What Happened This Week (4th July – 8th July)

Them’s the breaks.

For those of you who don’t know what that means, I assure you, you are not alone. Boris Johnson used the phrase during his resignation speech yesterday and supposedly it means ‘that is the way things happen; that’s life’.

I don’t think this was a massive surprise, especially how the week unfolded with more and more senior resignations and as a final kick in the teeth for the UK Prime Minister, UK related markets decided to rally higher following his departure. There are a few reasons for this of course and it is worth noting that there is no guarantee it will be long lasting. Firstly, this had been expected, the resignation. So when it was announced we essentially had a ‘sell the rumour, buy the fact’ scenario. Also, on Thursday, generally markets were going higher anyway so I would tread cautiously as there is still a high degree of uncertainty right now. For those who are interested in seeing who is the early front runner for the new PM, you can see so HERE.

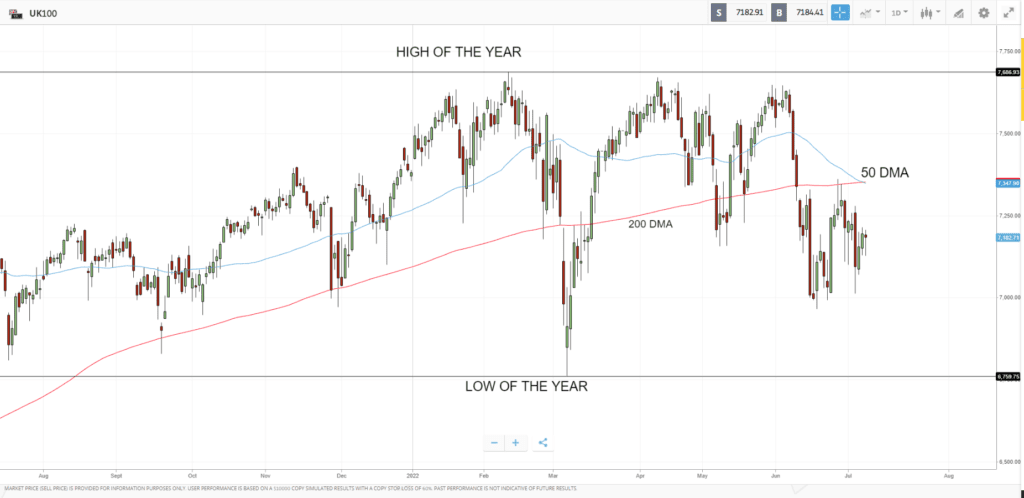

For the UK, everything else has taken a back seat as you would expect. Data wise we knew it would be quite a quiet week and the FTSE 100 has fared pretty well all things considered. However, the Great British Pound is on course for another poor week unless it stages a miraculous recovery into the close of play. Investors and traders alike will be debating whether the GBP can have a change of fortunes anytime soon but when you weigh it up, even the most positive of people may err on the side of caution. We are seeing the higher cost of living and energy prices, the potential recession and economic data struggling too. With Boris stepping down, this uncertainty is not going to help and when you add in the US Dollar safe-haven flows, GBPUSD could continue its move lower.

Chart In Focus

Winners & Losers from the FTSE 100

Winners

Auto Trader Group PLC – Having found support in Mid-June, share price has moved almost 20% higher

Ashtead Group – Breaking back above its previous low of the year has given the industrial and construction equipment rental company a much needed boost

Experian PLC – Similar to Ashtead Group, now on course for its third straight weekly gains.

Losers

Entain PLC – Disastrous week for share price as they cut their online revenue guidance as cost of living hits internet betting

Standard Chartered – After making a new high for the year profit taking has sent share price lower this week

British American Tobacco – Having made a new multi-year high last week, it suffers its worst week since February

Next Week

The likelihood is that most of the focus will be around the political mess in the UK. Who will be the new Prime Minister? Will there be a temporary one? Will they be positive or negative for the GBP and FTSE? Someone may come in who is more favourable for markets and this could be a positive or on the flipside the new Prime Minister could be in favour of tighter measures and we see a negative reaction. One thing is for sure though, this is a long way from being concluded.

Looking at the economic data calendar, the only standout is May’s GDP reading. We haven’t had a positive month on month number since January, with April’s report showing a -0.3% number. Can we get a positive result? Unlikely.

It is worth noting that from a data standpoint, UK markets will likely be influenced by the main event of the week – US Inflation from June. Market participants all over the globe will be hoping to see a lower-than-expected number which could give everything a timely boost. However, if 2022 has taught us anything, it is to approach these key economic highlights with caution and to expect the unexpected.

Quiz Question

For those that tuned in, hopefully you managed to answer 1984 for when the FTSE 100 was created. Is anyone 2 from 2?

Anyway, for our question this week I guess we have to keep it topical. Which UK Prime Minister has had the shortest post-war tenure from the list below?

a) Boris Johnson

b) Gordon Brown

c) Theresa May

Not a prize you really want to win, is it?

See you all next week, enjoy your weekends!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.