarding inflation appear to be a key driver of the price increase.

It is worth noting that some experts have suggested that today’s macro environment closely resembles that of the 1970s — a decade when gold saw phenomenal price gains. During that time period, oil prices were rising, central banks were printing money, and there were high inflation expectations.

As with oil, there are a number of ways investors can obtain portfolio exposure to gold.

- Gain direct exposure to the price of gold through a long CFD position. If gold rises in price, the value of the CFD position will increase too.

- Invest through a gold-focused ETF, such as the SPDR Gold and the iShares Gold Trust.

- Invest in gold mining stocks. Gold miners tend to perform well when the price of gold is rising due to the fact that their profits are higher. However, like oil stocks, this approach introduces stock-specific risk, although that can be mitigated with a gold stock-focused ETF such as the VanEck Vectors Gold Miners ETF.

- Investors may also consider eToro’s GoldWorldWide Smart Portfolio. This is a fully allocated portfolio that provides exposure to a range of gold mining companies as well as gold ETFs.

Bank stocks

A third asset class to consider for protection against inflation and higher interest rates is bank stocks. Higher interest rates are generally positive for banks. That is because banks typically generate a large proportion of their income from the spread between borrowing rates and lending rates. Higher interest rates create the potential for larger spreads and higher profits.

In 2021, bank stocks outperformed the broader market (we highlighted the opportunity in bank stocks late last year). Many bank stocks, such as JP Morgan Chase, Wells Fargo, and Lloyds Banking Group are up more than 25% year to date (YTD). With the global economy picking up speed, however, there could be more upside in the cards. Investors looking for exposure to bank stocks may want to consider eToro’s TheBigBanks Smart Portfolio. This portfolio provides exposure to the 25 largest banks in the world, which means that it is less risky than owning individual bank stocks.