The past week brought with it some interesting results from Immunomedics and a host of other companies in the healthcare sector. The wider stock markets continue to surprise too, with some large losses and strong wins recorded by companies on the Nasdaq and NYSE. Check out our weekly stock market update and find out which companies faltered, and which posted positive results, the lowlights and highlights of the last seven days, and our forecast for the week ahead.

Last Week’s Market Winners

Nasdaq Stock Market (NASDAQ)

Over the last week, some strong movement was made on the Nasdaq Stock Market by Immunomedics Inc. (IMMU), Arrowhead Pharmaceuticals Inc. (ARWR), Novocure Ltd. (NVCR), Exelixis Inc. (EXEL) and Intellia Therapeutics Inc. (NTLA).

- Immunomedics Inc. (IMMU) stocks surged ahead +102.44% week on week after a $21 billion buyout agreement was made between the company and Gilead Sciences (GILD).

- Interim data from a clinical trial undertaken by Arrowhead Pharmaceuticals Inc. (ARWR) revealed positive results for a liver disease drug, with stocks seeing a weekly growth of +29.78% in response.

- Operating in the healthcare sector, Novocure Ltd. (NVCR) stocks saw another week of growth, with a +24.06% boost to stock value occurring after the CEO and several directors and officers sold off a substantial amount of shares.

- Exelixis Inc. (EXEL) stocks saw strong growth of +23.33% after new preclinical data for a drug treating diverse solid tumours was released.

- After Goldman Sachs initiated a buy rating of Intellia Therapeutics Inc. (NTLA) stocks, their value increased by +22.13%.

New York Stock Exchange (NYSE)

The last seven days also saw positive growth for Renren Inc. (RENN), GameStop Corp. New (GME), R.R. Donnelley & Sons Co. (RRD), Oasis Petroleum Inc. (OAS) and Arch Coal Inc. (ARCH) on the NYSE.

- Renren Inc. (RENN) stocks continue to grow in value following news that the company posted a 582% revenue increase across the second quarter of 2020.

- GameStop Corp. New (GME) stocks jumped +55.50% week on week after several Wall Street analysts announced new upgrades of the stock.

- The past week saw growth in R.R. Donnelley & Sons Co. (RRD) stocks after the company reported a profit of $214.8 million and revenue of $1.16 billion.

- Oasis Petroleum Inc. (OAS) stocks improved by +31.42% over the week, although the cause behind this growth is currently unclear.

- A +29.91% growth in share value was noted for Arch Coal Inc. (ARCH), although the cause behind this growth is currently unclear.

| NASDAQ STOCK MARKET (NASDAQ) | ||

| STOCK | WEEKLY CHANGE (Positive) | SECTOR |

| Immunomedics Inc. (IMMU) | 43.28 (+102.44%) | Consumer Goods |

| Arrowhead Pharmaceuticals Inc. (ARWR) | 9.89 (+29.78%) | Consumer Goods |

| Novocure Ltd. (NVCR) | 21.48 (+24.06%) | Consumer Goods |

| Exelixis Inc. (EXEL) | 5.07 (+23.33%) | Consumer Goods |

| Intellia Therapeutics Inc. (NTLA) | 4.26 (+22.13%) | Industrial Goods |

| NEW YORK STOCK EXCHANGE (NYSE) | ||

| STOCK | WEEKLY CHANGE (Positive) | SECTOR |

| Renren Inc. (RENN) | 1.2700 (+76.51%) | Technology |

| GameStop Corp New (GME) | 3.38 (+55.50%) | Services |

| R.R. Donnelley & Sons Co. (RRD) | 0.3600 (+31.58%) | Services |

| Oasis Petroleum Inc. (OAS) | 0.1179 (+31.42%) | Consumer Goods |

| Arch Coal Inc. (ARCH) | 12.18 (+29.91%) | Consumer Goods |

Last Week’s Market Losers

Nasdaq Stock Market (NASDAQ)

From the Nasdaq Stock Market’s weekly performance, Qurate Retail Group Inc. (QRTEA), Illumina (ILMN), CBRL Group Inc. (CBRL), TravelCenters of America LLC (TA) and First Solar Inc. (FSLR) all fared worse than expected.

- Qurate Retail Group Inc. (QRTEA) stocks dropped by -32.74% last week, although the cause of this decline is currently unclear.

- Illumina (ILMN) stocks fell after news broke that the company was in discussions to purchase Grail, a company involved in the cancer diagnostics space. With the high cost of Grail and previous buyout failures in mind, the value of stocks fell by -15.55% week on week.

- News of a quarterly loss by CBRL Group Inc. (CBRL) saw stocks fall by -13.53% over the past week.

- TravelCenters of America LLC (TA) stocks fell by -11.92%, although the cause of this decline is currently unclear.

- The value of First Solar Inc. (FSLR) stocks dropped by -11.67% following news that 8.6 million shares would be sold off by Walmart heir Lukas T. Walton at a below market price.

