The Daily Breakdown looks at Nvidia amid its GTC event and the Fed ahead of its interest rate decision and economic outlook update.

Wednesday’s TLDR

- It’s Fed Day!

- NVDA’s GTC Event

- Tech looks for stability

What’s happening?

Every year, Nvidia hosts its GTC event in San Jose, as investors look forward to CEO Jensen Huang’s keynote address. In prior years, it wasn’t uncommon to see Nvidia shares rally into the event, but not this year.

The stock was down about 22% from its highs going into yesterday’s keynote and it failed to gain momentum afterward, ending lower on the day by 3.4%. Bulls were hoping that Nvidia would help stoke a rally, giving a lift to Wall Street since the stock is in the Dow, Nasdaq 100, and S&P 500.

Nvidia’s GTC event highlighted two things:

First, it’s still the undisputed leader in AI. Second, despite that, short-term momentum is like being stuck in the mud. The stock — and tech in general — just can’t seem to gain traction.

Maybe today’s Fed announcement will help.

At 2 p.m. ET, the Fed is expected to announce no change in interest rates and release its updated quarterly economic outlook (formally called the Summary of Economic Projections).

At 2:30 p.m. ET, Chair Powell will take the podium and go through a round of Q&A. The current volatility may not be due to the Fed, but investors are hoping that Powell & Co. can help ease investors’ current worries about the economy.

Want to receive these insights straight to your inbox?

The setup — Nasdaq 100

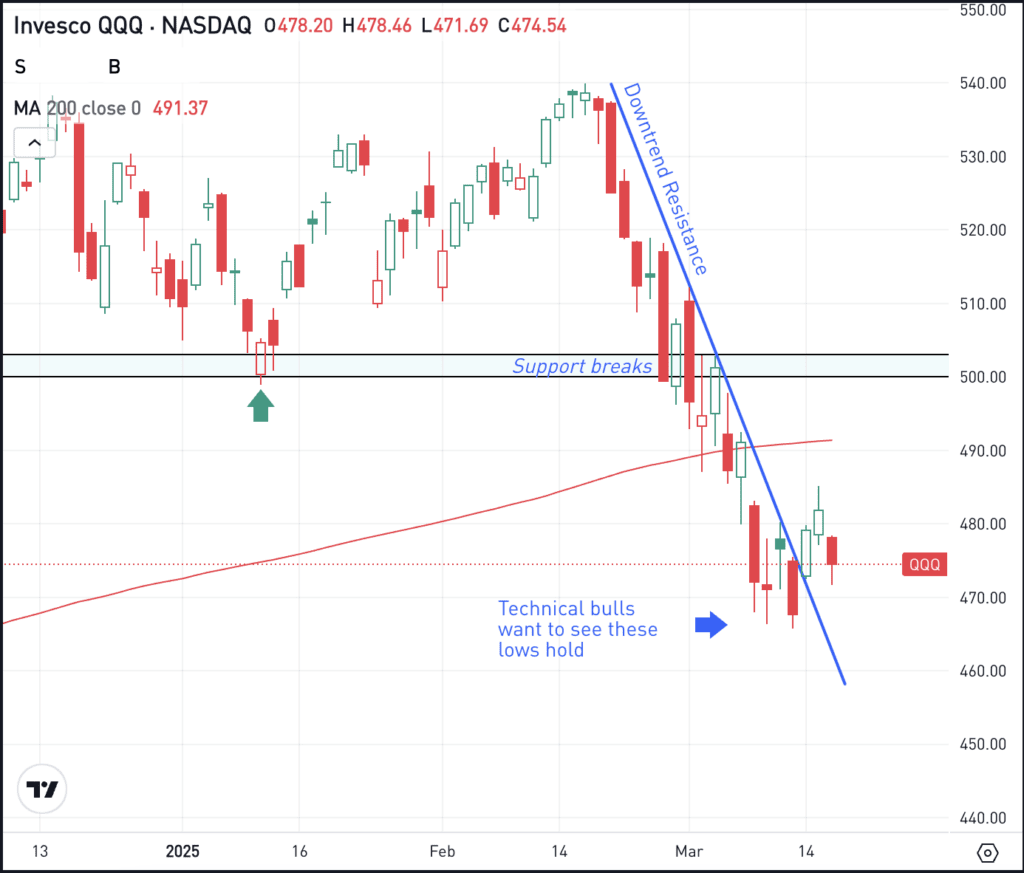

Looking at the Nasdaq 100 via the QQQ ETF, it’s been a nasty slide thanks largely to mega-cap tech stocks performing so poorly.

From its high in February to its low less than one month later, the QQQ stumbled 13.75%. This rapid selloff set up a steep downtrend resistance line, drawn in on the chart below with a blue line. It also sent the QQQ below a key support level near $500, as well as its 200-day moving average.

Now that the QQQ has technically cleared downtrend resistance, bulls are hoping to see the recent lows near $465 hold as support. These lows will likely be on watch today and this week, given the emphasis that investors put on Fed events.

If these lows ultimately hold in the days and weeks ahead, investors will look for a further rebound. While it may be a tough road ahead, they would likely look for the QQQ to push back toward the 200-day, then hopefully the $500 level.

If the lows do not hold, then more selling pressure could ensue as bearish momentum potentially re-accelerates.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GM – In yesterday’s keynote, Nvidia’s Jensen Huang said, “The time for autonomous vehicles has arrived,” while also announcing a strategic collaboration between Nvidia and General Motors. The sentiment around autonomous driving may also be giving Tesla a boost this morning, with shares higher by more than 3% in pre–market trading. We’ll see if GM stock can clear resistance today.

ETH – While Bitcoin is up about 1% this morning, Ethereum is up more than 4%. Relative to BTC, ETH has really struggled in recent trading, falling in the prior three weeks and losing about one-third of its value in that stretch.

SLV – While silver isn’t hitting new record highs like gold, it’s doing quite well, with the SLV ETF up more than 17% so far this year — and slightly outpacing the 15.6% gain for the GLD ETF thus far in 2025. Check out the charts for SLV.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.