Silver and gold prices have been shining in 2025. The Daily Breakdown digs into the metals as they outperform stocks and crypto this year.

Friday’s TLDR

- Gold is up 11.5% this year…

- …and 46.9% in the past year

- Don’t forget about silver

The Bottom Line + Daily Breakdown

We’re not that far into 2025 and it’s been a choppy stretch for assets like Bitcoin and the S&P 500. However, it’s been pretty smooth sailing for gold.

Gold has been shining so far this year, up about 11.5% and hitting record highs in eight of the last 11 sessions. Further, it’s up more than 46% over the past 12 months — easily outpacing leading US stock indices like the Nasdaq 100, which is up almost 25% over the past year.

Why is gold doing so well?

A lot of investors look at gold as a play on inflation and money supply. As these measures move higher, it takes more dollars to purchase the same thing. So while an ounce of gold was $2,000 about a year ago, it’s almost $3,000 now.

But these factors aren’t the only drivers of gold prices.

Investors also view gold as a “flight to safety” trade when uncertainty is on the rise. And don’t forget, gold is a commodity, which means supply and demand drives its price fluctuations. So as demand increases from investors, central banks, firms (like ETFs), semiconductor companies, jewelers and others, it puts upward pressure on the metal’s price.

Ways to invest in gold

The most direct way to play gold is to buy the physical metal. This comes in a variety of forms and weights, like gold bars or coins. For other investors though, they might prefer a simpler yet straight-forward solution, like the GLD ETF.

For those that are looking for exposure to gold mining companies, there are a few options, like the Gold Miners ETF (GDX). A few of its top holdings include stocks like Newmont Mining, Angico Eagle Mines and Barrick Gold.

There’s also a fund made up of smaller companies, known as the Junior Gold Miners ETF (GDXJ). Note that this group tends to be a bit more volatile.

The bottom line

There have been stretches where gold was a major laggard compared to stocks and other assets. But at other times — like over the past few years — having at least some exposure to gold can be a major asset for investors and those looking to diversify.

Want to receive these insights straight to your inbox?

The setup — Silver

All this talk about gold, but what about silver? Silver prices are up almost 12% in 2025, slightly outpacing gold. Like gold, it’s also up about 46.5% over the past year.

Another similarity is that silver can be bought in a variety of ways. Investors can buy silver bars and coins, but they can also buy silver stocks and ETFs. For the latter, one of the most common vehicles is the SLV.

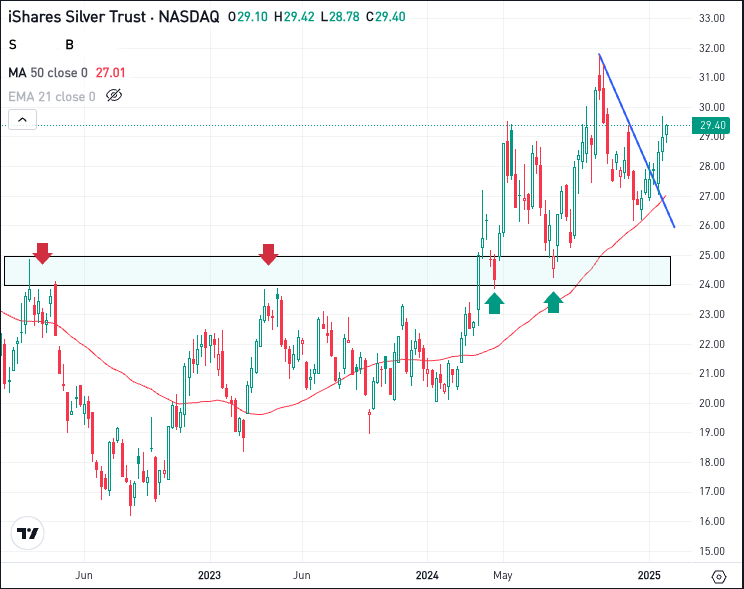

When looking at the longer term weekly chart of SLV, notice how it broke out over the key $24 to $25 area in the first half of 2024. This was a notable resistance zone in 2022 and 2023, but it has been acting as support since the breakout.

In October, the SLV hit its highest level in more than a decade, printing a high of $31.80 — (its all-time high is from 2011 near $48). After pulling back for several months, it’s now rallying after finding support at the 50-week moving average.

If SLV maintains momentum, bulls will hope to see new 52-week highs. They’ll also want to see continued support on the pullbacks.

Options

For those that don’t know, all of the ETFs mentioned today — GLD, GDX, GDXJ, and SLV — have options trading too.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on a decline.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.