A big pop in Bitcoin Cash has caught our attention, while The Daily Breakdown digs into Take-Two Interactive (TTWO) stock amid its recent strength.

Monday’s TLDR

- It’s a short trading week

- But big firms still report earnings

- Taking a look at TTWO charts

Weekly Outlook

Investors are looking at a short week, with US stock markets closed on Friday. Despite this, it’s set to be a busy one after the banks kicked off earnings last Friday.

Monday’s the calmest when it comes to planned events, with earnings from Goldman Sachs standing in as the headline event.

On Tuesday, Johnson & Johnson, Citigroup, Bank of America, and United Airlines will report.

Wednesday’s focus may very well be the retail sales report, which will give the latest update on consumer spending. Remember, consumption powers about two-thirds of US GDP, so we want to see consumers continuing to spend.

Thursday will be a key day of earnings, with Taiwan Semiconductor — remember, this firm has a market cap north of $700 billion — reporting in the morning, while Netflix reports after the close. UnitedHealth Group, Huntington, and American Express will also report.

Note: The full earnings calendar can be found here.

Today is beginning with notable pre-market gains. Let’s see if bulls can gain momentum after the open and potentially press last week’s high at some point this week. For the SPY ETF, that’s $548.62. For the QQQ, that’s $467.83.

Want to receive these insights straight to your inbox?

The setup — Take-Two Interactive

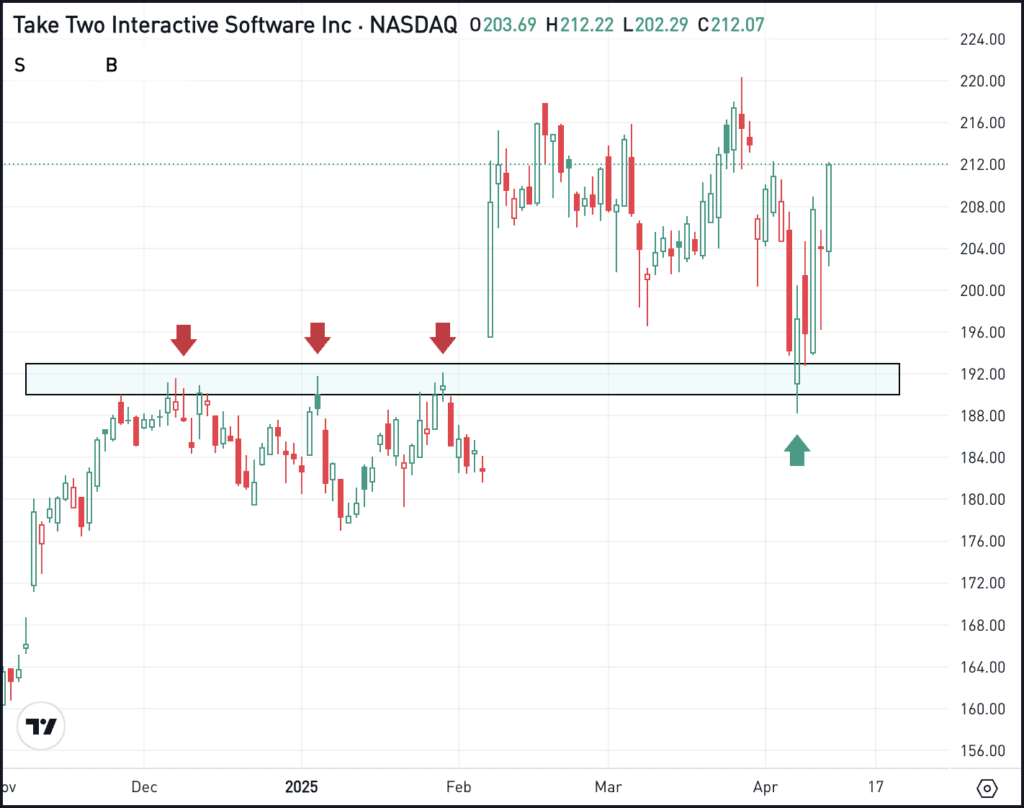

Video game stocks are not immune to volatility, but Take-Two Interactive — the producer of games like Grand Theft Auto, Red Dead and NBA 2K — has done a remarkable job lately. Shares are within 4% of record highs and are up more than 15% so far this year.

It’s particularly impressive with consumer discretionary and technology stocks underperforming the broader market.

Notice how shares are finding support in the $190 to $193 zone, an area that was resistance in Q4 and in January. If this area continues to hold as support, then bulls could maintain momentum. Ultimately, investors are hoping to see the stock hit new record highs.

However, if this zone fails as support, then it could usher in more selling pressure, potentially putting more downward pressure on TTWO.

Options

This is one area where options can come into play, as the risk is tied to the premium paid when buying options or option spreads.

Bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

That being said, investors can be neutral on TTWO and choose to do nothing with the stock. Remember, you don’t have to be involved with every stock all the time.

What Wall Street is watching

JPM – JPMorgan shares gained 4% on Friday after better-than-expected earnings results. Revenue of $46 billion topped estimates of $44.1 billion, fueled by strong trading revenue, while the firm also beat on profit expectations. Remember, JPM is the largest US bank.

BCH – Bitcoin Cash ripped higher over the weekend, climbing as high as $385 on Saturday. That was up more than 50% from the lows last week. Even though BCH has now faded lower, bulls are hoping this can lead to more gains in the weeks to come. Check out the chart for Bitcoin Cash.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.