Markets were hammered as a result of the Trump Administration’s “Liberation Day.” The Daily Breakdown tries to make sense of the situation.

Monday’s TLDR

- Markets under pressure

- Trade war wreaks havoc

- Microsoft approaches key level

Weekly Outlook

My colleague Javier Molina (at @xmolinaj) wrote this over the weekend and I think it applies quite well to the current situation: “When the system needs to purge, it does — painfully, but necessarily.”

We’re seeing panic and fear spread throughout markets — and not just in the US. These environments can come on like a tornado. What might seem like a modest thunderstorm can turn into a catastrophe in the blink of an eye.

That’s what we’re seeing now, with the S&P 500 and Nasdaq 100 falling more than 10% in just the past two days. Global equity markets — like China and Germany — are selling off, while Bitcoin, Ethereum, and other cryptocurrencies are tumbling lower too.

Gold and bonds — some of the safest assets — continue to hold up pretty well.

These markets aren’t easy. They elevate investors’ emotions and taunt them with volatility. However, if investors are buying quality assets, investing for the long term, nibbling in small increments, the long-term statistics favor forward returns during moments like these.

Going back to 1950, this is the fifth-worst two-day stretch for the S&P 500. We don’t know how the next 1, 3 and 5-year return periods will shake out, but in the other nine instances, all measures were positive. So take a deep breath and try not to panic. Consider looking for measured opportunities, adjust your time horizon to focus on the long-term, and try not to react to every headline and news item that crosses the tape. Hang in there.

***

This week’s big events are meaningful but limited. We have the CPI reading on Wednesday, while the big banks — like JPMorgan, Wells Fargo and Morgan Stanley — kick off earnings on Friday.

Want to receive these insights straight to your inbox?

The setup — Microsoft

Shares of Microsoft are getting roughed up, down more than 20% from the record highs last summer. The losses appear poised to grow this morning, despite the company’s immense cash flows and strong margins.

When Microsoft reports earnings later this month, we’ll learn of any meaningful business updates. For now though, analysts’ still expect ~13% revenue growth in fiscal 2025 and 11.5% earnings growth.

At roughly 25 times forward earnings, the stock is trading near its lowest forward price-to-earnings ratio in two years.

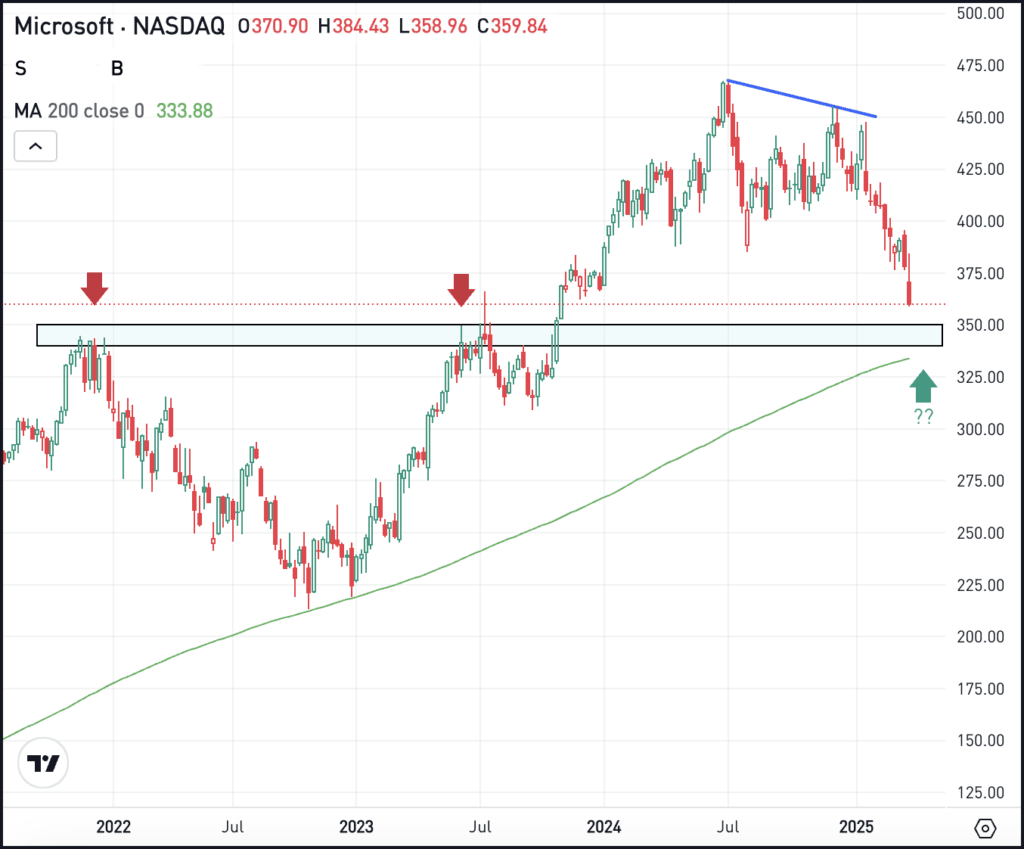

As for the technicals, long-term investors may be keeping a close eye on the $335 to $350 area. This zone was significant resistance in 2021 (the prior bull market high) and then again in mid-2023 before a massive breakout sent shares to a record high of roughly $468.

If the stock tests down into this area, it will mark a decline of at least 25% — enough for some investors to start accumulating the stock. Of course, those who are not bullish on Microsoft’s long-term fundamentals may continue to look past this stock and focus on other assets.

What Wall Street is watching

SPY – The S&P 500 ETF — SPY — has suffered greatly over the past two trading sessions, and is trading lower again in Monday’s pre-market session. The ETF is on the verge of a bear market, as defined by a 20% loss from its highs. However, as panic nears a potential boiling point — visible by the spike in the VIX — investors are anxious to see some form of capitulation, potentially marking a short-term bottom.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.