This week the markets took a negative turn as, once again, the stimulus conversation did not seem to be reaching any sort of conclusion. With House speaker Nancy Pelosi walking back her deadline for a fiscal stimulus bill, the market was left uncertain as to whether a stimulus deal would be put in place any time soon. With many earnings reports still to come and a looming election, it is not surprising to see the markets failed to make a strong move in either direction, as investors continue to be cautious due to the rising number of coronavirus cases in the US.

Last Week’s Top Five Market Winners

Nasdaq Stock Market (NASDAQ)

- 9F climbed an impressive 54.10% despite an investigation into its IPO over concerns of possible breaches of fiduciary duties.

- Orthodontic device maker Align Technology jumped 38% for the week, after excellent third quarter results.

- Restaurant chain Dave & Buster Entertainment saw a welcome gain of 26% this week, after the company announced a plan to increase liquidity by selling 500 million worth of senior secured debt.

- Avis budget group showed investors it is not the next Hertz and climbed up 26% to $40.41.

- Cannabis company Tilray was riding high again this week, up 21% due to election speculation over a possible democratic party victory, which would very likely assist the cannabis sector’s future.

| NASDAQ TOP-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| 9F Inc. (JFU) | 0.4880 (+54.10%%) | $1.39 USD | Technology Services |

| Align Technology Inc. (ALGN) | 130.04 (+38.53%) | $470.62 USD | Health Technology |

| Dave & Buster Entertainment Inc (PLAY) | 4.28 (+26.47%) | $20.43 USD | Consumer Services |

| Avis Budget Group Inc (CAR) | 8.43 (+26.38%) | $40.41 USD | Finance |

| Tilray Inc. (TLRY) | 1.17 (+21.04%) | $6.72 USD | Process Industries |

New York Stock Exchange (NYSE)

- Snapchat exploded this week, gaining 54% off the back of a huge third quarter earnings and user growth.

- Oasis petroleum showed some signs of life this week, climbing a respectable 31% after its bankruptcy announcement pulled the stock low earlier this month.

- Despite its looming merger, CIT group has gained 25% this week, as encouraging third quarter results increased the appeal of an already existing stock.

- Pinterest went to an all-time high, gaining 20% this week, as its peer Snapchat delivered stellar third quarter results, leading analysts to expect Pinterest to do the same.

- Cinema stock Cinemark jumped 19% this week as news of an ease in pandemic-related shutdowns gave a glimmer of hope that the company’s movie theatres would reopen soon.

| NYSE TOP-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE (Positive) | CURRENT TRADING PRICE | SECTOR |

| Snapchat Inc (SNAP) | 15.27 (+54.93%) | $43.16 USD | Technology Services |

| Oasis Petroleum (OAS) | 0.0373 (+31.61%) | $0.1556 USD | Energy Minerals |

| CIT Group (CIT) | 6.30 (+25.20%) | $31.30 USD | Finance |

| Pinterest Inc (PINS) | 8.94 (+20.29%) | $53.09 USD | Technology Services |

| Cinemark Holdings Inc (CNK) | 1.50 (+19.08%) | $9.35 USD | Consumer Services |

Last Week’s Top Five Market Losers

Nasdaq Stock Market (NASDAQ)

- Intercept Pharma took a hit of 15% this week as analysts labeled the stock overweight and under-performing.

- Backing off from a strong run the previous week, NIU Technologies dropped 14%.

- Sumo Logic stands on the outside of a tech rally this week, closing down 14% amid concerns of slowing growth.

- Education IPO Vitru Limited had a harsh end to an otherwise hopeful month, dropping 13%.

- Vaccine stock Novavax closed down 13% for the week, after analysts lowered the price target for the stock.

| NASDAQ WORST-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| Intercept Pharma (ICPT) | -5.52 (-15.85%) | $29.33 USD | Health Technology |

| NIU Technologies (NIU) | -4.55 (-14.26%) | $27.38 USD | Consumer Durables |

| Sumo Logic Inc (SUMO) | -3.02 (-13.70%) | $19.03 USD | Technology Services |

| Vitru Limited (VTRU) | -1.85 (-13.02%) | $12.42 USD | Commercial services |

| Novavax Inc (NVAX) | -13.91 (-13.00%) | $93.27 USD | Health Technology |

New York Stock Exchange (NYSE)

- Hertz stock dropped 30% this week, as investors took advantage of last week’s high to cash out of the struggling car rental company.

- United Natural Foods took a hit of 17% this week, as it continued to struggle through a weak fourth quarter earnings report.

- Virgin Galactic closed the week down 14% after popular short seller Jim Chanos stated that he loved space stocks, but was later revealed to be joking, which the market seemed to react to dramatically indeed.

- Online insurance platform Lemonade tumbled 13% this week after negative coverage from both Credit Suisse and Goldman Sachs, reiterating that the stock was at a sell rating.

