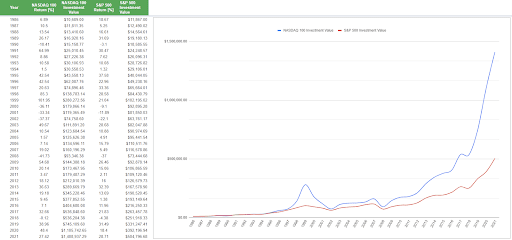

If you had invested $10,000 in the S&P 500 in 1986, you would have about $504,796 today*. A return of almost 5000%. Not too shabby! However, if you did the same for the NASDAQ 100 (which was launched in 1986), you would instead have made $1,408,937 [assuming in both cases you had reinvested all dividends]. Nearly 14,000% for the same period. However, you would have paid a non-financial price for this higher performance: enormous volatility.

The NASDAQ 100, a good proxy of “Growth”, has much higher peaks and troughs than the S&P 500.

Past performance is not an indication of future results.

And this is part of the draw for “growth” investors. Choose the right companies and growth investing will net you much higher returns. But you also need the stomach to endure the downswings.

What is Growth Investing?

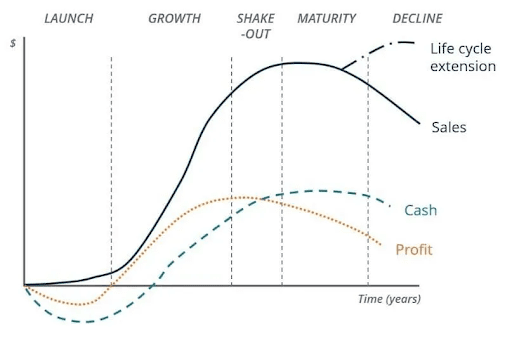

Businesses tend to follow the same life cycle when it comes to making revenue, profit, and generating cash flow:

- At first, they’re just trying to find some customers. In this phase (Launch), they’re usually losing money. If they find some customers and some investment (or loans) to keep them going, they grow. We have a name for these types of businesses: startups.

- In the second phase (Growth), they try to scale up operations. If successful, revenue can grow very fast, and later in this phase, they might even become profitable — generating cash flow.

- The next phase (Shake-Out) sees the business growing fast, but not as fast as previously. The company eventually has trouble finding new ways to grow.

- The penultimate phase (Maturity) has the business just trying to maintain the status quo. It’s usually in this phase that a company starts to issue dividends to reward investors since appreciation in the share price is hard to come by.

- And finally (Decline), the business starts to shrink and ultimately shutters its doors. This can take years or even decades. But sometimes it is surprisingly fast.

“Growth Investing” (in public markets) tends to focus on companies somewhere within phases two and three. These companies don’t have to be tech companies! Historical growth industries through the decades have included: automobiles, utilities, and even carpeting. But these days, they often are tech businesses since they can scale their operations rapidly while maintaining or improving profit margins, i.e., expanding a non-tech company such as a hotel chain requires large sums of money to buy property and hire all the people to operate those hotels. Whereas a tech company, such as a mobile gaming studio, just needs to make their app available in additional markets.

If you’re able to find a good company at a good price, growth investing can be a powerful way to increase your investment returns. Fast growth in the business translates into fast growth in the share price. A high-margin business means plenty of spare cash to accelerate growth, buy back shares, or save for a rainy day. But, these types of companies can also be incredibly risky. Especially those closest to the left-hand side of the life cycle (see chart above). It is not definite that a company with enormous revenue growth will one day be profitable and small mistakes can destroy companies still in their infancy. The market tends to expect explosive growth, so any signs of this slowing will concern investors.

Growth vs Value Investing

You will often hear people in financial circles talk about value vs growth stocks. This can be misleading. Over the decades, the definition of “value” has evolved, and now there are several sub-categories. However, in their simplest versions, you might define each as:

Value: businesses whose stock price is a good value because it is below the fair value of that business.

Growth: businesses which are growing revenue and/or profit very fast, and this is expected to continue.

A business can be both a value and growth investment. This can be reasonably common in bear markets. It is rarer in sustained bull markets. In a multi-year bull market, you might have to settle for “Growth at a Reasonable Price“, although good value growth investments do appear from time to time.

In Summary

Growth investors typically invest in younger businesses whose revenue and profits are expected to grow faster than the average market participant. There is a wide spectrum of companies in this category. From businesses that are just a few years old and not yet profitable, to multi-billion dollar enterprises. The volatility associated with these investments is generally higher than in non-growth areas. Sometimes much higher.

The younger and more unproven companies can be very risky investments. But there’s also the chance that they become the FAANGs of the next decade. That is the dream of every growth investor. But that doesn’t mean you should skimp on your homework!

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.