Although we saw some positive signs such as the tech-heavy NASDAQ posting its first week out of four in the green, the spectre of COVID-19 continues to hamper market confidence with fears of a second outbreak in the UK and France, plus a further increase in cases in the USA, which is keeping investors on their toes. Despite this uncertainty (and perhaps unsurprisingly), there were strong individual performances from the medical and diagnostics sector with Owens & Minor Inc. and Exact Sciences Corp., the top weekly gainers on the NYSE and NASDAQ respectively. In addition, recent tech IPOs from Unity, Snowflake and JFrog continued to post significant weekly gains.

Last Week’s Top 5 Market Winners

Nasdaq Stock Market (NASDAQ)

- Exact Sciences Corp. CEO Kevin Conroy announced at Cowen’s Liquid Biopsy Summit that the company will be the leader in the liquid biopsy market over the next 5 years, resulting in a 26.11% rise in value and a closing price of $97.70.

- JFrog Ltd. continued its hot streak following the company’s IPO on September 16th, posting a 16.90% weekly gain to close at $75.73. This represents a 72% increase from its initial IPO value of $44.

- Bed Bath & Beyond Inc. saw a solid 15.68% rise following price target upgrades from investment banks, Baird & Raymond James. The appointment of new Chief Technology Officer, Scott Lindblom may also have had a positive impact on price.

- Roku Inc. saw a 13.68% surge in price after confirming that NBC’s streaming service Peacock will be available on its platform of digital media players with the ad-sharing agreement of particular interest to market observers.

- Natera Inc. rose 13.38% last week possibly due to the market hedging its bets on its upcoming earnings report, to be released on November 4th. This is despite some Wall Street brokerages predicting less than stellar results.

| NASDAQ TOP-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| Exact Sciences Corp (EXAS) | 20.23 (+26.11%) | $97.70 USD | Consumer Goods |

| JFrog Ltd. (FROG) | 10.95 (+16.90) | $75.73 USD | Consumer Goods |

| Bed Bath & Beyond Inc. (BBBY) | 1.97 (+15.68%) | $14.53 USD | Services |

| Roku Inc. (ROKU) | 21.96 (+13.68%) | $182.43 USD | Services |

| Natera Inc. (NTRA) | 8.10 (+13.38%) | $68.62 USD | Consumer Goods |

New York Stock Exchange (NYSE)

- Dual announcements last week from Owens & Minor Inc. confirming adjusted earnings for 2020 that were 66% higher than their previous projection, plus the deployment of PPE equipment in the USA ahead of schedule, saw their value rise by 41.98% to close at a price of $20.36.

- Speculation on the Cubic Corp. takeover bid by Elliott Management and Veritas Capital resulted in a weekly increase of 32.14% in their share value to close at $58.63.

- Another strong IPO performer this month, Unity Software Inc. rose another 31.46% last week to close at $89.85. This is around 20% higher than its opening price of $75.

- Chinese social networking service, Renren Inc. continued to coast on its Q2 earnings report with a weekly increase of 25.26%.

- Online car dealership, Carvana Corp. released an encouraging Q3 revenue forecast last week which resulted in a 23.35% rise in value.

| NYSE TOP-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE (Positive) | CURRENT TRADING PRICE | SECTOR |

| Owens & Minor Inc. (OMI) | 6.02 (+41.98%) | $20.36 USD | Services |

| Cubic Corp. (CUB) | 14.26 (+32.14%) | $58.63 USD | Technology |

| Unity Software Inc. (U) | 21.50 (+31.46%) | $89.85 USD | Consumer Goods |

| Renren Inc. (RENN) | 0.7400 (+25.26%) | $3.67 USD | Technology |

| Carvana Co. (CVNA) | 38.48 (+23.35%) | $203.26 USD | Consumer Goods |

Last Week’s Top 5 Market Losers

Nasdaq Stock Market (NASDAQ)

- Fossil Inc. continued its steady decline in value with its share price experiencing a weekly drop in value of 25.15%, although no specific factor has been identified as the cause.

- An adverse clinical data readout in their RESOLVE-1 study of lenabasum continues to haunt Corbus Pharmaceuticals Holdings Inc. with a weekly decrease in share value of 17.63%.

- An adverse earnings report released on September 24th triggered a 16.18% drop for CalAmp Corp.

- Office Depot, Inc. fell by 15.31%, which may be due to a combination of renewed COVID-19 fears causing stricter lockdowns and a natural price correction following an 80% rise in value since March 2020.

