Georg Kell, a pioneer of the sustainability movement who first coined the term ‘ESG’ in 2004, describes it as akin to an X-ray. He says:

“ESG allows investors to look beyond the skin, to look at the solidity of the infrastructure that is behind it [the company] and detect what is wrong and what is not wrong, and this has never happened before because in the past we made superficial assessments on financial indicators, measurements exclusively. ESG processes factors to look at the robustness, the resilience, the impact of the company overall. It is a breakthrough.”

ESG stands for environmental, social and governance, and in this article, we briefly explain the methodology behind the ESG scores on our platform.

If you are new to the ESG world, we have an article that summarises all you need to know about the subject. You can find it here.

ESG scores on eToro

Using data from ESG Book, eToro is now providing an ESG score for more than 2,700 of its stocks. You will be able to find the score on the asset page in the overview section.

This ESG score shows the sustainability of a company, an indicator of whether it is low, high, normal, as well as the sector average.

More granular detail will be coming soon when eToro adds the individual category scores, so you will be able to see the specific environment, social and governance score. We will also display ethical flags and you will be able to see how a company’s ESG score has evolved over time.

In addition to the total ESG score, you can also see an individual score for each of the three pillars of ESG. This means a total score as well as an individual score for Environment, one for Social, and one for Governance. Furthermore, you can see a chart that shows the fluctuation of the company’s ESG score in the past.

ESG Book

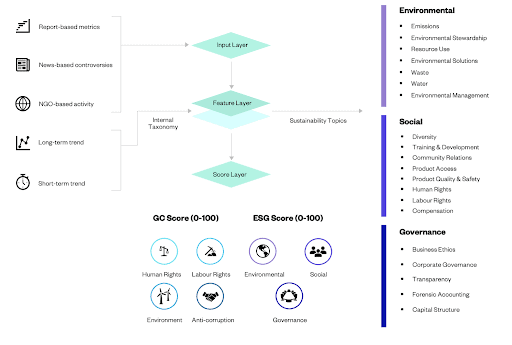

ESG Book uses technology to quantify ESG values, helping investors to understand how prepared a company is to face environmental (e.g., water and waste management, resource use, emissions, etc.), social (e.g., labour rights, human rights, diversity, etc.) and governance (e.g., transparency, anti-corruption, corporate governance, etc.) risks, and, therefore, makes it more resilient to financial risks. In this sense, the more resilient a company is to non-financial risks, the more sustainable it is deemed to be.

The ESG Score provided by ESG Book essentially consists of the aggregation of many sustainability metrics (350 to be exact!) which a company may disclose on a yearly basis. Unfortunately, not every company around the world discloses the same metrics with the same quantity and quality of information due to different regulations, lack of incentives and the absence of one internally recognised standard. That’s why sustainability data providers, such as ESG Book, started to gather information from myriad different sustainability reports around the globe and translate it into easy-to-understand analytics. An ESG score is really a “summary” of what ESG Book, as an ESG data provider, has found on Company XYZ, which helps investors to understand how sustainable that company is, or, how exposed this company is to non-financial risks across E, S and G factors.

How ESG Book calculates its scores

ESG Book’s ESG scores are based on three sources of data:

· Report-based: data they collect from sustainability reports published by companies (i.e., what the company is saying about itself. This is not estimated data; it comes directly only from publicly available sources).

· News signals: data gathered via AI from 30,000 different news sources from 170 countries in four different languages (i.e., what civil society is saying about the companies).

· NGO signals: data gathered via AI on 400 different ESG topics published by international NGOs (i.e., what experts are saying about breaches in global norms, international principles and standards).

ESG Book considers what the market and society are saying about each company on a daily basis, through their AI signals; so they are able to provide the most up-to-date scores on a company’s ESG performance. While a company may publish great things about itself in a sustainability report, it is important to also consider what external sources are saying about that company, especially in the case of scandals. So, it is vital to keep the ESG score updated with current events for it to be relevant.

When it comes to ESG issues, some topics are more impactful for the financial performance of a company based on their sector. For example, for an energy company, certain environmental issues will be very material to their financial performance because a company within the energy sector is more exposed to risks from environmental factors than others due to the nature of their business. In contrast, a financial services company is more likely to be exposed to governance risks. With ESG scores, greater weights are assigned to the sustainability topics that matter for different sectors. Hence, if a company has a high ESG score, you can expect that they are performing particularly well on the sustainability issues that matter most within its sector.

Therefore, the ESG Score by ESG Book is a signal for a company’s sustainability performance in the long run.

What an ESG Score is NOT

An ESG score is not a reflection of a company’s moral grounds nor of their positive/negative impact on the world. Some companies usually deemed as “bad,” such as those in the oil & gas industry, for example, do not have a bad ESG score. The ESG score is a reflection of the company’s own disclosures on their sustainability performance, adapted, through ESG Book’s methodology, to what the market is saying about that company (via news and NGO analysis). It is not an assessment of their impact on the world nor of their moral compass.

Companies do not necessarily publish data on their entire supply chain. This is because corporates often do not own their supply chain, rather, they are contractors and, therefore, they don’t always have visibility over these smaller private companies. Of course, most companies run due diligence on their suppliers, but depending on international regulations, they may be more or less diligent. Therefore, the ESG score of a company does not fully take their suppliers into account.

Business involvement flags

ESG Book provides a feature that allows users to screen companies for alignment with their values. Companies are checked on a daily basis and if its revenues and business involvement exceed a 5% threshold in any one of 13 ethical categories, then an icon with the symbol of the category is placed below their ESG score.

There are 13 categories which raise business involvement flags and they include: AdultEntertainment, Alcohol, ControversialWeapons, Defence, Firearms, FossilFuels, Gambling, Nuclear, Pork, StemCells, ThermalCoal, Tobacco, GMO and RecreationalDrugs

Why is an ESG score useful?

ESG scores empower you with more insights into how the companies in your portfolio are preparing and behaving on a range of sustainability issues, including diversity, transparency, water and waste management, emissions, health and safety and many more, all included in one score.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.