The Daily Breakdown takes a look at the stock market as the S&P 500 is on the verge of a 10% correction and as GOOG looks for support.

Thursday’s TLDR

- Can bulls gain strength?

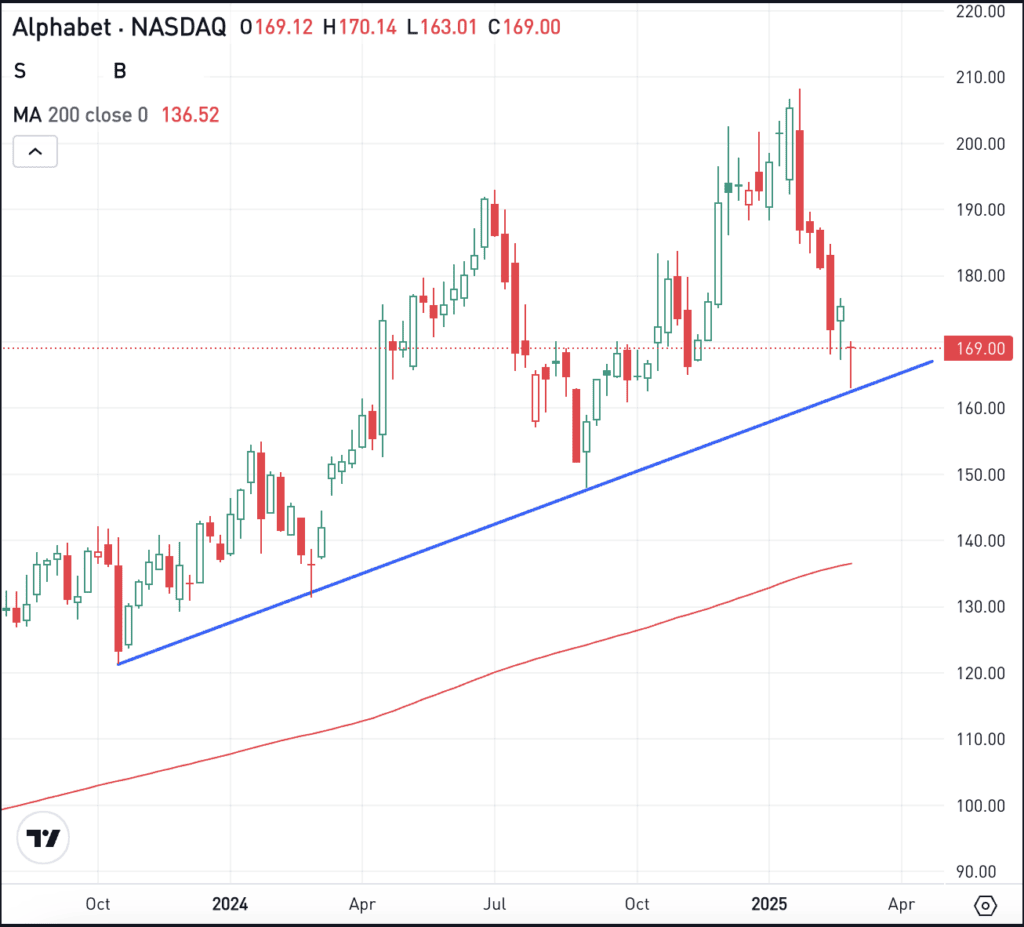

- GOOGL hits key trendline

- Gold aims for record high

What’s happening?

Bitcoin is looking for traction, while stocks found a little relief yesterday. The S&P 500 rallied 0.5%, while the Nasdaq 100 jumped over 1% as tech helped lead the advance.

That’s good, since tech has been a major under-performer amid this pullback. I think that’s part of the reason sentiment has soured so much, given that tech tends to make up such a large percentage of investors’ portfolios.

Yesterday’s lower-than-expected inflation report helped spark the rally, but the question is, can stocks string together a bigger bounce?

A positive day was nice, but the reality is that the S&P 500 and Nasdaq 100 are only up 1% to 2% from the recent lows and are still down 9% and 11.8% from their highs, respectively.

Earlier in the pullback, bulls were hoping the 5,650 area would be a support zone for the S&P 500. After breaking below it this week though, bulls are just hoping this area doesn’t become resistance instead!

If markets can get a multi-day bounce going, technical investors will want to see that both indices are able to regain their 200-day moving averages. Same goes for the SPY and QQQ ETFs. If they can’t, concern will linger about the strength of the rally.

Want to receive these insights straight to your inbox?

The setup — Alphabet

Shares of Alphabet have struggled since reporting earnings, down about 19%. However, the stock is trying to find support on a key trendline.

This trendline dates back to the October 2023 lows, which coincided with the major market rally from the Q4 2023 lows all the way through 2024.

GOOG bulls are hoping Alphabet can hold this trendline in the low- to mid-$160s, helping fuel a bounce back to the upside. Bears are hoping that the rally fails, opening up more potential downside in the stock.

Of the Magnificent 7 stocks, Alphabet has the lowest valuation on a forward price-to-earnings basis. Shares trade at about 18 times this year’s expected earnings results, which calls for growth of 14%.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

ADBE – Shares of Adobe are under pressure this morning, down about 5% in pre-market trading. While the company beat on Q1 earnings and revenue expectations, guidance for Q2 was not quite as strong as investors were hoping for.

GLD – The gold ETF — GLD — previously hit a record high on February 24th, but is back within 1% of that high as of yesterday’s close. With a mild rally in pre-market trading, gold bugs will be watching to see if gold can make new record highs today. Check out the chart for the gold ETF.

DG – Dollar General stock is rising in pre-market trading, up about 5% after the firm delivered a Q4 earnings and revenue beat. Shares were rising despite management’s full-year outlook coming in below analysts’ expectations.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.