Inflation is back in focus this week, with the monthly CPI due up Wednesday. The Daily Breakdown looks at Broadcom after earnings.

Monday’s TLDR

- This week’s inflation report is key

- AVGO faces key technical level

- COST dips on earnings

Weekly Outlook

The S&P 500 and Nasdaq 100 have now fallen in three straight trading weeks. On the plus side, markets were able to rally on Friday after being down notably in the morning following a slightly disappointing jobs report. On the flip side, they’re down more than 1% apiece in pre-market trading.

Monday’s focus will be on Oracle’s earnings report after the close. The stock has been volatile as the company becomes more closely connected to the AI trade.

On Tuesday, earnings from Dick’s Sporting Goods and Kohl’s will be on watch, followed by the JOLTs report — which is the Job Openings and Labor Turnover Survey — at 10 a.m. ET. That should shed more light on the current jobs market.

Wednesday’s main focus will be the CPI report, with investors keeping a very close eye on inflation amid the ongoing trade war. In reality, this report is likely the main focus of the week. We’ll also get earnings from iRobot before the open, followed by American Eagle and Adobe after the close.

On Thursday, Dollar General, Ulta Beauty and DocuSign will report earnings. By Friday, hopefully the markets will have found a way to end their three-week losing streak!

Want to receive these insights straight to your inbox?

The setup — Broadcom

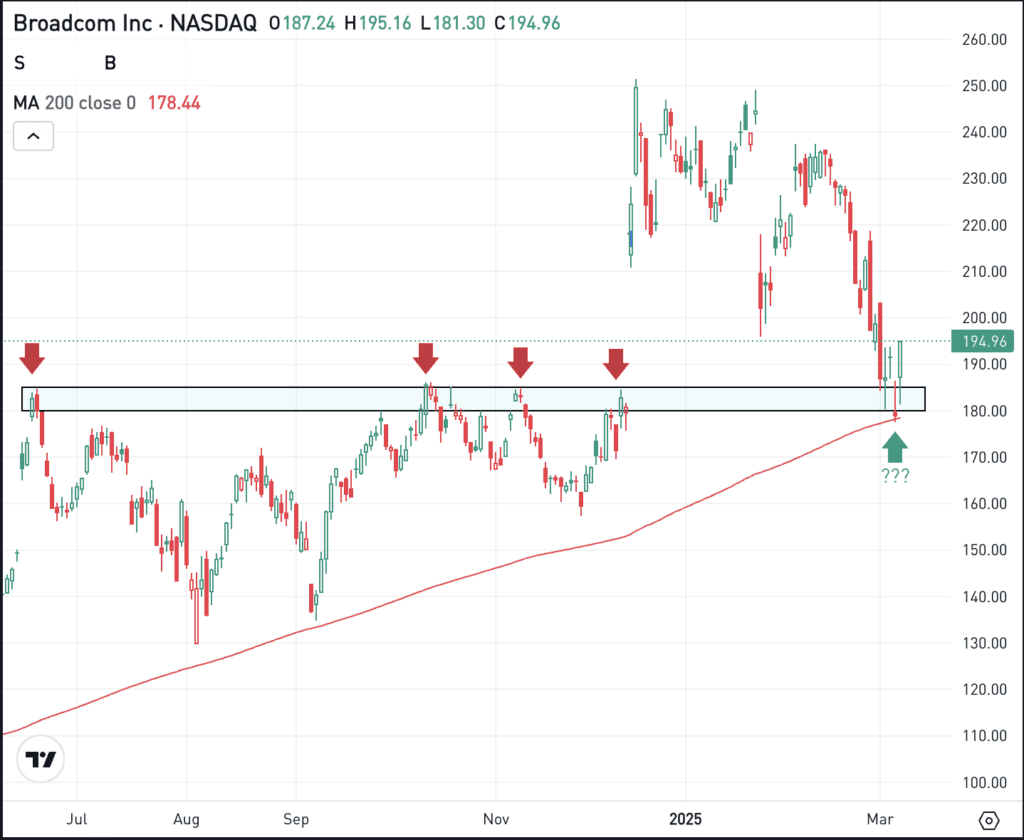

Not long ago, Broadcom’s market cap swelled beyond $1 trillion as the AI trade buoyed its bullish momentum. However, coming into its earnings report on Thursday evening, shares had fallen almost 30% from the highs.

The company delivered a solid earnings report, beating on earnings and revenue expectations, and providing a solid outlook. Now, the stock is trying to hold a key level on the charts:

Broadcom’s earnings report in November triggered a major breakout over the $180 to $185 zone, but the recent market weakness sent AVGO back down to this zone — and the 200-day moving average — going into the latest earnings result.

The stock popped higher on Friday, gaining more than 8%, but this will be a key area to watch moving forward.

If it continues to act as support, bulls will look for a larger bounce out of this zone. However, if support fails, then more selling pressure could ensue.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

COST – Shares of Costco fell more than 6% on Friday, which was its worst one-day performance in about a year. The retailer beat revenue expectations with healthy growth of 9.1%, however, it missed earnings expectations while operating margins were flat year over year.

IBM – IBM doesn’t always get a lot of credit, but the stock is holding up incredibly well right now. After rallying more than 5% on Friday, the stock is within 2% of its 52-week high. The recent momentum came after IBM rallied 13% on January 30th following a solid earnings report.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.