The Daily Breakdown takes a closer look at Amazon’s valuation as the stock continues to pullback with the broader market.

Thursday’s TLDR

- Headlines continue driving stocks

- Amazon’s valuation is falling

- Chipotle dips on earnings

What’s Happening?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

The technical levels we talked about yesterday remain in play for the active investors out there. Even though markets opened strong yesterday, they ultimately faded from their highs.

Despite the SPY ETF finishing higher by 1.6% and the QQQ jumping 2.3%, the intraday fade really soured the mood, with the SPY up 3.5% and the QQQ up 4.3% at the highs, respectively.

Today’s jobless claims report at 8:30 a.m. ET will shed light on whether there’s been an increase in unemployment claims. Knock on wood, but so far we haven’t seen a spike in this figure, suggesting that the labor market is remaining in a good place.

This week has been a great reminder to just how sensitive markets remain to the headlines. Positive headlines on de-escalating the trade situation with China sent stocks rocketing higher, but negative headlines about the same thing halted that momentum.

I’ve been digging into dozens of conference calls over the last few weeks and will share some of those findings in tomorrow’s Daily Breakdown.

Want to receive these insights straight to your inbox?

The Setup — Amazon

Amazon has become a staple in Americans’ lives with its booming e-commerce business. However, other components — like its advertising and cloud businesses — have become juggernauts as well.

These units have added steadiness to the firm’s business, while helping fuel revenue growth and padding the bottom line.

For years, Amazon endured criticisms for its lack of profits and seemingly sky-high valuation. However, because of the progress it’s made on profits and margins, the valuation has gotten cheaper and cheaper over the years.

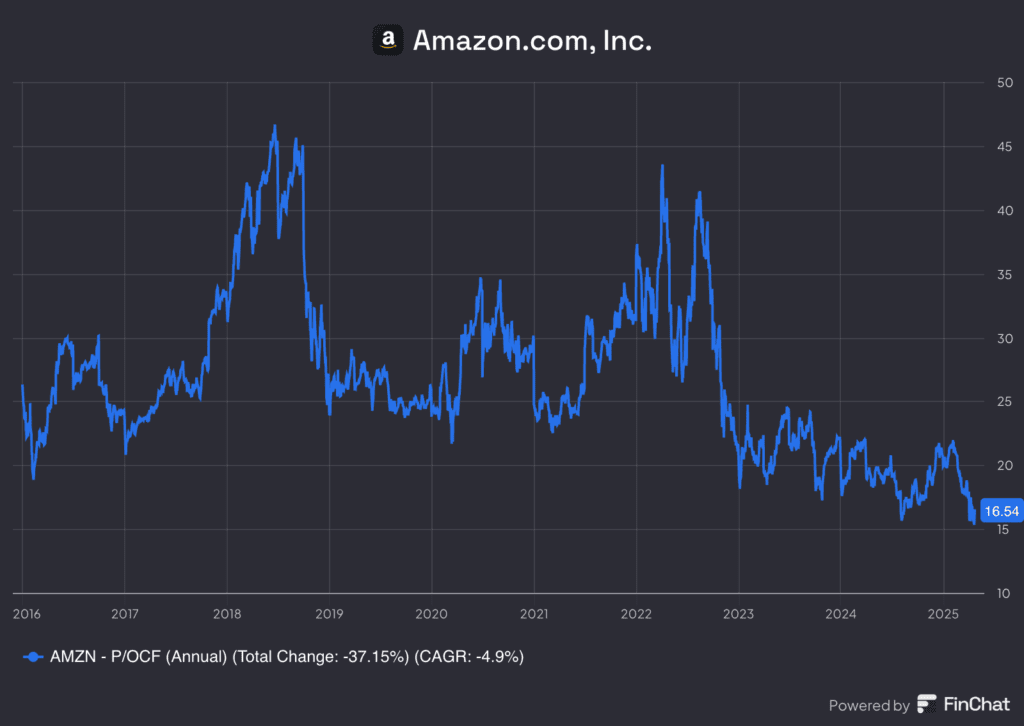

The above chart shows Amazon’s declining price-to-operating-cash-flow measure. The P/OCF ratio takes the current stock price (P) and divides it by operating cash flow (OCF). In fact, this figure is hitting its lowest levels since the depths of the financial crisis in 2009.

Despite the stock’s recent struggles, analysts remain pretty optimistic.

Consensus expectations currently call for roughly 10% revenue growth in each of the next three years, alongside annual earnings growth in the low-20% range. When it comes to free cash flow, analysts expect growth of roughly 14% this year, followed by a big acceleration up to about 50% growth in 2026.

That said, I try not to focus too much on estimates for 2026 or 2027 because so much can change between now and then (and particularly in this uncertain environment). But given that Amazon’s valuation has become relatively cheap on a historical basis, the forward estimates for the firm seem noteworthy.

Note: Just because a stock’s valuation has gotten cheaper, doesn’t mean the stock price can’t go lower. But for long-term investors, the valuation is often a critical component to their investment case.

What Wall Street is Watching

GOOG, GOOGL – Shares of Alphabet will be in focus tonight, as the company is set to report its Q1 results. According to Bloomberg, analysts expect adjusted earnings of about $2.05 a share on revenue of $75.4 billion. However, the bigger focus is likely to be on the regulatory environment that the company is trying to navigate. Check out the charts for GOOG.

INTC – Intel will also report earnings tonight and bulls are hoping that some of the reassuring reports from other firms — like Taiwan Semiconductor and Texas Instruments — will mean good things for Intel too. While INTC shares are actually up 2.7% so far this year, the stock has struggled badly over the past 12 months, down 40%.

CMG – Shares of Chipotle are moving lower this morning following the company’s mixed quarterly results. Earnings of 29 cents a share beat estimates of 28 cents a share, while revenue of $2.9 billion missed expectations of $2.94 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.