The Daily Breakdown looks at the new tariff orders that are ratting stock markets and investors on Monday morning.

Monday’s TLDR

- Tariff worries fuel selloff

- It’s a busy earnings week

- Gold prices at new highs

Weekly Outlook

Last Monday, it was the DeepSeek news that sank stocks. This week it’s tariff concerns. However, the situations are quite different. The DeepSeek news wasn’t necessarily what it seemed on the surface and it focused primarily on one industry and sector. Plus, many of the AI companies are still on very solid footing.

On the tariff front, not only are there concerns about the potential for higher inflation, but now we’re seeing retaliatory tariffs back toward the US. While the Trump administration can pivot quickly on topics like trade, the newly established tariffs have a direct (and notable) impact on global economies. We’re seeing the markets reprice this risk today, as investors underestimated how large and swift these tariffs were going to be.

As for key events this week, we’ll get earnings from Palantir this evening, followed by PayPal, Spotify, AMD, and Alphabet tomorrow.

On Wednesday morning, we’ll get the monthly job openings report (the JOLTs data), along with earnings from Uber and Disney.

On Thursday, companies like Amazon and Eli Lilly will report, then on Friday we get the all-important monthly jobs report. That will tell us how many jobs were lost or added last month — right now, economists expect that about 154,000 were added — as well as provide the unemployment rate.

Want to receive these insights straight to your inbox?

The setup — Gold

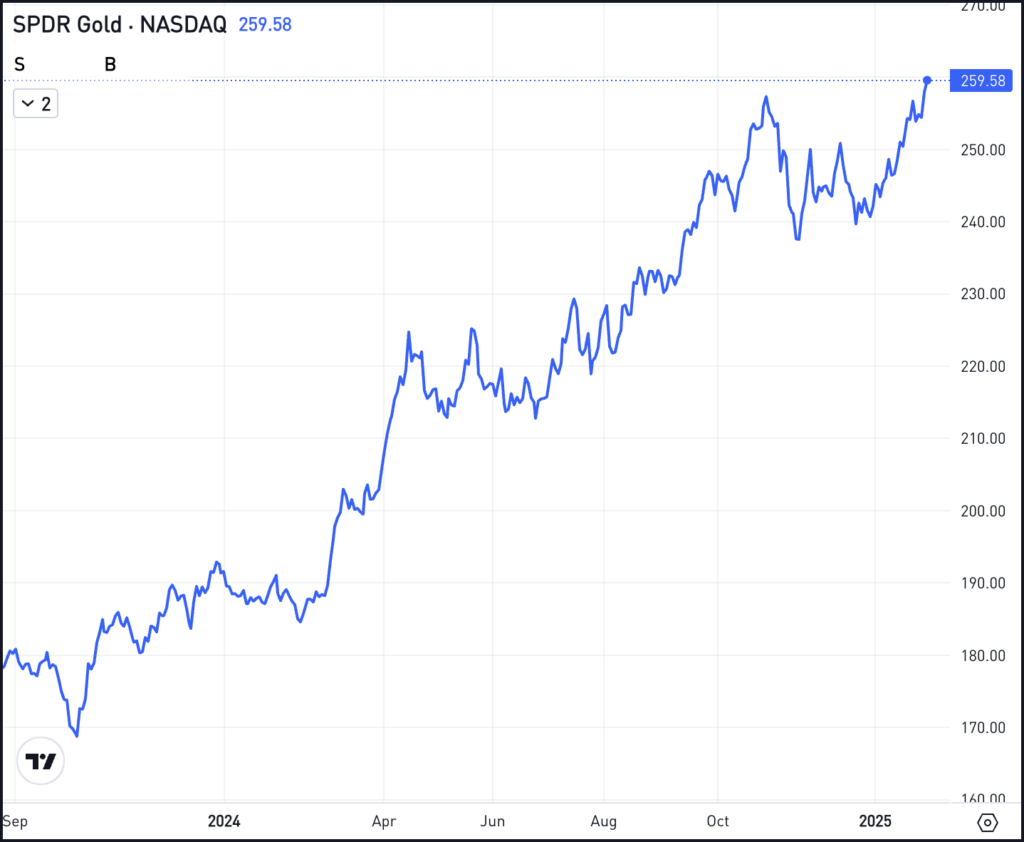

The most popular gold ETF — the GLD — hit a new record high on Friday. While many assets are moving lower in pre-market trading today, gold is not among them.

Many pundits consider gold to be a “safe haven” trade, acting as a hedge on geopolitics, inflation and other worries.

Specific to GLD, bulls will want to see the ETF stay above its Q4 high from late-October, at $257.71.

Gold is just one way investors can seek to hedge their portfolio in times of trouble. For short-term traders who primarily have stock exposure, they can also consider inverse ETFs as one way to hedge. These ETFs are designed to go up when markets go down…but remember, they also go down when markets are rallying.

Another common hedging technique is found through the options market.

While put options are often used by traders to speculate on potential downside, they can also be a way for investors to hedge their long positions.

Find out more about options trading with our free Academy courses and more specifically, find out more about hedging here.

What Wall Street is watching

BTC – Bitcoin prices dropped into the $91,000s this morning, but have since recovered some of those losses as investors try to size up the situation. Bitcoin had been holding above the key $100K mark until Sunday as worries over tariffs weighed on global markets. Check Bitcoin’s chart.

SPX500 – The S&P 500 came within a few points of its all-time high on Friday, before a late-day selloff pushed it lower on the day and forced the index to finish lower on the week. For now, the index is still struggling with the key 6,100 level that we talked about earlier this month.

ETH – Bitcoin is taking a hit, but Ethereum is really getting crushed. At the overnight low, ETH was down more than 20% as it declined toward the $2,000 mark. In fact, many alt coins have taken a beating in overnight trading, although we’ve seen a bounce from the lows.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.