The Daily Breakdown takes a closer look at Bitcoin as it tries to regain momentum and rally off the recent lows.

Monday’s TLDR

- Bitcoin looks at resistance

- Stocks set to start day higher

- LULU, GME earnings this week

What’s happening?

Markets were able to squeeze out a gain last week, ending a four-week losing streak for the S&P 500 and Nasdaq 100. After a bumpy Friday involving a big quarterly options expiration, bulls are looking to add to their gains this week.

That’s with Bitcoin and US stocks rallying notably in pre-market trading. Can these “risk-on” assets continue to bounce amid a busy week of key reports?

On Tuesday, the consumer confidence report will drop at 10 a.m. ET. Consumer confidence has been a key focus for investors lately, as economic worries impact spending.

On Thursday, we’ll get the final GDP report for Q1 at 8:30 a.m. ET, with economists expecting a final figure of 2.3%. On Friday, we’ll get the PCE report, which is the Fed’s preferred inflation gauge.

As for notable earnings reports, a few stand out.

KB Home will give an update on the housing market on Monday, while GameStop will report on Tuesday. Chewy and Dollar Tree will report on Wednesday morning, while Lululemon Athletica will report on Thursday afternoon.

Want to receive these insights straight to your inbox?

The setup — Bitcoin

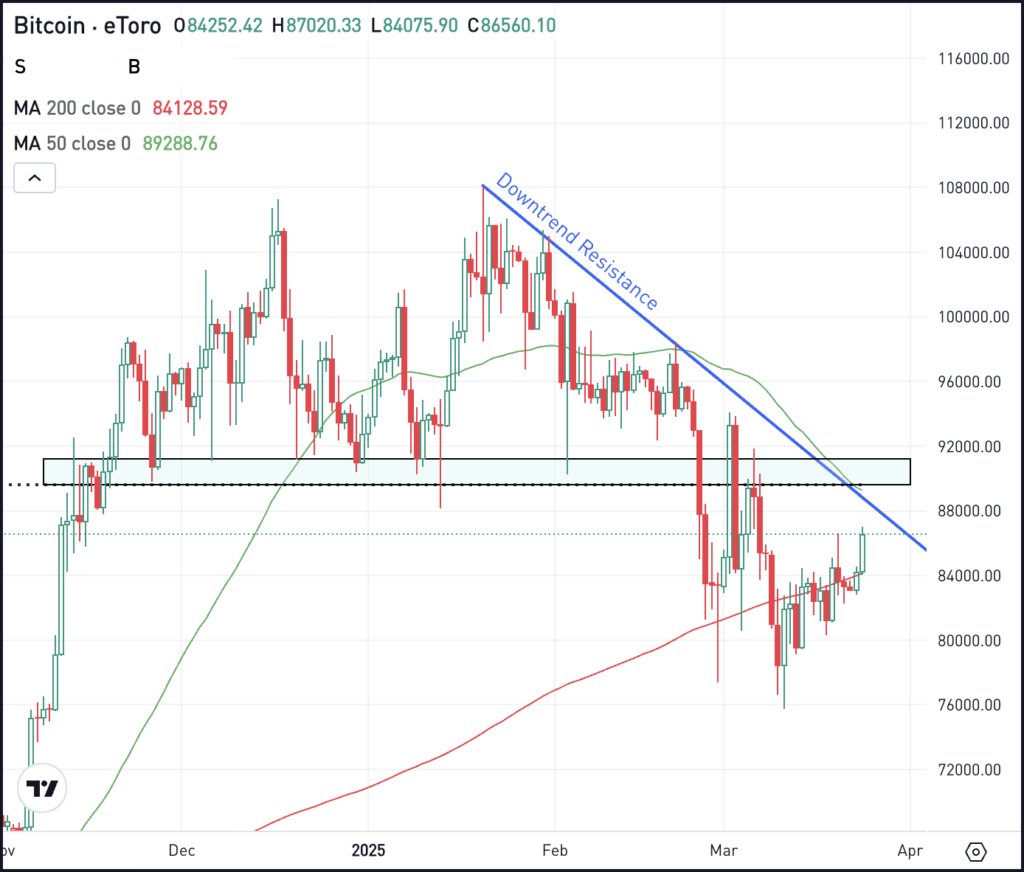

At least for now, Bitcoin has bottomed a bit for US stocks and has been slowly but surely gaining altitude. However, if that momentum continues, it will soon face a key test of potential resistance.

That’s as Bitcoin could test the declining 50-day moving average, prior support in the low-$90,000 range, and downtrend resistance (blue line). Some technical traders may prefer to draw their downtrend resistance a little tighter (so it aligns with the highs from early March and thus puts that resistance test into play near current levels). Try it out on your own, if you’d like.

Either way though, BTC has to clear all of these levels in order to see a dramatic rise in price and re-establish a longer-term uptrend.

If BTC does clear these measures, bulls will want to see these current resistance levels turn into support, re-establishing the bullish momentum and putting more potential upside in play.

If these areas are resistance though, shorter term traders may remain a bit cautious to see what levels re-establish themselves as support. That could potentially come from the $80,000 to $84,000 area and the 200-day moving average.

What Wall Street is watching

SPY – Stocks are catching a boost this morning, with the S&P 500 ETF — SPY — up about 1.3% on reports that the planned reciprocal tariffs on April 2nd will be more targeted than initially expected. This highlights how de-escalation in the trade war could help give a potential lift to markets.

BA – Boeing jumped more than 3% on Friday and climbed more than 10% last week. It’s in focus again this morning, as the stock’s recent momentum has traders’ attention and as the company’s recent defense contract for the new F-47 jet has long-term investors feeling relieved. Check out the chart for Boeing.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.