Environmental, social, and governance (ESG) investing sounds like a simple concept: invest in companies with sustainable practices, and hopefully generate some good returns.

But, in reality, ESG is having something of an identity crisis. Is it a way to invest ethically? A filter for well-run companies? A cheat code for above-average portfolio performance?

This year, the answer is becoming clear: it’s none of the above. There have been accusations of greenwashing and public spats over the subjectivity of ESG guidelines. Last quarter, US-based ESG funds encountered their first outflows in more than five years. Pull the performance stats, and ESG-focused stocks are trailing the S&P 500 this year for the first time since 2017*.

*Past performance is not an indication of future results.

ESG isn’t useless. But this year has taught us that we all need to think about it a little differently.

A measure of risk

If you’re a hands-on investor, your strategy may be to find companies which operate better than the others. That’s OK — we’re all here to live our best financial lives.

But sometimes, we focus too much on return and ignore risk. Bear markets like the one we’re in now make this glaringly obvious.

There are two types of risk to consider. One is systematic risk, or risk factors that can impact the entire market: the economy, monetary policy, unknown political crises, etc. The other is unsystematic risk, or risk factors that impact a specific company or sector. Both are important to consider, and they can be managed in different ways.

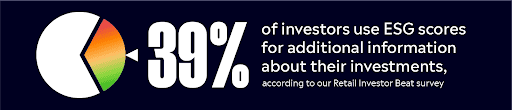

ESG scores and ratings can help us to measure the unsystematic risk in a non-traditional way — beyond numbers that you would see on a balance sheet or income statement. Think about ESG as quantifying the unquantifiable, such as how sustainable a company’s energy policies are or how diverse their leadership team is. In fact, about 39% of investors use ESG scores for additional information about their investments, according to our Retail Investor Beat survey.

An ESG score won’t help you gauge how much money a company can bring in, but it may give you insights into obsolete business practices, untenable working conditions, and imbalanced power dynamics in the C-suite. Over time, these issues can boost operational costs and erode confidence in management. Plus, in a world where information moves at the speed of light, a small misstep can turn into a costly PR crisis.

It is also important to understand how many of your investments struggle with the same ESG-related risk factors. Is your portfolio tilted too far towards traditional energy, or does it include enough climate-friendly companies? Do your companies have operations in third-world countries with limited human rights? ESG scores can help you to measure just how susceptible your money is to unpredictable shocks such as commodity crises or geopolitical tensions.

A sense of control

We all want control over our money — how we earn it, how we spend it, where we invest it. But when you invest in a company, you are acting on faith — no matter how much you know about the business plans or the stock performance. These days, big, multi-faceted companies are the norm in the stock market. Just look at Amazon: it’s an online retailer that has recently ventured into grocery stores, smart home technology, and streaming content. Companies evolve over time, and you need to understand what you’re getting.

In the past, you could dig through financial statements to get the ins and outs of a company, but that required time and expertise. There are thousands of exchange-traded funds on the market that offer exposure to different themes — memes, the metaverse, even cool stock tickers — or can give you a window into what drives the bottom lines of your favourite names.

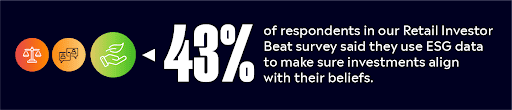

That is also where ESG data comes in handy. ESG data may not paint the complete picture of a business, but it can give you more information on where the company’s time and money are going, so you have more transparency around what you’re investing in. Would you prefer to avoid investing in a company that participates in fracking? You don’t have to invest there, and you can make that decision more easily with ESG data that flag increasingly scrutinised business practices. That’s a feature investors want too — about 43% of respondents in our Retail Investor Beat survey said they use ESG data to make sure investments align with their beliefs.

Be careful, though. While there’s nothing wrong with this, you need to do your research before deeming a company “ethical” or not. ESG standards can only tell a fraction of the story, and the overall score may be a reflection of a company that focuses hard on one letter.

A rule of thumb

It has been a rough year for ESG. And while the concept has good intentions, it still requires you to scrutinise what you are looking at. ESG data can be a powerful tool for evaluating risk and controlling where you invest.

Here’s an easy rule of thumb: If you are using ESG to understand where your money is going, you are probably on the right track. If you are using ESG as an avenue to save the world, you may need a reality check.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

*Data sourced through Bloomberg. Can be made available upon request.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.