New York Stock Exchange (NYSE)

On the New York Stock Exchange, the week’s losers included ADT Inc. (ADT), Carnival Corp. (CCL), Coty Inc. (COTY), Citigroup (C) and Genworth Financial Inc. (QEP).

- ADT Inc. (ADT) stocks fell -20.37% off the back of an announcement of a secondary offering of 43.5 million shares.

- As cruise stocks took a hit last week, Carnival Corp. (CCL) stocks dropped by -13.45%.

- Coty Inc. (COTY) stocks took a hit (-13.11%) after a class action was announced on behalf of shareholders.

- The value of Citigroup (C) stocks fell by -12.04%, although the cause of this decline is currently unclear.

- Genworth Financial Inc. (GNW) stocks fell by -11.59%, although the cause of this decline is currently unclear.

| NASDAQ STOCK MARKET (NASDAQ) | ||

| STOCK | WEEKLY CHANGE (Negative) | SECTOR |

| Qurate Retail Group Inc. (QRTEA) | -3.48 (-32.74%) | Consumer Goods |

| Illumina (ILMN) | -54.43 (-15.55%) | Healthcare |

| CBRL Group Inc. (CBRL) | -18.51 (-13.53%) | Consumer Goods |

| TravelCenters of America LLC (TA) | -2.55 (-11.92%) | Services |

| First Solar Inc. (FSLR) | -8.16 (-11.67%) | Technology |

| NEW YORK STOCK EXCHANGE (NYSE) | ||

| STOCK | WEEKLY CHANGE (Negative) | SECTOR |

| ADT Inc. (ADT) | -2.23 (-20.37%) | Industrial Goods |

| Carnival Corp. (CCL) | -2.38 (-13.45%) | Consumer Goods |

| Coty Inc. (COTY) | -0.46 (-13.11%) | Consumer Goods |

| Citigroup (C) | -6.14 (-12.04%) | Financial |

| Genworth Financial Inc. (GNW) | -0.43 (-11.59%) | Financial |

Highlights and Lowlights

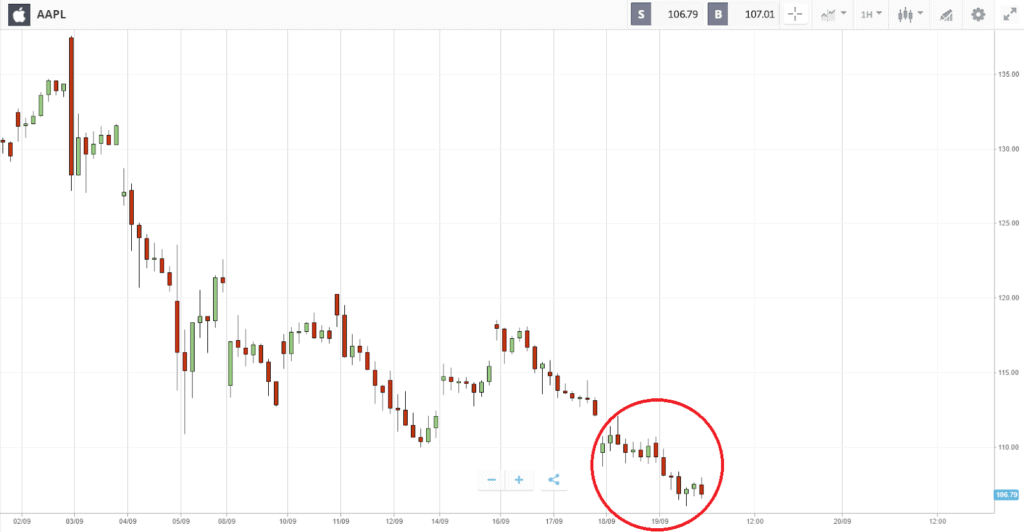

Apple’s new products fail to excite

Despite a number of new product announcements last week, tech giant Apple (AAPL) failed to excite investors. With a new iPad Air, a 6th generation Apple Watch and more information on subscription bundles revealed, stocks closed relatively steady.

US Federal Reserve predict interest rate flatline

The result of a two-day policy meeting, projections released by the US Federal Reserve indicate that interest rates are unlikely to rise any time soon. Rates close to zero are expected to be maintained until 2023 at the earliest, unless a tight labour market is established and inflation rises above 2%.

What is in Store for the Market this Week?

In the US, uncertainty remains around the development of a new COVID-19 stimulus package. Both major parties are currently locked in a stalemate, with President Donald Trump signalling that he may even back a larger relief package. There is still no word on when a new package may be confirmed or what it may entail, but traders continue to keep an eye on Washington for any new progress.

Markets continue to remain unsteady following the tech stock crash that occurred earlier in the month. Although a swifter recovery was predicted by some, the consensus among leading analysts is that it is unlikely that stocks will exceed any peaks recorded prior to the crash earlier this month. It will be a waiting game to see whether the current trend continues or if we will see a recovery soon.