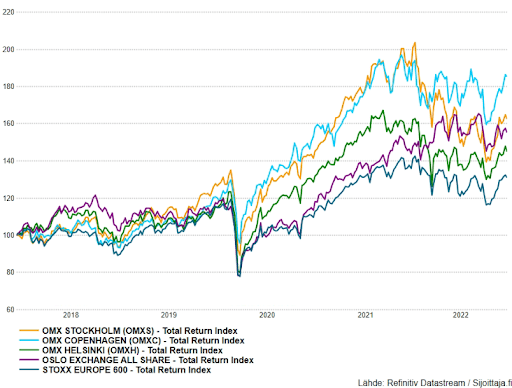

Nordic stock exchanges have offered competitive returns. All Nordic countries have performed better than the STOXX Europe 600 index over a period of three and five years. In the five-year period, Danish stocks have achieved the best returns. We asked top Nordic stock picks from cooperation partner in the region Sijoittaja.fi

Nordic stock exchanges differ from each other and offer a diversification benefit. Finland and Sweden are very finance and industry focused, but there are also globally known consumer companies on the Swedish stock exchange. Norway is energy-intensive and Denmark’s specialty is the high weight of the healthcare sector.

Stock picks from the Nordic stock exchanges

We ranked the stocks of Nordic stock exchanges and selected three interesting stocks from each Nordic stock exchange. All those stocks are available for purchase on eToro. The stocks have been selected using quantitative models and our own investment vision.

TOP 3 stocks from Finland

We start stock picking in our home country Finland. Our TOP 3 stock selections are Huhtamaki, Neste and UPM.

Huhtamaki is a global provider of sustainable packaging solutions for consumers and food service customers. The company’s products are renewable, recyclable, and biodegradable. Company’s customers are big global players like Mc Donald’s and Starbucks.

Huhtamaki had a very strong Q3. Net sales increased 31% to 1 178 million euros. The company has pricing power, as the operating profit margin remained at the level of the comparison period at 8.6 percent.

In the current year, Huhtamaki has suffered from China’s covid lockdowns, but the situation is improving, because China has eased its restrictions.

Neste is the world’s largest producer of renewable diesel refined from waste and residues and has renewable solutions to the aviation and plastics industries. Neste is also a technologically advanced refiner of high-quality oil products.

Neste’s Q3 comparable operating EBIT exceeded analysts’ estimate and was 821 M€. Investors especially follow the profit development of renewable products. The result of the renewable products segment was good despite the negative impact of margin protection and logistical delays in product deliveries. The renewable products segment’s comparable EBITDA for the third quarter was EUR 389 million (analysts’ estimate 357 million). Neste also expects a strong Q4.

UPM consists of six separate business areas: UPM Fibres, UPM Energy, UPM Raflatac, UPM Specialty Papers, UPM Communication Papers and UPM Plywood. UPM’sd growth areas are: fibre products, specialty packaging materials and biorefining.

UPM reached all-time high quarterly results in Q3. Sales grew by 36% to EUR 3,420 million, and comparable EBIT grew by 84% to EUR 779 million. Both exceeded analysts’ estimates.

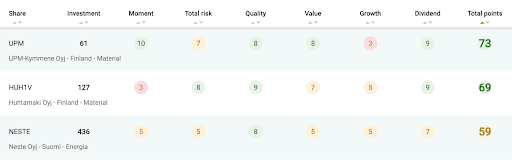

Quality stocks with good dividends from Finland

Our quantitative model gives all three stocks good total points. UPM is an excellent dividend stock that has strong momentum. Neste is a quality stock that has growth. Huhtamaki is a low risk quality dividend stock.

TOP 3 stocks from Sweden

Our TOP 3 stock picks from Sweden are: Assa Abloy, Boliden and Evolution.

Assa Abloy is one of the most famous Swedish companies and Abloy’s locks are known all over the world. Assa Abloy operates in more than 70 countries and employs approximately 48,000 employees. Assa Abloy is a global leader in access solutions.

CEO said that Assa Abloy had a very strong third quarter with an organic growth of 14 percent, and operating income grew 47 percent from Q3 last year, which is a big acceleration. Management sees a good momentum in Assa Abloy’s markets.

Boliden is an almost hundred-year-old mining company that owns mines and smelters. Boliden’s vision is to be the most climate friendly and respected metal provider in the world. The company mines, processes and transports valuable and useful metals such as zinc, copper, nickel, cobalt, lead, silver and gold for industrial needs. The company has benefited in 2022 from high metal prices.

Boliden has its own electricity production. Around 80% of electricity consumption secured for next two years (2023-2024).

In Q3 Operating profit excluding revaluation of process inventory increased to SEK 3,484 m (2,419). A stronger USD, higher by-product prices and higher metal premiums had a positive effect. Volumes were largely unchanged.

Evolution AB is a Swedish company that develops digital casino games. Evolution develops, produces and licenses fully integrated B2B online casino solutions for other players in the gaming industry. Currently, the company employs more than 10,000 employees in Europe and North America.

Evolution is a growth company. In Q3, Evolution’s turnover was 379 million euros, an increase of 37% from a year ago. The company’s operating result was 236.4 million euros. The company is very profitable. According to its guidance for 2022 Evolution estimates the EBITDA to be between 69 – 71%.

