The Daily Breakdown looks at the S&P 500 amid its four-week losing streak and as the index enters correction territory with a 10% decline.

Friday’s TLDR

- Stocks try to find their footing

- Friday’s a big options expiration

- Micron beats on earnings

What’s happening?

After four straight weekly declines, the S&P 500 is trying to put together a positive weekly return. From peak to trough, the index has suffered a 10.5% decline — enough to consider it in “correction” territory.

Much of today’s action is likely to be decided by the options market, as Friday is one of four triple-witch expirations of the year. The others will be in June, September and December.

What is triple-witch?

It’s the monthly options expiration for stock options, the quarterly expiration for index futures, and the monthly expiration of index options. To make it a little less confusing, let’s look at the S&P 500 for example. Options will expire on the:

- SPY ETF — stock options

- S&P 500 index (or ticker “SPX”) — index options

- S&P 500 futures contracts (which trades under the symbol “ES” on the Chicago Mercantile Exchange).

Can Stocks Find Their Footing?

Triple-witch expirations can make for tricky trading sessions. This likely doesn’t make much of a difference for long-term investors, but for active traders, it’s definitely worth keeping on your radar. That’s as there tends to be a lot of volume on these days.

Despite the potential volatility, investors are looking to see if the market can find its footing. For now, the S&P 500, Nasdaq 100 and Dow made their low last Thursday. From here, we want to see a larger rebound to the upside and ideally, regain their 200-day moving averages.

Remember, the 200-day moving average is a long-term moving that’s generally viewed as “above the 200-day is good and below the 200-day is bad.” If the indices remain below the 200-day and then close below those recent lows from last Thursday, it could trigger more bearish momentum.

Let’s see how stocks react to tomorrow’s triple-witch expiration. For now, we’re in a correction and short-term investors should continue exercising some caution, while long-term investors — either in index ETFs or in individual stocks — may start looking for opportunities, making a watchlist, and potentially even nibbling on new positions.

Want to receive these insights straight to your inbox?

The setup — MU

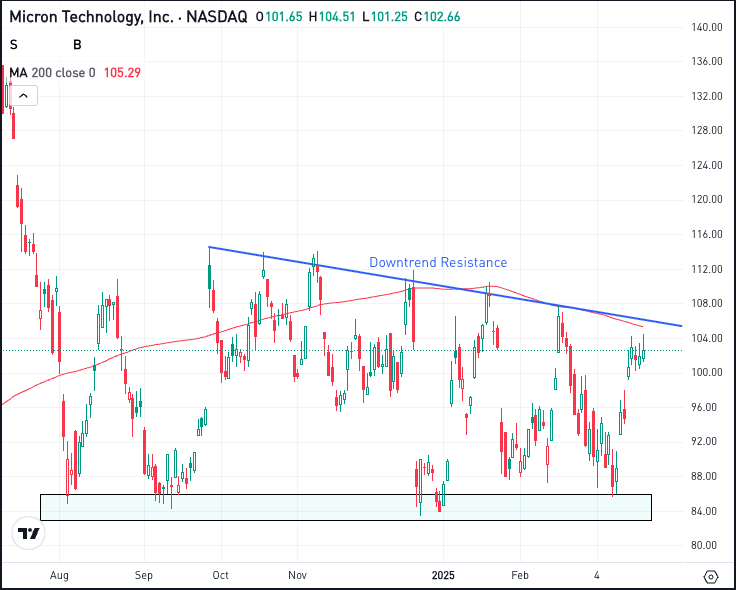

Micron reported its quarterly results on Thursday, beating analysts’ expectations on earnings and revenue, while also providing a stronger-than-expected Q2 revenue outlook.

That had shares rallying in after-hours trading. If those gains stick, investors will be eyeing a potentially larger move on the charts on Friday morning. That’s as the stock has been treading water below downtrend resistance (blue line) and the 200-day moving average.

Tomorrow’s reaction will be very key. Will the initial after-hours rally to the good news be sold or will investors embrace some good news and take Micron higher on Friday?

Bulls are hoping for a decisive close above the $107 to $108 area. That will technically break the stock out over downtrend resistance and allow for it to reclaim the 200-day moving average, something it hasn’t done since November.

In that scenario, more upside could be possible. However, if MU stock is rejected from this area, momentum may still favor the bears in the short to medium term.

Options

For some investors, options could be one alternative to speculate on MU. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and MU rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.