- Cellectis S.A. may be seeing the initial impact of an increased short interest that began in August with its weekly share value dropping by 14.75%.

| NASDAQ WORST-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| Fossil Group Inc. (FOSL) | -2.04 (-25.15%) | $6.07 USD | Consumer Goods |

| Corbus Pharmaceuticals Holdings Inc. (CRBP) | -0.33 (-17.63%) | $1.56 USD | Healthcare |

| CalAmp Corp. (CAMP) | -1.41 (-16.18%) | $7.33 USD | Services |

| Office Depot, Inc. (ODP) | -3.31 (-15.31%) | $18.31 USD | Services |

| Cellectis S.A. (CLLS) | -3.07 (-14.75%) | $17.74 USD | Industrial Goods |

New York Stock Exchange (NYSE)

- Rite Aid Corp. took another battering last week with forecasts signalling further losses next year, resulting in a 25.60% decrease in share price.

- An excessive debt load coupled with external factors impacting the sector signalled more pain for Transocean Ltd. with its weekly share value dropping 24.54%.

- Continued quarterly losses, a C$1.8 billion impairment charge and a revolving door of CEOs resulted in further weekly decreases for Aurora Cannabis Inc. with its share value dropping by 22.16%.

- The lacklustre performance of crude oil prices continues to negatively impact the sector as a whole with Apache Corp. dropping 22.13% and SM Energy Co. dropping 19.63%.

| NYSE WORST-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| Rite Aid Corporation (RAD) | -3.440 (-25.60%) | $10.00 USD | Services |

| Transocean Ltd. (RIG) | -0.2601 (-24.54%) | $0.80 USD | Basic Materials |

| Aurora Cannabis Inc. (ACB) | -1.4388 (-22.16%) | $5.05 USD | Healthcare |

| Apache Corporation (APA) | -2.80 (-22.13%) | $9.85 USD | Basic Materials |

| SM Energy Co. (SM) | -0.4200 (-19.63%) | $1.72 USD | Consumer Goods |

Highlights and Lowlights

Good Times Ahead Predicted for new tech IPOs

September has ushered in IPO season with Snowflake Inc. (SNOW), Unity Software Inc. (U) and JFrog Ltd. (FROG) all providing stellar returns for early investors.

Snowflake, initially valued at $75-$85 went public at $120 and is currently trading at $229 as of last week. Unity, which is up 71% from its initial IPO price of $52, was given its first buy rating from Wall Street on Friday with investment bank, D.A. Davidson setting a target of $100. JFrog Ltd. went public with an IPO value of $44 and promptly skyrocketed 50% during the first day of trading. It currently sits at $75.73 at the time of writing.

While many investors may see these as great opportunities, like any IPO it is advisable to approach these high risk/high return investments with caution and do your homework before committing to buy.

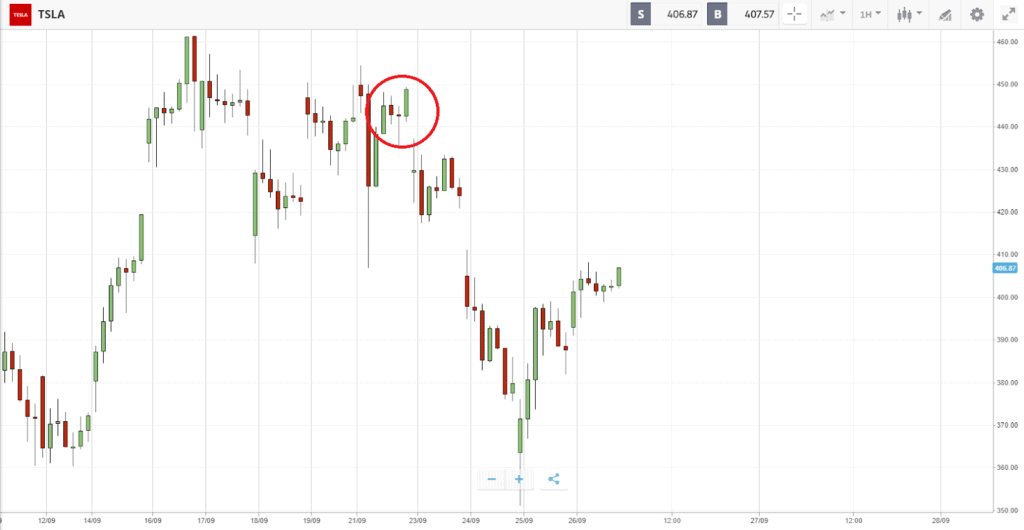

Tesla Battery day Fails to Recharge Share Price

Despite Elon Musk declaring that Battery Day on September 22nd would be ‘insane,’ his announcement to halve the cost of battery-operated vehicles within three years failed to reinstill market confidence, with $70 billion being shed from Tesla’s market cap last week. Many analysts have pointed to the lack of a tangible plan to back up these claims as a key reason for the continued downward slide. It appears that the ‘hype over substance’ well that Tesla has been relying on for much of this year may be starting to run dry.