The Daily Breakdown previews the last Fed meeting of 2024, where they are expected to cut interest rates by 25 basis points.

Wednesday’s TLDR

- Fed is expected to cut rates

- But the 2025 outlook is key

- Birkenstock jumps on earnings

What’s happening?

The market has been really weird lately, (I’ll dive into that later this week). And by “weird” I’m talking about things like the Dow being down in nine straight sessions, yet stocks on the whole still look pretty good with the S&P 500 up 0.3% for the month, while the Nasdaq 100 is up more than 5%.

Will any of this change with the Fed?

Today at 2 p.m. ET, the Fed will make its final interest rate decision of 2024 and it’s expected that they will cut rates by 25 basis points. (This is a good Fed watch tool, by the way).

It would mark the third time the Fed has cut rates this year and will bring the total size of the cuts to 100 basis points (a 50 bps cut in September, 25 bps in November, and an assumed 25 bps today).

Perhaps more important than today’s rate decision will be the Fed’s outlook.

Known formally as the Fed’s Summary of Economic Projections — and informally referred to simply as the Fed’s “dot plot” — will give us an outlook on how many rate cuts the Fed expects in 2025. It will also tell us the Fed’s outlook for other measures, like inflation and unemployment.

The Fed’s outlook is not gospel; it changes just like estimates for other events (like earnings or economic reports). But when it comes to the short- and intermediate-term narrative, the Fed’s outlook and Chairman Powell’s commentary will steer the ship.

Want to receive these insights straight to your inbox?

The setup — XRT

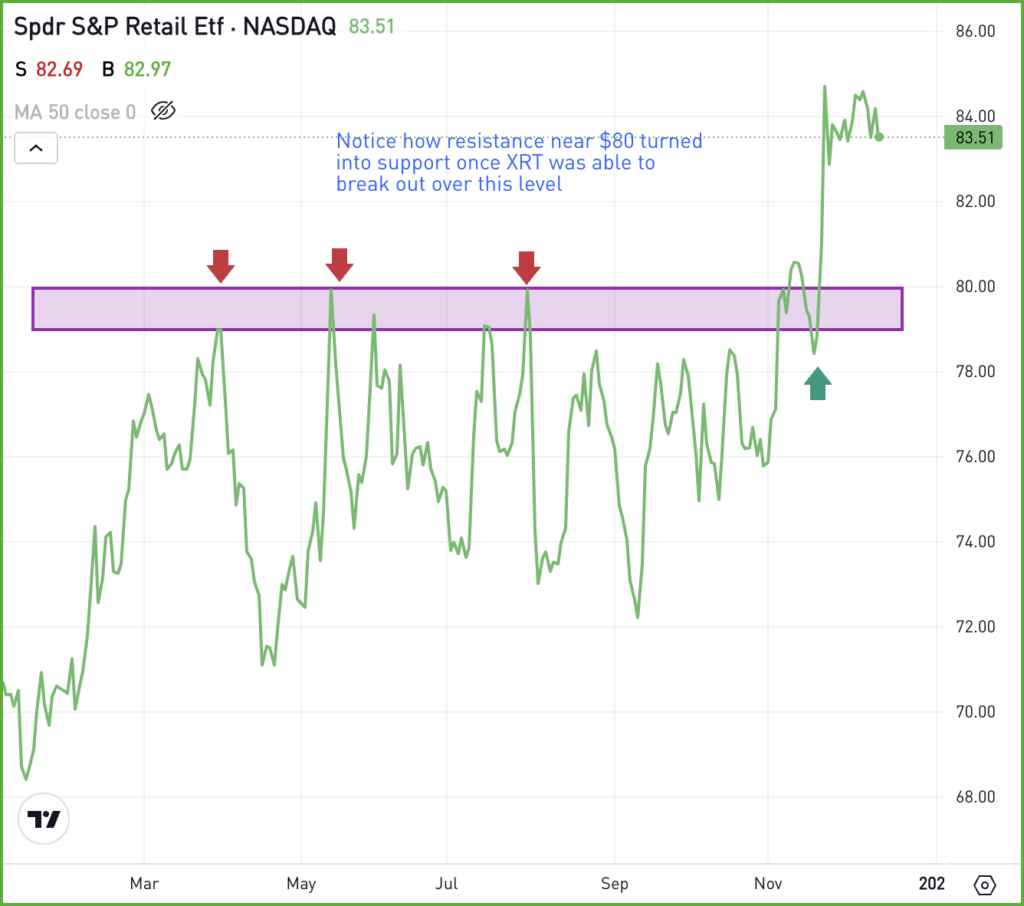

Retail stocks have been in focus with the holiday season currently under way. That’s also clear with the breakout in the S&P Retail ETF — the XRT.

This fund is different from something like the consumer discretionary fund (the XLY), which is market-cap weighted and dominated by firms like Amazon and Tesla. Instead, the XRT is an equal-weighted fund, meaning each stock in the portfolio has roughly the same allocation.

Holdings in the XRT include stocks like Carvana, GameStop, Warby Parker, and Walmart, among many others.

Notice how the XRT was able to clear the key $80 level, which was previously a stiff area of resistance. Now above that mark, bulls want to see this area hold as support on future pullbacks.

If it does, the ETF’s momentum can remain with the bulls. However, if the XRT breaks back below this zone, bearish momentum could accelerate.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GIS — Shares of General Mills are moving lower this morning, despite the firm beating on its fiscal Q2 earnings and revenue expectations. The culprit? Management’s guidance for the remainder of the year, as it was more downbeat than analysts had expected.

BIRK — On the flip side, shares of Birkenstock are rallying this morning following better-than-expected quarterly results. Revenue climbed 22% year over year, while earnings more than doubled amid strong consumer demand.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.