The Daily Breakdown previews the week ahead, which includes a key retail sales figures and the two-day Federal Reserve meeting.

Monday’s TLDR

- Retail sales drop today

- Fed in focus on Wednesday

- SOFI tries to hold key support

Weekly Outlook

This week starts off with a bang with the monthly retail sales figure dropping at 8:30 a.m. ET. Ordinarily, the retail sales figure might not pack that much of a punch, but given the recent worries around consumer spending and confidence, today’s figure is actually quite meaningful.

However, the big news item this week should come on Wednesday when the Fed provides its latest update.

The bond market is confident that the Fed will not cut interest rates this week, but investors are awaiting an update from Chairman Jerome Powell. They want to know how the Fed is viewing the current market volatility and is looking for reassurance about inflation and the economy.

When it comes to earnings, a few reports still stand out.

First, several Chinese EV stocks will report this week, with Xpeng reporting on Tuesday morning and NIO reporting on Friday morning.

We’ll also hear from Micron, FedEx and Nike on Thursday afternoon, before Carnival reports on Friday morning.

Want to receive these insights straight to your inbox?

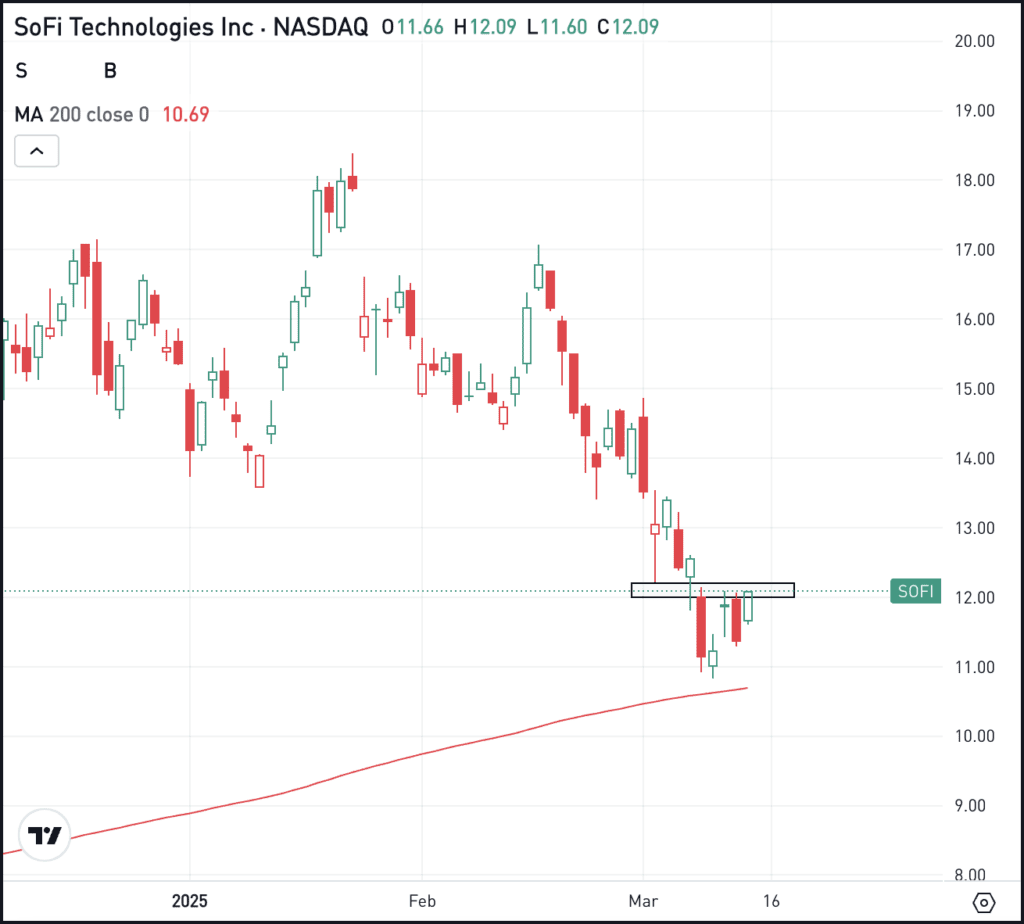

The setup — SoFi

SoFi Technologies exploded above $18 in late January, but has pulled back significantly amid the recent market decline, dipping below $11 on Friday. The decline sent shares down to the 200-day moving average, which acted as support.

Notice the recent highs from last week: Monday’s high of $12.17, Wednesday’s high of $12.12, Thursday’s high of $12.09 and Friday’s high of $12.12. Clearly, this zone has been acting as recent resistance.

If SOFI stock can clear this short-term resistance area and stay above it, then it might be able to sustain a larger upside rebound.

For longer term bulls less concerned about last week’s price action, they’ll want to see the recent lows and the 200-day moving average hold as support. If they fail to do so, more selling pressure could ensue. If support holds though, a larger rebound could take place.

Options

For some investors, options could be one alternative to speculate on SOFI. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and SOFI rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

BTC – Bitcoin ended in the green last week, climbing about 2.3%. While the move is modest, it ended a two-week losing streak and came on the heels of a 14.4% loss in the prior week. Still, bulls want to see if BTC can regain the $90,000 level. Check Bitcoin’s chart here.

NVDA – Nvidia was the best-performing Magnificent 7 stock on Friday, gaining over 5%. Despite some market weakness this morning, NVDA shares are up more than 1% in pre-market trading. Bulls are hoping the recent rebound can continue as Nvidia’s GTC event will be in full focus.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.