- Recreation vehicle producer Winnebago lost 12% this week, despite posting a higher than expected $1.45 earnings per share.

| NYSE WORST-PERFORMING STOCKS | |||

| STOCK | WEEKLY CHANGE | CURRENT TRADING PRICE | SECTOR |

| Hertz Global Holdings Inc (HTZ) | -0.75 (-30.00%) | $1.76 USD | Finance |

| United Natural Foods Inc (UNFI) | -3.34 (-17.14%) | $16.19 USD | Distribution Services |

| Virgin Galactic Holdings Inc (SPCE) | -3.30 (-14.71%) | $19.17 USD | Electronic Technology |

| Lemonade Inc (LMND) | -7.90 (-13.39%) | $51.12 USD | Finance |

| Winnebago Industries Inc (WGO) | -6.82 (-12.36%) | $48.41 USD | Consumer Durables |

Highlights and Lowlights

ANT Group IPO gets final greenlight from regulators

Fintech company ANT Group received the green light from the Chinese securities regulator on Wednesday to go ahead with their massive dual-offering IPO across both the Shanghai and Hong Kong stock exchanges. ANT Group is expected to set a new record for initial offerings, with analysts reporting the company could generate as much as $30 billion off the back of both IPOs, with a company wide valuation of $270 Billion.

As one of the world’s largest online payment platforms, ANT Group is already heavily embedded within the Chinese financial landscape, with the company’s premier payment app, ‘Alipay,’ alone serving 731 million active monthly users for a cool $17.7 trillion worth of transactions. Further highlighting the company’s strength within the Chinese market, strategic Chinese investors have already agreed to take on 80% of the Shanghai stock offerings.

The decision to avoid listing on US-based exchanges, despite the landmark success of Alibaba’s IPO on the New York stock exchange, should come as no surprise, as we have seen Chinese companies be increasingly wary of Wall Street over the course of the year. This, of course, comes off the back of increased tensions between Washington and Beijing, which have led the US government to take a stronger stance on Chinese tech companies, with popular apps Tik Tok and weChat being the primary targets.

Intel Looking to take advantage of China-US tensions

With the sale of their flash memory production business to South Korean firm SK Hynix Inc. for a quick 9 billion, Intel is looking towards fast-growing industries such as5G technology and AI-driven computing to reinvest capital generated from the sale. Specifically, Intel CEO Bob Swan highlighted the opportunities presented by the US government’s strict stance on Chinese tech company Huawei, which resulted in the ban on Huawei-produced 5G infrastructure. This represents a unique opportunity for Intel to diversify their offering outside of the production of central processing units and into the chips that will power the 5G networks of tomorrow. This supply chain opportunity, however, comes with the obvious caveat that Intel is still heavily reliant on the continued sale of their chips to Chinese tech manufactures, and increasing restrictions between the two economies will inevitably have consequences for their bottom line going forward.

Hold on tight, pandemic continues to worsen across the globe

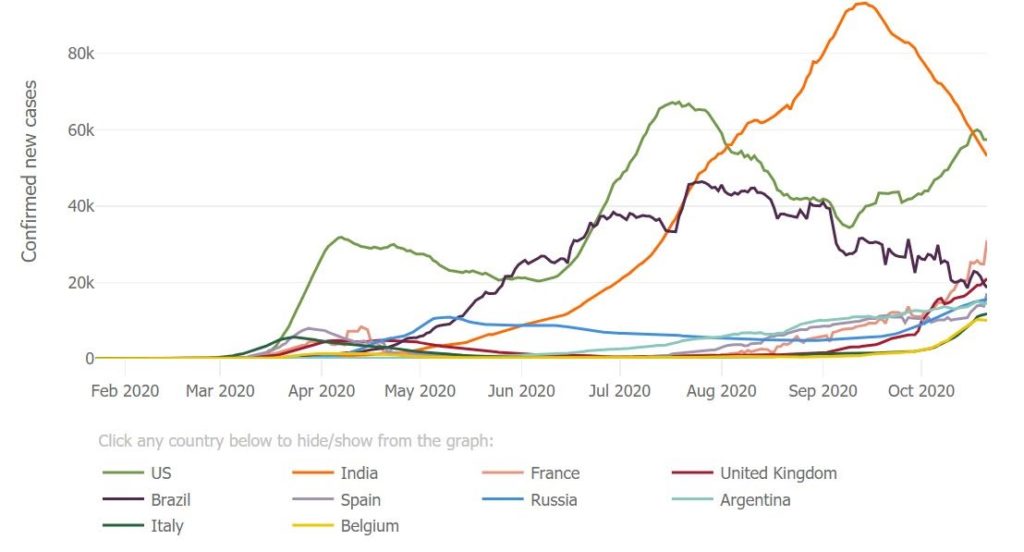

This week we saw hospitalizations due to Covid-19 across the US reach a new two month record. This comes alongside news of a record number of cases in Germany and a statement from the Spanish health minister saying that the spread of the coronavirus is out of control in certain parts of the country. As you can see in this data from the John Hopkins University, cases are once again trending upwards globally:

Source: John Hopkins University

The resurgence of the virus across Europe and America in this so-called second wave has investors worried about the possibility of a drawn-out pandemic, with continued debate surrounding when, or even if, a vaccine will be found. Expect the market to continue to react strongly to all vaccine-related news headlines going forward.