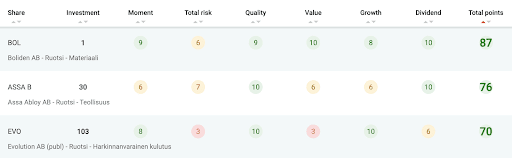

High growth and low valuation from Sweden

Our quantitative model gives high scores for these Swedish stocks. Boliden has rather low valuation figures. Evolution is one of the fastest growing listed companies in the Nordic countries and Assa Abloy is perhaps the best quality industrial company in the Nordic countries.

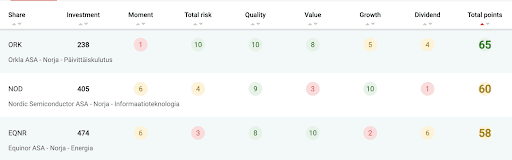

TOP 3 stocks from Norway

Norwegian TOP 3 stocks are: Equinor, Nordic Semiconductor and Orkla.

The energy sector has been the best sector in 2022 in terms of return. That’s why we wanted to choose one traditional energy sector stock from the Nordic countries. Our choice is Equinor, which is the largest company on the Oslo Stock Exchange in terms of turnover and market value.

Equinor’s adjusted earnings after tax has been stunning 16,9 billion dollars for the first nine months of 2022.

Nordic Semiconductor ASA is a Norway-based fabless semiconductor company that specializes in wireless communication technology that powers the Internet of Things (IoT). The Company is engaged in the development of solutions for short-range wireless communication.

The stock has clearly fallen from the peak levels of 2021, but the business is still in strong traction. Nordic Semiconductor delivered 36% revenue growth to USD 202 million in the third quarter. Gross profit was 57% in the third quarter. Company has a backlog of USD 1.1 billion, this provides good coverage for the company’s overall 2023 revenue target of USD 1 billion. Wafer supply constraints do however represent an increasing risk factor. Nordic Semiconductor aims to more than double revenue from 2023 to 2026.

Orkla is a defensive consumer staples stock. It is a leading supplier of local branded goods with strong market positions. On 27th October the company announced that it will be transformed into a leading industrial investment company with a brands and consumer-oriented scope. Orkla will consist of 12 portfolio companies.

Inflation has affected Orkla. The company has made the necessary price increases, but they are reflected in the result with a delay. In addition, the company intends to lower its cost level. In Q3 operating revenues increased by 7,5 % but adjusted EBIT decreased by 10,7 %. On the other hand, adjusted EPS increased by 15,3 % to 1,58 NOK.

Consumer brands, oil and technology

Orkla is a consumer staples brand company. Our quantitative model gives the stock full marks for low risk, which is a good thing in this market situation. The company has also highest quality score. Nordic Semiconductor is a high-quality technology company capable of good growth. Doesn’t the stock then represent exactly what you need to look for in the technology sector at this moment? Equinor, on the other hand, offers a very low P/E ratio, being below 6 based on analysts’ earnings forecast for 2023.

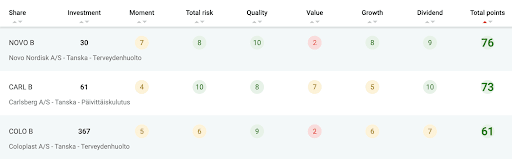

TOP 3 stocks from Denmark

Our TOP 3 stock picks from Denmark are: Carlsberg, Coloplast and Novo Nordisk. We have probably the best beer company in the world and two health care stocks. These stock picks also complete the 12 stock diversification.

The global economy is feared to be drifting into recession. In history, consumers have not left their beers without drinking, even in a recession.

In Q3 earnings report Carlsberg CEO was satisfied with company’s performance with strong volume growth in Asia and many European markets, which along with a strong price/mix development led to revenue growth of 11.6 %- Company raised its guidance and now expects organic growth in operating profit to be in the level of 10 – 12 %.

Coloplast develops products and services that make life easier for people with very personal and private medical conditions. This is called intimate health care. Business includes Ostomy Care, Continence Care, Wound & Skin Care, Interventional Urology and Voice & Respiratory Care.

For full-year (1 October 2021 – 30 September 2022) Coloplast delivered organic growth of 6 % and 31 % EBIT margin before special items, in line with guidance. For current financial year organic revenue growth is expected to be at 7 – 8 % and EBIT margin in the range of 28 – 30 %.

Novo Nordisk’s purpose is to drive change to defeat diabetes and other serious chronic diseases such as obesity, and rare blood and rare endocrine diseases.

In the first nine months of 2022 operating profit increased by 28 % to DKK 57.7 billion (that is 7,8 billion euros). Novo Nordisk raised its guidance for 2022. For the 2022 outlook, sales growth is now expected to be 14-17% at constant exchange rates and operating profit growth is now expected to be 13-16% at constant exchange rates.

High-quality defensive stocks from Denmark

All the three stocks from Denmark are high-quality stocks. Carlsberg has the lowest risk and highest dividend score. Novo Nordisk offers quality growth. Coloplast has increased its dividend for 13 years in a row.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication. Your capital is at risk.