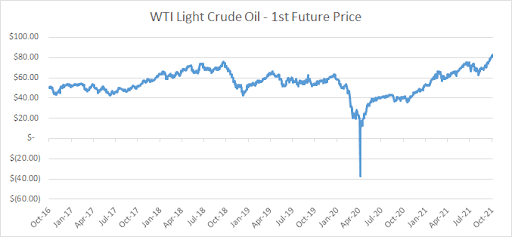

After crashing spectacularly last year during the early stages of the coronavirus pandemic, oil prices have bounced back and surged to multiyear highs in 2021. Recently, the price of WTI crude oil shot up past $80 per barrel — its highest level since 2014.

Can oil prices continue to rise from here? Many analysts believe they can. Right now, we appear to be in the midst of a global energy crisis. Here’s a look at what’s going on in the energy markets right now.

Why oil prices have exploded higher

The significant rise in oil prices that we have seen recently can ultimately be attributed to a massive supply and demand imbalance.

Last year, during the pandemic, oil demand plummeted. With most of the world on lockdown, there was much less need for the commodity. However, with planes now back in the sky and cars now back on the road, demand for oil is picking up again. According to the International Energy Agency (IEA), global oil consumption is set to rise by 5.5 million barrels per day this year and a further 3.3 million barrels per day next year1. It is worth noting that demand for oil has been boosted by the surge in natural gas prices, which has made oil a cheaper alternative for power generation. In the past, it made sense for the energy sector to use natural gas instead of oil because gas prices were very low. Today, however, it’s a different story.

The problem is, though, oil supply is very tight at present. One reason for this is that the Organization of the Petroleum Exporting Countries (OPEC) and its partners — which cut supply last year — have been slow to boost output this year. OPEC+ recently advised that it plans to increase production gradually in the near term, by a modest 400,000 barrels per day each month2. This is not nearly enough to meet demand.

A second reason is that adverse weather events have caused disruption in the oil market. Hurricane Ida in the US, for example, initially shut down 1.7 million barrels a day of oil production. Analysts believe that the total crude supply loss from the Category 4 storm could amount to 30 million barrels3.

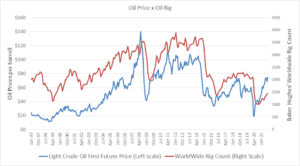

Another issue is that rig count remains low. Typically, the number of rigs in action increases as oil prices rise. However, looking at the latest data from oil field services company Baker Hughes, we can see that rig count has not increased at the same pace as oil prices recently.

Why is this? Well, it may have something to do with the fact that over the last 18 months, major oil producers have turned their attention to renewable energy. With climate change becoming a major focus for governments, businesses, consumers, and investors worldwide, oil giants have shifted their focus from fossil fuels to green energy, and pumped billions of dollars into clean energy projects.

In Europe, the likes of BP, Total, and Eni have made ambitious pledges to switch to renewable energy on the back of government initiatives such as the European Green Deal. These businesses no longer want to be known as oil companies. Instead, they want to be called “energy companies.” Meanwhile, in the US, oil giants such as Chevron and Exxon-Mobil are investing in new technologies such as “carbon capture,”, which aims to capture more than 90% of carbon dioxide (CO2) emissions from power plants and industrial facilities. This means that investments in new oil platforms and drilling rigs have not been made.

This move makes sense in the long-term as renewable energy appears to be the way forward. However, today, the world still very much runs on energy derived from fossil fuels, so the lack of investment in this space has created some serious supply issues.

Oil price forecasts: can oil rise to $100?

In the near term, many experts expect oil prices to remain high, especially if the coming winter in the Northern Hemisphere is cold.

Analysts at investment bank Goldman Sachs, for example, recently upgraded their year-end Brent crude oil price forecast to $90 per barrel, up from $80 per barrel, citing a faster-than-anticipated recovery in global demand.4

Meanwhile, analysts at JP Morgan recently said that oil could potentially go as high as $150–$200 per barrel. “We believe the evolution of coal prices might reflect supply, demand, cost of capital and energy transitioning issues for all fossil fuels, and it would certainly be possible that oil prices will follow the same pattern (inflation adjusted for oil, that would be in a $150–$200/bbl range),” wrote a team of JP Morgan analysts led by top market strategist Marko Kolanovic.5

It is worth pointing out that oil prices are notoriously hard to predict as there are many factors that can impact prices. So, these kinds of forecasts should be taken with a grain of salt.

However, if oil prices do remain high, there will be implications for the financial markets and investors. Inflation, for example, is likely to rise, hitting companies’ profits. So, it is worth thinking about the risks and opportunities now.

Investment opportunities in oil

Those who are bullish on oil may wish to consider a number of potential options:

- Open a direct position on the price of the oil itself through a Contract For Difference (CFD). A CFD is a financial instrument that allows you to capitalise on the price movements of an asset without actually owning it (i.e., a barrel of oil).

- Invest in oil-producing companies. Some examples here include Exxon-Mobil, Royal Dutch Shell, and Chevron. Oil stocks tend to rise when oil prices climb due to the fact that higher oil prices boost their profits. With energy stocks, however, there is always some “stock-specific” risk.

- Invest in an oil stock-focused exchange-traded fund (ETF) such as the SPDR S&P Oil & Gas Exploration & Production ETF. This ETF tracks the performance of US companies operating in the oil and gas exploration and production industries. This approach minimises stock-specific risk.

- Invest in eToro’s OilWorldWide Smart Portfolio. This is a fully allocated portfolio containing exposure to stocks of leading global companies involved in oil mining, exploration, and production and oil-related products, as well as oil stock-focused ETFs and oil futures. Similar to an ETF, it minimises stock-specific risk since capital is spread out over a wide range of companies. In addition, it also offers broader diversification through the combination of equities and direct asset exposure.

Clean energy is the future

While oil prices could have upside in the near term, long-term investors may also wish to think about investing in renewable energy.

Today, we are seeing a huge shift towards clean energy on the back of concerns over climate change and sustainability. By 2030, solar, wind, hydropower and other sustainable sources are expected to account for around half of our global energy mix6, compared to just 11% in 20197. This shift to green energy is likely to create some lucrative opportunities for investors.

Those interested in gaining exposure to clean energy may wish to consider eToro’s RenewableEnergy Smart Portfolio, which allocates capital to companies that are striving to develop more sustainable energy solutions. This portfolio provides exposure to a wide range of leading renewable energy companies that use clean sources of energy such as solar, wind, and hydrogen, as well as companies developing the technologies behind the systems used for renewable energy production.

Sources

- https://www.reuters.com/business/energy/oil-rises-expectation-high-natural-gas-drive-switch-heating-2021-10-14/

- https://www.reuters.com/business/energy/opec-seen-sticking-november-output-plans-despite-80-oil-2021-09-29/

- https://www.worldoil.com/news/2021/9/14/extra-opec-oil-production-canceled-out-by-hurricane-ida-outages

- https://www.worldoil.com/news/2021/9/22/goldman-sachs-projects-90-oil-if-winter-is-colder-than-normal

- https://www.foxbusiness.com/markets/oil-prices-200-barrel-possible-stocks-jpmorgan

- https://about.bnef.com/new-energy-outlook/

- https://ourworldindata.org/renewable-energy

Smart Portfolios is a product that may include CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results.

This communication is for information and educational purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments. This material has been prepared without taking any particular recipient’s investment objectives or financial situation into account, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.